EUR/USD Pair Consolidates Strong Gains, Key Levels to Watch Amidst Bullish Momentum

The EUR/USD pair is currently in a consolidation phase after recording significant gains in the previous session, reaching a two-week high.

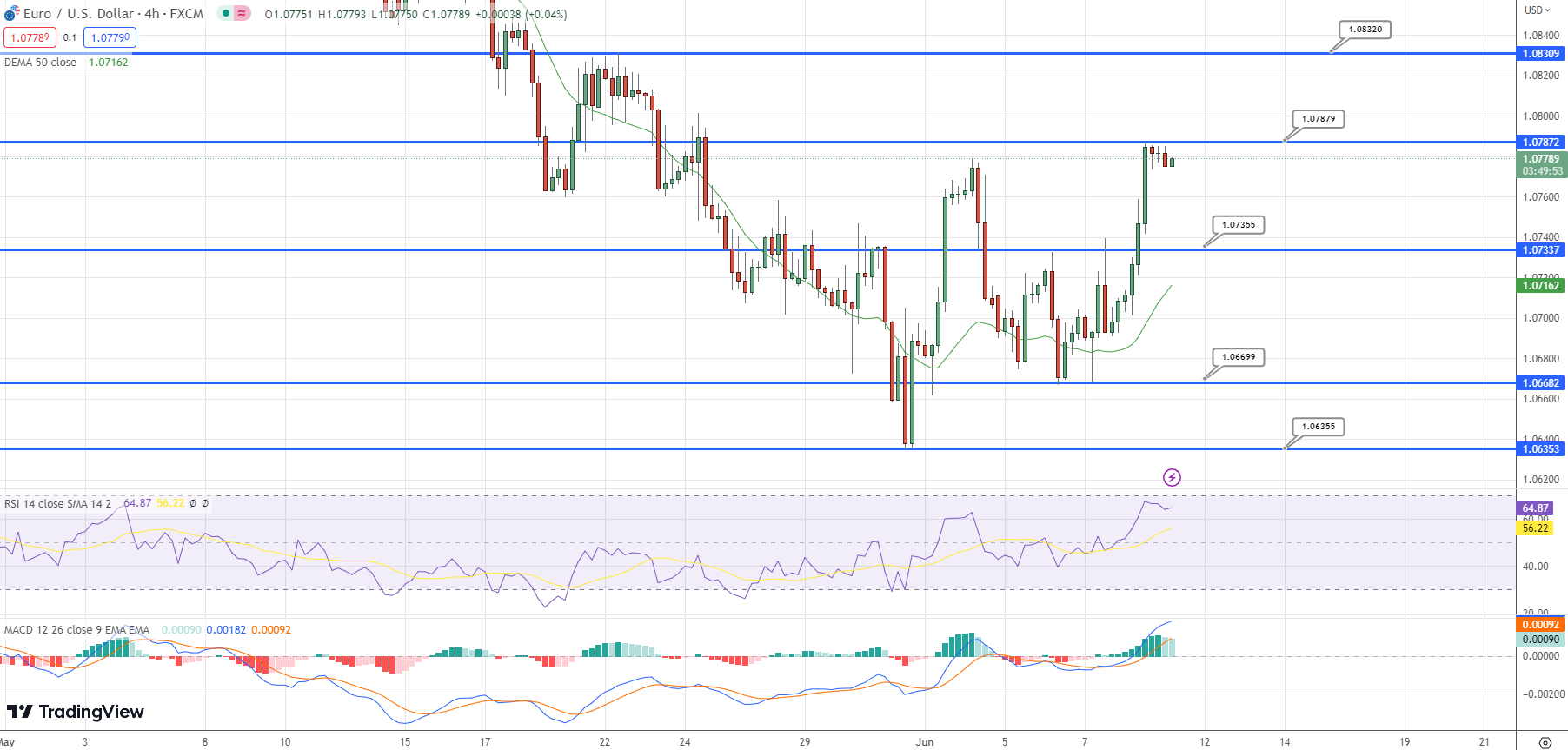

The EUR/USD pair is currently in a consolidation phase after recording significant gains in the previous session, reaching a two-week high. During the Asian session on Friday, the pair traded within a narrow range around the 1.0775-1.0780 region. It appears to be building on the recent rebound from the 1.0635 level, which was the lowest point since March 20th.

The sharp overnight increase confirmed a breakout above the 1.0745 confluence level, which consists of the 100-period Simple Moving Average (SMA), the 23.6% Fibonacci retracement level from the previous downtrend in May, and a short-term descending trend-line. This breakout is favorable for bullish traders and indicates the potential for further short-term appreciation. However, it’s worth noting that the technical indicators on the daily chart, although recovering from negative territory, have yet to confirm a fully bullish outlook. As a result, any subsequent upward movement is likely to face resistance around the round-figure level of 1.0800, which represents the 38.2% Fibonacci level.

If follow-through buying occurs, it could pave the way for additional gains, pushing the EUR/USD pair towards the next significant hurdle around the 1.0860 region. This level corresponds to the 200-period SMA on the 4-hour chart and the 50% Fibonacci level. A decisive breakthrough at this point would suggest that the recent pullback from the one-year high reached in May has concluded. In such a scenario, spot prices may target the 1.0900 round figure and test the 61.8% Fibonacci level within the 1.0915-1.0920 zone.

On the downside, the confluence resistance between 1.0750 and 1.0745 is currently acting as a barrier, preventing immediate declines below the 1.0700 mark. This resistance level is closely followed by an upward sloping trend-line near the 1.0680 region. A breach of this trend-line would expose the EUR/USD pair to potential downside movement, potentially revisiting the May monthly swing low around the 1.0635 area. Further selling pressure could push spot prices below the 1.0600 mark, with the next support levels at 1.0540-1.0535 on the way towards the psychological mark of 1.0500.

On the downside, the confluence resistance between 1.0750 and 1.0745 is currently acting as a barrier, preventing immediate declines below the 1.0700 mark. This resistance level is closely followed by an upward sloping trend-line near the 1.0680 region. A breach of this trend-line would expose the EUR/USD pair to potential downside movement, potentially revisiting the May monthly swing low around the 1.0635 area. Further selling pressure could push spot prices below the 1.0600 mark, with the next support levels at 1.0540-1.0535 on the way towards the psychological mark of 1.0500.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account