Shorting WTI Crude Oil As Sellers Remain in Charge

Crude Oil has been finding it hard to stay above $100 recently and we decided to open two Oil signals today

Just a day after the ECB decided to raise interest rates by 50 bps ( basis points) in a surprise move that sent the Euro higher, the leading indicators in Europe started to flash recession signals, with the PMI data suggesting that the Eurozone economy contracted in the month of July. Soaring prices and energy costs have taken their toll on the economy, as demand conditions deteriorated. The worst part is that things look set to intensify in the months ahead with a gas crisis looming.

The fact the European Central Bank raised rates by 50 bps and is expected to raise them again by another 50 bps in September, as they are trying to frontload rates, is bearish for Oil. So, this will be another negative factor for the European economy as it heads into recession.

Today’s economic data from the Eurozone showed that manufacturing already contracted this month, while services are very close to that. US WTI crude Oil has been finding support at moving averages as it has declined for more than a month, but they have eventually turned into resistance, which is a bearish signal.

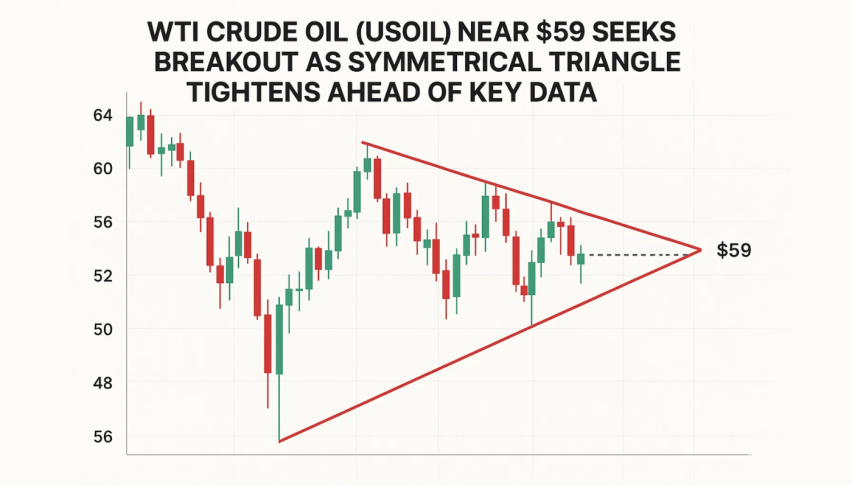

Crude Oil Daily Chart – WTI Stuck Between 2 MAs

The 200 SMA is still holding for now but it’s under attack

Last week we saw a tumble to $90 lows as China’s covid restriction came back, although the 200 SMA held as support and we saw a bounce to the 100 SMA (green) which rejected the price. This week Oil reversed back down and right now the price is holding just above the 200 SMA, although we decided to open two short term signals in crude Oil earlier today, both of which closed in profit.

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account