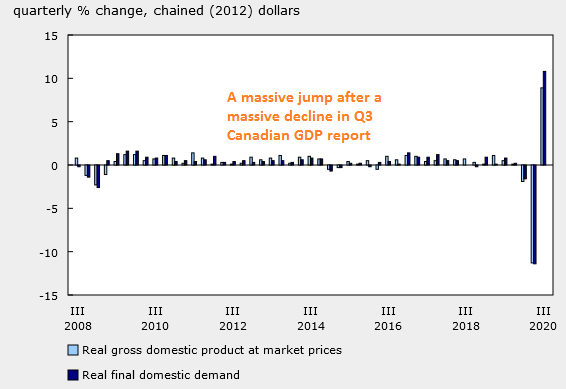

Record Surge in Canadian GDP in Q3, in Between of 2 Deep Valleys in Q1 and Q4

Canadian GDP made a massive jump in Q3, but it's coming after a massive dive in Q2

Skerdian Meta•Tuesday, December 1, 2020•1 min read

The economy of Canada came back on track during Q3, after the country reopened, following the lock-downs in March and April. The economy expanded by 40.5%, although it missed expectations of 47.9%. Although, in Q2 we saw the biggest contraction ever at -38.7% and Q4 should be another terrible quarter, as the country is locking down again, on top of the winter season which is severe in Canada. So, the chart above should come back down in Q4 and Q3 will look like a mountain between two deep valleys.

- Q3 GDP +40.5% QoQ annualized vs +47.9% expected

- Largest quarterly gain on record

- Q2 GDP was -38.7%

- GDP YoY +8.9% vs -11.3% in Q2

- September GDP +0.8% MoM vs +0.9% expected

- August GDP +1.2% MoM, revised to 0.9%

- September GDP YoY -3.9% vs -2.9% expected

- Aug GDP YoY -3.8%

- Full report

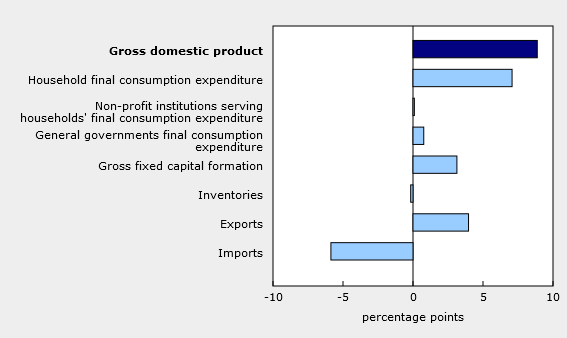

- Housing investment +30.2% QoQ and +10.3% YoY

- Household spending +13.0% in Q3 vs -13.6% in Q2

A $381.6B deficit doesn’t buy what it used to. Inventories were a drag as companies drew down $33.1, leaving the stock to sales ratio at the lowest since Q4 2018. That should be a tailwind in upcoming data. The household savings rate also remains extremely high at 14.6% but down from a record 27.5% in Q2. Before the pandemic, it was at 2.0% in Q4 of last year.

The report is also a reminder that estimating GDP down to 0.1 pp is a fool’s errand. Canadian benchmark revisions moved GDP from 3.17% to 3.04% for 2017, and revised up from 2.01% to 2.43% for 2018, and from 1.66% to 1.86% for 2019.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

Please login to comment

0 Comments

Oldest

Newest

Most Voted

Inline Feedbacks

View all comments