GBP/USD Slips to $1.1025 – Quick Update on Trading Signal

The GBP/USD is trading near $1.1025 in a five-day slump as bears await the UK's monthly job figures on Tuesday. A hawkish stance for the

The GBP/USD is trading near $1.1025 in a five-day slump as bears await the UK’s monthly job figures on Tuesday. A hawkish stance for the US Federal Reserve (Fed) and rising Treasury yields also weigh on the Cable pair GBP/USD, as measured by a stronger US dollar Index (DXY).

Nonetheless, the CME’s FedWatch Tool predicts a 78.4% chance of a 75-basis point rate hike in November. As a result, market participants pay little attention to the contrasting remarks of Federal Reserve Vice Chair Lael Brainard and Chicago Fed President Charles Evans.

Chicago Fed President Charles Evans said on Monday that the United States could cut inflation quite fast without a recession or a significant increase in unemployment. The policymaker also stated that the Fed must navigate to a “reasonably restrictive” policy rate “carefully and prudently.”

It should be mentioned that, according to the Wall Street Journal, Federal Reserve Vice Chair Lael Brainard argued for cautious rate hikes in the future (WSJ).

The 30-year Treasury yield in the United States has reached a new high since January 2014, while the 10-year equivalent has crossed the 4.0% threshold amid the market’s rush for risk safety and the Fed’s hawkish wagers.

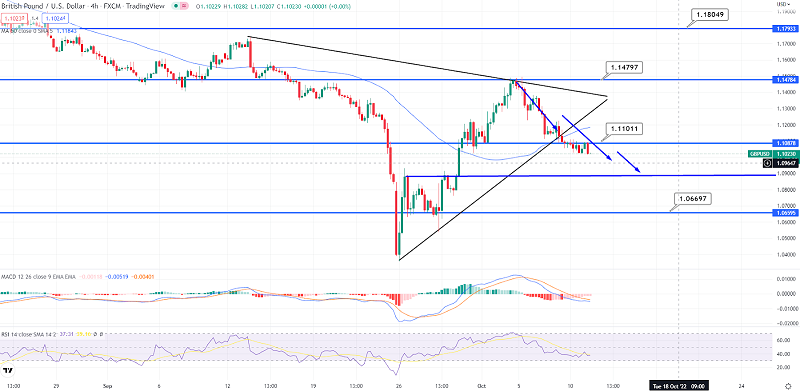

GBP/USD Technical Outlook

On the technical front, the GBP/USD has broken through a support level of $1.1101 and is now descending toward an immediate support level of $1.0898. The RSI, MACD, and 50-day moving averages are all in a downtrend.

As a result, consider entering a sell trade below the $1.1101 level with a target of $1.089 or $1.0647.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account