HYCM Review

- HYCM Review – 13 key points quick overview:

- Overview

- At a Glance

- HYCM Account Types

- How To Open a HYCM Account

- HYCM Deposit & Withdrawal Options

- Trading Instruments & Products

- HYCM Trading Platforms and Software

- HYCM Spreads and Fees

- Leverage and Margin

- Educational Resources

- HYCM Pros & Cons

- Security Measures

- Conclusion

Overall HYCM is considered trusted, with an overall Trust Score of 88 out of 100. They are licensed by two Tier-1 Regulators (highly trusted), one Tier-2 Regulator (trusted), zero Tier-3 Regulators (average risk), and one Tier-4 Regulator (high risk). The broker offers three different retail trading accounts: a Fixed, Classic, and Raw Account.

HYCM Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️HYCM Account Types

- ☑️How To Open an HYCM Account

- ☑️HYCM Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️HYCM Trading Platforms and Software

- ☑️HYCM Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️HYCM Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

HYCM, a Hong Kong-based broker, has a 40-year history dating back to 1977 when it started as Henyep Gold Dealers. It has since expanded into other financial areas and has offices in major financial hubs.

Therefore, HYCM’s commitment to customer satisfaction and technical innovation has earned it several industry awards, including “Best Forex Broker Europe” and “Best Mobile Trading Platform.”

The broker offers a variety of markets, including forex, commodities, and indices. Because of this, traders have a wide range of opportunities to choose from.

In addition, powerful trading platforms are available to support your activity. Furthermore, the broker’s focus on trader education provides essential tools for both new and seasoned traders.

HYCM’s market experience, coupled with its industry reputation and commitment to client-centric ideals, makes it an appealing option for traders seeking a reliable partner in their financial journey.

How can HYCM guarantee the protection of my funds?

The broker focuses on client fund security by segregating funds in tier-1 financial institutions and offering negative balances.

What distinguishes HYCM from other brokers?

Unlike many brokers, HYCM has over 40 years of expertise in the financial business, exhibiting a long-standing dedication to offering dependable and trustworthy brokerage services to customers worldwide.

At a Glance

🗓 Established Year 1977 ⚖️ Regulation and Licenses FCA, CySEC, CIMA, DFSA 🪪 Ease of Use Rating 4/5 📞 Support Hours 24/5 💻 Trading Platforms MetaTrader 4, MetaTrader 5, HYCM trader 🛍 Account Types Fixed, Classic, Raw 🤝 Base Currencies USD, EUR, GBP, AED, JPY 📊 Spreads From 0.1 pips 📈 Leverage Up to 1:500 💸 Currency Pairs 67; major, minor, and exotic pairs 💳 Minimum Deposit 20 USD 🚫 Inactivity Fee Yes, 10 USD after 3 months of inactivity 🗣 Website Languages English, Swedish, Polish, German, French, Thai, Italian, Spanish, Russian, Vietnamese, Japanese, etc. 💰 Fees and Commissions Spreads from 0.1 pips, commissions from $4 on Forex ✅ Affiliate Program Yes 🏦 Banned Countries Afghanistan, Belgium, Hong Kong, United States ✔️ Scalping Yes 📉 Hedging Yes 🎉 Trading Instruments Forex, metals, energies, commodities, indices, stocks, cryptocurrencies 🎖 Open an Account Open Account

HYCM Account Types

Fixed Classic Raw ✅ Availability All; ideal for beginners All; ideal for casual traders All; ideal for scalpers, day traders, and professionals 🛍 Markets Forex – 67

Metals – 8

Energies – 3

Commodities – 4

Indices – 28

Stocks – 212

Crypto - 19Forex – 42

Metals – 4Forex – 42

Metals – 4💸 Commissions None; only the spread is charged None; only the spread is charged $4 per round turn on Forex 💻 Platforms All All All 📊 Trade Size From 0.01 lots From 0.01 lots From 0.01 lots 📈 Leverage 1:500 1:500 1:500 💰 Minimum Deposit 20 USD 20 USD 20 USD 🎖 Open an Account Open Account Open Account Open Account

HYCM Fixed Account

The Fixed account provides a stable trading environment with set spreads starting at 1.5 pips. In addition, the Fixed account is ideal for those with predictable expenses.

Because of the low minimum deposit of $20 and the high maximum leverage of 1:500, traders can access various products, including forex, metals, energy, commodities, indices, equities, and cryptocurrencies.

HYCM Classic Account

The Classic account has changeable spreads that begin at 1.2 pips, giving more options to traders who want competitive pricing.

It supports experienced advisers and provides Islamic swap-free choices. Traders may access various products with the same minimum deposit and leverage as the Fixed account, albeit certain categories have fewer possibilities.

HYCM Raw Account

The Raw account offers raw spreads and direct market access, starting at 0.1 pips, and is ideal for experienced traders and scalpers seeking tight spreads and low latency. It includes variable spreads, commissions, expert advisors, and Islamic swap-free alternatives, similar to the Classic account.

HYCM Demo Account

In other words, the broker provides a Demo account for traders to test their trading platform and techniques, offering $50,000 in virtual capital and 14 days of real-market simulation.

This account replicates the functionality of the actual account, allowing users to practice their skills without risk.

HYCM Islamic Account

The Islamic account is designed to meet the needs of Muslim traders by adhering to Sharia law, which prohibits interest collection.

It offers a swap-free trading experience, eliminating interest costs on overnight holdings. This is a significant benefit for traders who want to avoid these fees. Furthermore, it provides access to various financial assets like Forex, equities, indices, commodities, and cryptocurrencies.

Overall, the account offers reasonable spreads, leverage choices, and no hidden fees for transparency and fairness.

Does the Raw account support high-frequency trading strategies?

Yes, with its raw spreads and direct market access, the Raw account is designed for experienced traders and scalpers who want narrow spreads and minimal latency to execute their trades quickly.

Are there any hidden costs related to HYCM account types?

No, HYCM is open about its pricing structure, with account types providing either fixed spreads or raw spreads with fees

.

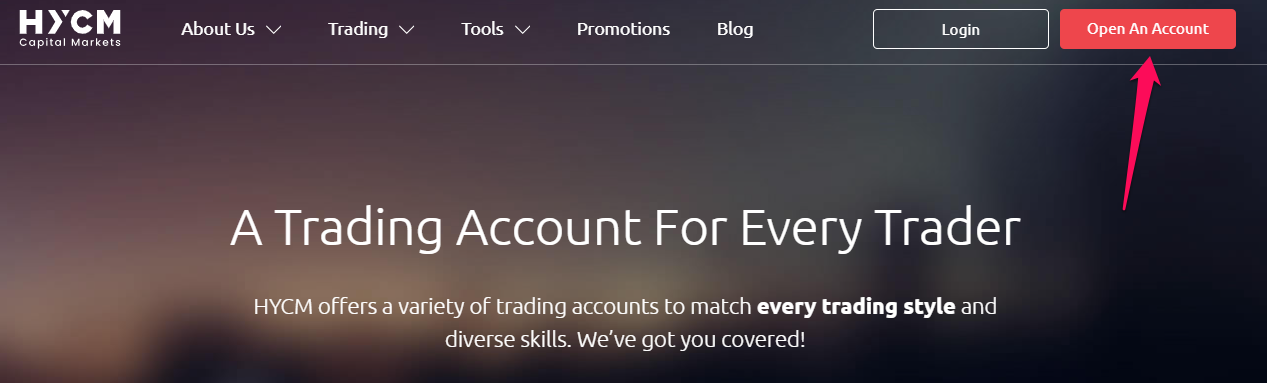

How To Open a HYCM Account

To register an account with HYCM, follow these steps:

Step 1 – Click on the Open an Account button.

Navigate to the HYCM website. You can find the website by searching for it in your computer browser. Click the “Create Live Account” button.

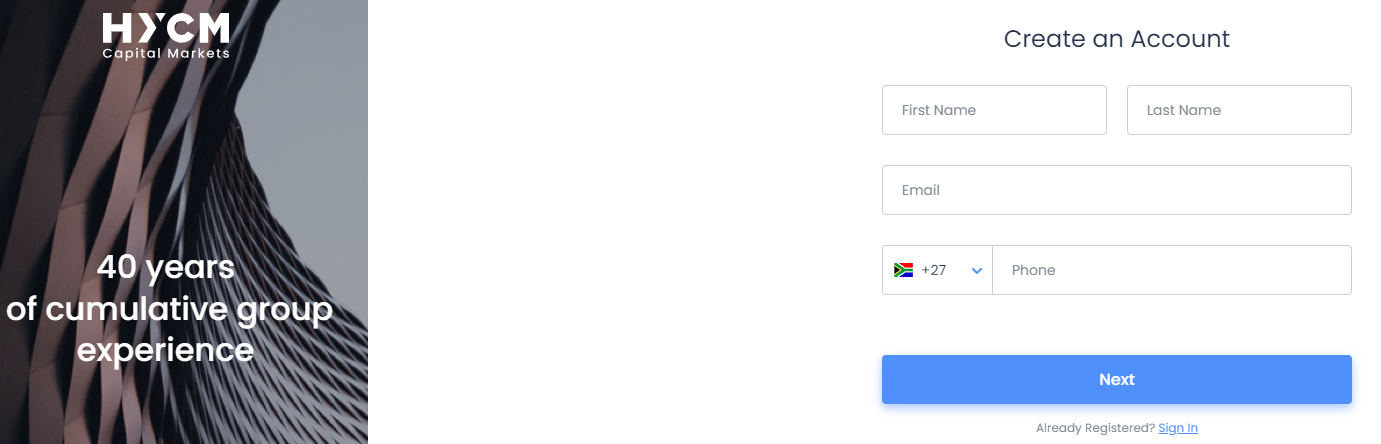

Step 2 – Fill in the form.

Complete the online registration form. You will be asked to input personal information on the registration form, including your name, email address, and phone number and complete the financial profile questionnaire.

HYCM Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time Bank Wire Transfer All Multi-currency 1 – 7 days Credit/Debit Card All Multi-currency 1 hour – 7 days Neteller All Multi-currency 1 – 24 hours Skrill All Multi-currency 1 – 24 hours Cryptocurrency All Multi-currency 3 hours Perfect Money All Multi-currency 1 – 24 hours AstroPay All Multi-currency 1 – 24 hours WebMoney All Multi-currency 1 – 24 hours PayTrust All Multi-currency 1 – 24 hours Fasapay All Multi-currency 1 – 24 hours ZotaPay All Multi-currency 1 – 24 hours UPI All Multi-currency 1 – 24 hours

Deposits

How to Deposit using Bank Wire Step by Step

✅Log in to the client portal.

✅Enter the “Banking” or “Deposits” section.

✅Select “Bank Wire” to receive the essential bank information for your transfer.

✅Make the wire transfer from your bank, including the reference information supplied by HYCM.

How to Deposit using Credit or Debit Card Step by Step

✅Log in to the HYCM client portal.

✅Go to the “Banking” or “Deposits” section.

✅Choose “Credit/Debit Card” and choose your card issuer (Visa, MasterCard, etc.).

✅Enter your card details, including the number, expiration date, CVV, and deposit amount.

✅Follow the on-screen steps to complete the deposit.

How to Deposit using Cryptocurrency Wallets Step by Step

✅Log in to the HYCM client portal.

✅Navigate to the “Banking” or “Deposit” area.

✅Choose your preferred cryptocurrency from the available choices.

✅Your deposit will establish a unique wallet address.

✅Transfer funds from your cryptocurrency wallet to the address supplied by HYCM.

How to Deposit using e-Wallets or Payment Gateways Step by Step

✅Log in to the client portal.

✅Go to the “Banking” or “Deposits” section.

✅Choose your favourite e-wallet or payment gateway (e.g., Skrill, Neteller).

✅Enter the deposit amount and follow the instructions, which will take you to the e-Wallet/gateway’s website to make your payment.

Withdrawals

How to Withdraw using Bank Wire Step by Step

✅Log in to the HYCM client portal.

✅Go to the “Banking” or “Withdrawals” section.

✅Select “Bank Wire” and input your bank account information.

✅Enter the amount you want to withdraw and submit your request.

How to Withdraw using Credit or Debit Cards Step by Step

✅Log in to the client portal.

✅Enter the “Banking” or “Withdrawals” section.

✅Choose “Credit/Debit Card”. It is worth noting that you may generally only withdraw to the same card you used to deposit.

✅Enter the desired withdrawal amount and submit your request.

How to Withdraw using Cryptocurrency Wallets Step by Step

✅Log in to the HYCM client portal.

✅Navigate to the “Banking” or “Withdrawal” section.

✅Select the applicable cryptocurrency.

✅Provide your external crypto wallet address and the withdrawal amount.

✅Submit a withdrawal request.

How to Withdraw using e-Wallets or Payment Gateways Step by Step

✅Log in to the client portal.

✅Go to the “Banking” or “Withdrawals” section.

✅Select your desired eWallet/payment gateway.

✅Enter your withdrawal amount and submit the request.

Does HYCM charge any deposit cost?

No, HYCM does not charge direct deposit fees.

Can I withdraw funds from my HYCM account using cryptocurrency?

Yes, HYCM offers cryptocurrency withdrawals.

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – Trade one of the most liquid asset classes in the world with spreads starting at 0.1 pip and maximum leverage of 1:500. Forex instruments comprising 67 for Fixed accounts and 42 for Classic and Raw accounts are available for trading across all account types.

➡️CFD Stock – In addition to investing in traditional stocks, CFD stocks allow you to invest in top international brands. Furthermore, you can achieve this with a maximum leverage of 1:20 and margins as low as 5%. Importantly, CFD stock instruments are available for all account types. Specifically, 212 are available for Fixed accounts and 4 for Classic and Raw accounts.

➡️Indices – In addition, with a maximum leverage of 1:200, you can quickly access the world’s most popular indexes and trade across all account types. There are a total of 28 instruments accessible for Fixed Accounts.

➡️Cryptocurrencies – In addition to gaining access to maximum leverage of up to 1:20, you can also leverage the performance of Bitcoin, Ethereum, and Litecoin without physically holding them. There are also 19 cryptocurrency instruments available for Fixed Accounts.

➡️Commodities – You can trade commodities without physical possession. Additionally, a maximum leverage of 1:133 is offered. Furthermore, it is accessible for all account types. Finally, four commodities products are available for Fixed accounts.

What are the leverage options for FX trading at HYCM?

HYCM offers leverage options of up to 1:500 for major and minor currency pairs.

Does HYCM provide commodity trading opportunities?

The broker provides traders access to various commodities, including gold, silver, crude oil, and natural gas.

HYCM Trading Platforms and Software

HYCM MetaTrader 4

MetaTrader 4, a popular trading platform that caters to traders of all skill levels, further empowers users with advanced technical analysis tools.

In addition to adaptable platforms, it also offers support for Expert Advisors and algorithmic trading, providing a comprehensive trading experience.

In addition to offering a user-friendly interface and customizable charts, it also provides over 100 instruments, allowing users to customize their trading strategies.

HYCM MetaTrader 5

MetaTrader 5 builds upon the capabilities of MetaTrader 4 by offering several enhancements, such as extra timeframes for analysis, a wider range of technical analysis indicators, and the integration of an economic calendar.

Additionally, with nearly 300 trading instruments, MetaTrader 5 provides traders with a significantly broader selection of options.

Furthermore, it supports Trading Central compatibility and automated trading apps like Expert Advisors while maintaining user-friendliness on PC and mobile platforms.

HYCM Trader

HYCM Trader is a mobile app for traders, therefore offering smooth trading transactions on over 300 assets, including equities, indices, commodities, and cryptocurrencies.

Widely available on both Google Play and the App Store, the program offers lightning-fast trade execution, customizable account settings, and convenient in-app deposits and withdrawals.

Additionally, the user-friendly design empowers users to view charts, indicators, and market news, allowing them to trade anytime, anywhere.

Does HYCM provide mobile trading options?

Yes, HYCM offers a mobile trading app that allows traders to access their accounts, make trades, and monitor market conditions on the road using their smartphones or tablets.

Can I utilize automated trading methods on HYCM platforms?

Yes, HYCM’s trading platforms, including MetaTrader 4 and MetaTrader 5, provide automated trading methods using Expert Advisors (EAs).

HYCM Spreads and Fees

Spreads

In addition to offering competitive spreads on all its account types, the broker also caters to traders’ diverse skills and strategies.

Fixed accounts start at 1.5 pip, providing consistency and predictability in trading costs. Classic accounts offer 1.2 pip for narrower spreads, while the Raw account, with spreads as low as 0.1 pips, is ideal for high-frequency traders and scalpers seeking direct market access.

Commissions

For Raw account types, HYCM further levies commissions in addition to spreads. A $4 round turn commission is charged to traders who use the Raw account for forex trading.

Overnight Fees

The broker therefore provides overnight financing for positions held overnight based on current interest rates and currency value differential. (This option emphasizes that overnight financing is a consequence of holding positions overnight.)

Negative Overnight Financing percentages increase deal costs, while positive percentages provide credits. Traders must consider Overnight Financing to manage their expenses while holding overnight positions.

Deposit and Withdrawal Fees

The broker does not impose any direct fees on deposits or withdrawals. Third-party fees, however, can be applicable based on the selected payment method or the banks acting as intermediaries.

Inactivity Fees

Traders should be aware of inactivity penalties, which include a $10 fee after three months of inactivity, and should either regularly maintain or consider cancelling inactive accounts.

Currency Conversion Fees

In addition, currency translation costs may be charged if the account currency differs from the trading instrument’s listed currency.

Negative amounts are converted at the Sell rate, while positive amounts are converted at the Buy rate. Traders should account for these fees when handling deals and account balances.

How does HYCM’s fee structure compare to other brokers in the industry?

HYCM provides cheap spreads and straightforward fees, making it attractive for traders looking for cost-effective trading options with few hidden costs.

Does HYCM charge inactivity fees for inactive accounts?

Yes, HYCM levies a $10 inactivity fee after three months of inactivity.

Leverage and Margin

In order to handle higher trading volumes, the broker offers leverage for traders. However, financial leverage ratios are influenced by both the governing body and the asset class.

HYCM provides dynamic leverage for major and minor Forex pairs up to 1:500. In addition to Forex, exotic Forex pairings offer leverage up to 1:100. Cryptocurrencies and spot gold also benefit from leverage, with offerings up to 1:20 and 1:200 respectively.

HYCM’s dynamic credit leverage mechanism on the MT4 and 5 platforms ensures risk control by automatically decreasing leverage as instrument volume increases. In other words, different margins are needed based on traded volume for responsible risk management.

How does HYCM manage traders’ leverage to guarantee prudent risk management?

HYCM’s trading platforms use dynamic credit leverage systems, which dynamically modify leverage as trading volumes grow to reduce the danger of margin calls and safeguard traders’ accounts from excessive losses.

Can I change the leverage levels in my HYCM account?

Yes, traders can easily modify leverage levels within the acceptable limitations specified by HYCM.

Educational Resources

The broker offers the following educational resources:

➡️Articles – Additionally, the HYCM Help Center provides various educational resources, including articles to increase trading expertise. These materials offer various subjects that are appropriate for traders of all skill levels.

➡️HYCM Lab is a complete reference to Forex trading, offering information on Forex education and tactics. Consequently, it seeks to improve trading abilities by providing extensive information on many elements of trading.

➡️Demo Account – HYCM offers a demo account for trading with virtual money, which makes it an excellent tool for learning. This is suitable for both novice and experienced traders alike.

Does HYCM provide access to market analysis and research reports?

Yes, HYCM provides market analysis reports and research updates regularly.

Can novices profit from the HYCM educational resources?

Yes, HYCM’s instructional tools appeal to traders of all skill levels, including beginners, with user-friendly guidelines and tutorials that give a strong foundation in trading concepts and methods.

HYCM Pros & Cons

✔️ Pros ❌ Cons Regulated by respectable agencies such as the UK's FCA, CySEC in Cyprus, and others Charges inactivity fees, which might be a disadvantage for infrequent traders To assist traders in expanding their expertise, a good range of instructional resources is provided HYCM's research services can appear basic when compared to those of top-tier brokers Known for narrow spreads on main Forex pairings Certain services, such as crypto CFDs, might be inaccessible or limited based on your area owing to restrictions Uses the renowned MetaTrader 4 and 5 platforms, which are well-known and provide a variety of instruments Neither copy nor social trading is currently accessible via HYCM Traders have access to Forex, equities, commodities, indices, and certain cryptocurrency CFDs Primarily focused on forex and CFDs, which may be less enticing to traders seeking direct stock ownership or a broader asset portfolio HYCM has over 40 years of experience and a proven track record in the financial business Depending on your location, customer service might not be available at all hours Customer support is available in a variety of languages to provide worldwide accessibility Protects traders' accounts from falling below zero by providing negative balance protection Uses segregated accounts at tier-1 institutions to keep customer money separate from the company's The HYCM mobile app has garnered positive feedback for its user-friendly layout and functionality

Security Measures

The HYCM secures its trading environment using a range of mechanisms. In particular, they separate customer cash from operational cash and hold them in different bank accounts. This ensures that customers’ funds can be safe and will not be used for other purposes.

Moreover, HYCM complies with some of the regulatory criteria of some very reputable financial agencies. These all add to their genuineness, and the credibility received through conformity to regulation.

Therefore, this compliance with regulatory regulations shows their dedication to providing a secure and transparent trading environment for every customer.

What safeguards does HYCM use to secure traders’ personal information?

HYCM uses modern encryption techniques and strong cybersecurity measures to protect traders’ personal and financial information from unwanted access, assuring confidentiality and data integrity.

Are there any extra security measures on HYCM’s trading platforms?

Yes, HYCM’s trading platforms use multi-factor authentication (MFA) and secure socket layer (SSL) technology.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

Conclusion

Overall, HYCM is a reliable forex and CFD broker with over four decades of experience and a robust regulatory framework. It offers features like negative balance protection and segregated accounts for customer safety. Traders enjoy competitive spreads, a variety of trading products, and access to major MetaTrader platforms.

However, our findings show that HYCM has limitations, such as inactivity fees and restricted availability of services like crypto CFDs in select locations. Customer assistance is available in multiple languages but does not operate 24/7.

For more information on FXLeaders.

HYCM provides the industry-standard MetaTrader 4 and 5 platforms, well-known for their charting capabilities and versatility. They also offer their customized mobile app for trading on the move.

Withdrawal processing timeframes with HYCM vary based on the method used, ranging from 1 hour to 7 days. Electronic payment mechanisms such as e-wallets often have faster processing periods than bank wire transactions.

The minimum deposit necessary to start an account with HYCM is $20.

HYCM accepts various deposit options, including bank wire transfers, credit/debit cards, common e-wallets (Skrill, Neteller, etc.), and some cryptocurrencies.

Yes, HYCM is regarded as a safe broker since it is regulated by respected institutions such as the FCA and CySEC, and it has implemented security measures such as negative balance protection and segregated customer accounts.

Yes, HYCM provides demo accounts. These are excellent opportunities to practice trading and explore their platforms risk-free using virtual money.

HYCM offers traders a wide selection of trading instruments, including forex, commodities, indices, stocks, and some cryptocurrency CFDs.

HYCM’s headquarters are in Hong Kong, with other offices in key financial locations around the globe.

No, HYCM often does not impose deposit fees.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |