Uniswap (UNI) Sees Double Digit Gains: v3 Gaining Popularity?

On Monday, Uniswap (UNI) is having quite the bull run, with prices soaring by over 10% in the past 24 hours as buyers try to reverse all

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

On Monday, Uniswap (UNI) is having quite the bull run, with prices soaring by over 10% in the past 24 hours as buyers try to reverse all of last week’s losses. At the time of writing, UNI/USD is trading at around $22.

Although the popular DeFi protocol has suffered lately owing to the bearish mood among investors towards Bitcoin and the crypto market in general, things have been looking up for Uniswap ever since the launch of v3 last month. Uniswap’s third iteration merges the concept of limit order books from conventional exchanges into the automated market maker (AMM), ushering in higher levels of efficiency, flexibility and liquidity into the system.

Shortly after its launch, v3 went on to become the second most popular DEX on Ethereum, trailing the previous version Uniswap v2 by trading volume, It overtook other competitors such as SushiSwap and Ox as it offered lower gas fees for its users and greater capital efficiency.

Although migration from v2 to v3 is progressing at a slower than expected pace, there is hope that the integration of more features could expedite this process and raise participation levels among users in the coming weeks and months. Recent research by The Block also indicates that the latest release can overtake v2 in terms of trading volume going forward, especially with Uniswap’s concerted efforts.

Key Levels to Watch

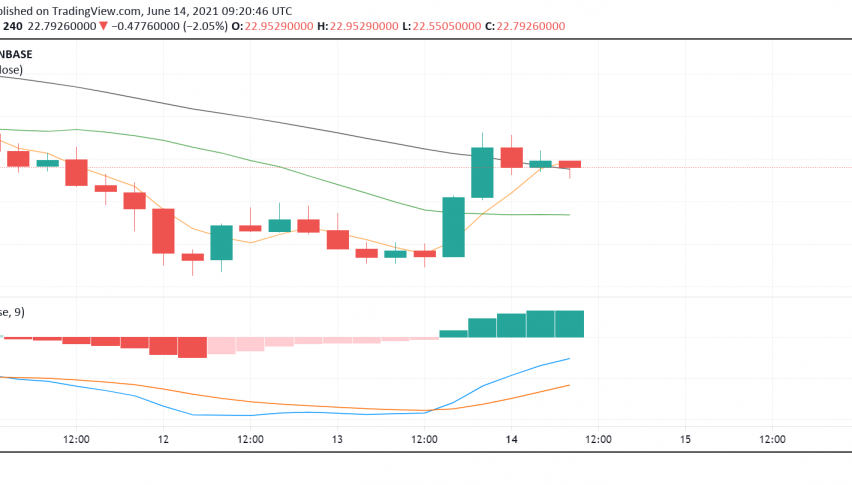

Right now, the UNI is enjoying buying interest on the back of a positive mood in the crypto market, which recently helped boost Bitcoin’s price as well. On the 4-hour price chart of UNI/USD, the smaller moving averages and the MACD indicator are signaling a bullish bias.

There could be an increase in interest among buyers to test the key $30 level in the near-term. Before that, however, Uniswap’s price has to break past the pivot at $23 and overcome immediate resistance thereafter at just under $27.

| (%) | ||

MARKETS TREND The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account