The Top of the Range Turns Into Support for US Crude Oil

Crude Oil has been retracing lower today, but the trend is still bullish, so we decided to go long.

Just like all other risk assets such as stock markets and commodity Dollars, crude Oil mad a bullish reversal at the end of December. The trend has turned bullish since then and US WTI crude has climbed nearly $15 from the bottom back in late December.

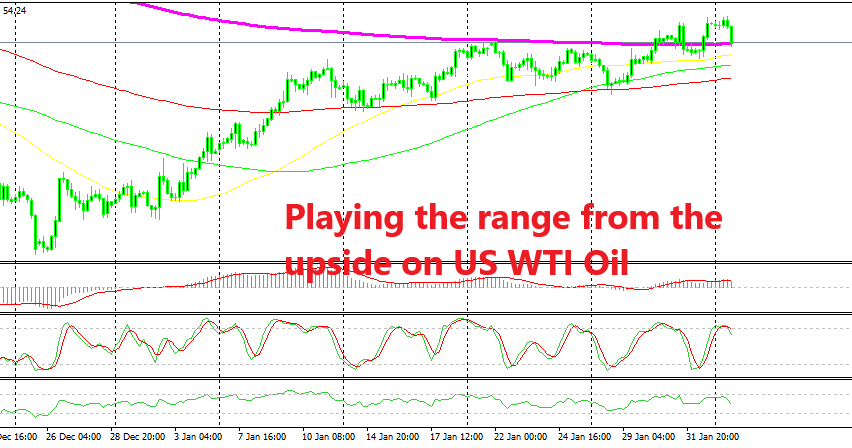

US crude broke the 100 SMA (red) on the H4 chart in the fist week of January, but it couldn’t break the 200 SMA (purple). As a result, US Oil traded inside a range between the 100 SMA at the bottom and the 200 SMA at the top.

That went on until the last two days of last month when Oil finally broke out of the range, pushing above the 20 SMA. So, the range was finally broken but it seems like the top of th range has turned into support now. The price is leaning against the 200 SMA as you can see above and we just decided to go long from here.

On the H1 chart, I can see the 100 SMA providing support right now, so let’s hope Oil turns around and continues the bullish trend now. Alright, Crude Oil has just dived around 100 pips in the last 30 minutes and our signal here got smoked. I suppose Oil is back in the range now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account