Bitcoin Shaky: What’s next for BTC—Will Sellers take over?

Bitcoin is under pressure and might crash below $64,500 if sellers press on in the days ahead. Resistance is at $70,000

Bitcoin has been under significant selling pressure over the weekend. Despite prices recovering on Sunday, sellers are still in control in the short term.

From coin trackers, the coin is up 3% on the last day but down 6% in the past week of trading. Overall, the market cap is steady at around $1.3 trillion. Technically, buyers are in charge from a top-down preview. However, the risks of lower lows cannot be discounted.

BTC trading volume is lower, shrinking 20% in the past 24 hours. This development is expected considering the weekend. From now on, traders expect a recovery. Losses below the 20-day moving average will cancel this outlook.

How Bitcoin will evolve in the short term will be shaped by the following events:

- Skew notes that the recent dump was primarily due to market selling. While prices fell, there were entities engaged in dollar-cost averaging (DCA) at present lows. The immediate zone of interest lies between $60,000 and $64,000. Most analysts say the recent drop was mainly a bear trap.

- Matt Hougan of Bitwise Management thinks Bitcoin would begin losing its reputation as a volatile asset. This is primarily because of the sharp demand, especially from institutions. The more liquid the asset is, the more attractive it becomes.

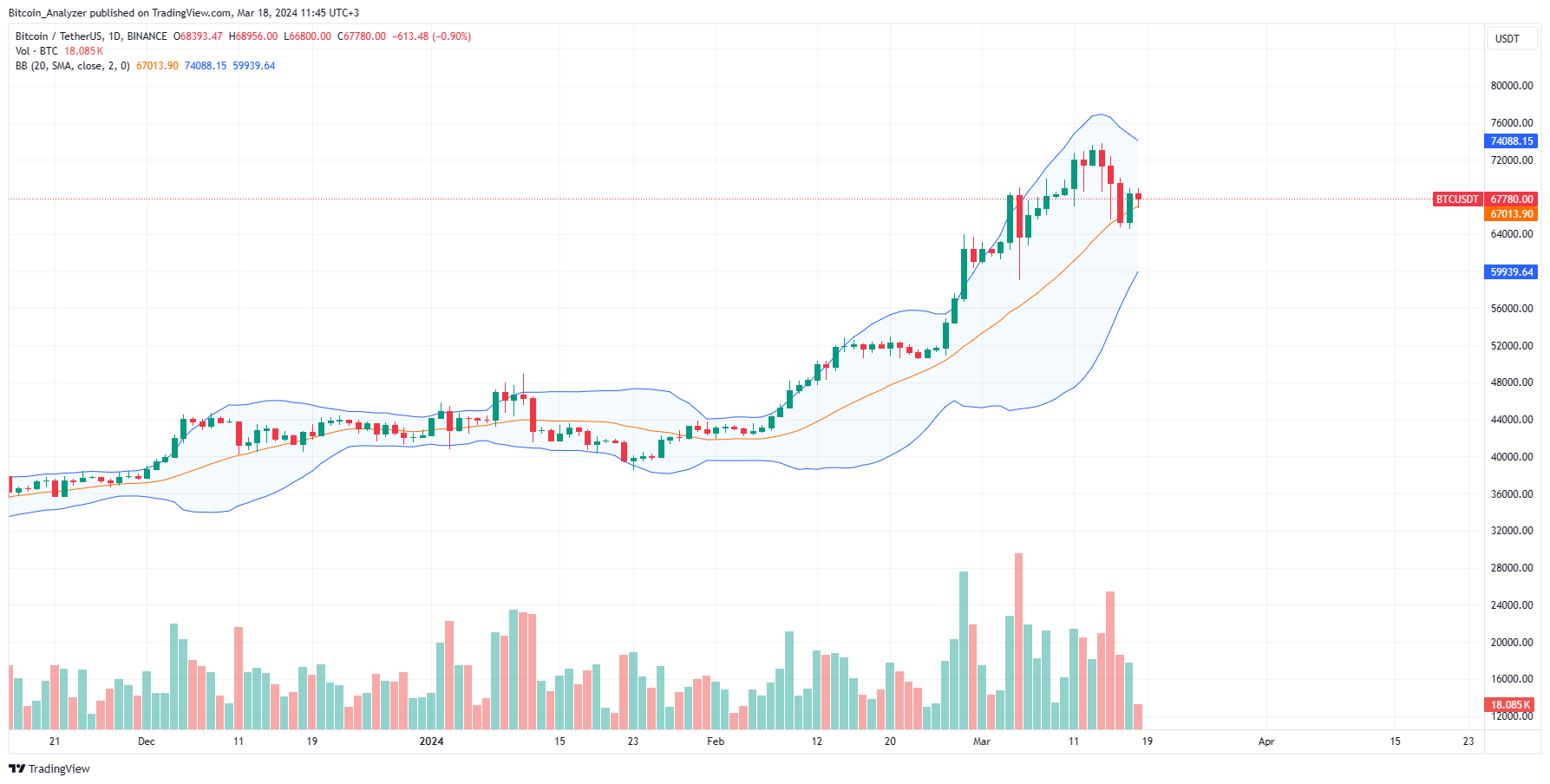

Bitcoin Price Analysis

BTC/USD is bullish, at least in the medium term, looking at price action in the past few sessions.

The immediate resistance lies at around $70,000, a top formed over the weekend.

Conversely, support is at around the $64,500 and $65,000 zone.

Traders are waiting for a breakout.

A break above $70,000 might increase capital, pushing BTC to $73,800.

Conversely, losses below $64,500 might lead to FUD, forcing weak hand to sell and take profit. In that case, BTC might crash to March 5 lows of $59,000.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account