Oil Prices $2 Lower Despite EIA Inventories Drawdown

Crude Oil has been fiding solid demand recently, with WTI Oil climbing above $83 yesterday. But, today Oil prices have are $2 lower

Crude Oil has been fiding solid demand recently, with WTI Oil climbing above $83 yesterday. But, today Oil prices have reversed after EIA crude inventories which showed a 2 million-bareel decline last week, sengng WTI spot oil to $81 where it is trading at the moment.

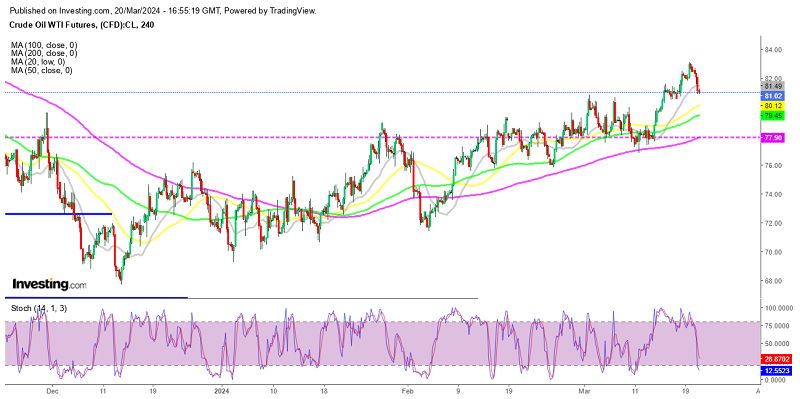

WTI Crude Oil Chart – This Week’s Gains Erased

After reaching year-highs yesterday, Crude oil is now experiencing a round of selling, which should be due to some profit-taking. The selling began after API private inventory data late yesterday revealed a considerable decline. Despite the drawdown in crude oil inventories, the unexpected build in distillates inventories and the moderate build in Cushing inventories may have contributed to the profit-taking in the oil market.

The weekly US crude oil inventories report for the current period shows a significant drawdown of 1952K barrels, contrasting with the expected build of 13K barrels. Gasoline inventories also saw a larger-than-expected drawdown of 3310K barrels compared to the forecasted drawdown of 1350K barrels. However, distillates inventories experienced an unexpected increase of 624K barrels, against the anticipated decrease of 87K barrels.

Weekly US EIA Crude Oil inventories

- Weekly crude oil inventories: -1,952K barrels vs. +13K expected

- Gasoline inventories: -3,310K barrels vs. -1,350K expected

- Distillates inventories: +624K barrels vs. -87K expected

- Production: 13.1 million barrels per day (mbpd) vs. 13.1 mbpd prior

- Refinery utilization: +1.0% vs. +0.9% expected

Additionally, the American Petroleum Institute (API) inventories released late yesterday showed the following:

- Crude inventories: -1,519K barrels

- Gasoline inventories: -1,574K barrels

- Distillates inventories: +512K barrels

- Cushing inventories: +325K barrels

US WTI Crude Oil Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account