Palladium Price Forecast for 2021: Buy the Dips on the Bullish Trend?

Last Update: January 11th, 2022

Palladium – Forecast Summary

| Palladium Forecast: H2 2021 Price: $2,400 – $2,500 Price drivers: Technical retreat, US Dollar, CB/Govt’ stimulus | Palladium Forecast: 1 Year Price: $2,700 – $2.800 Price drivers: Less dovish central banks, Post COVID-19, Higher auto demand | Palladium Forecast: 3 Years Price: $3,500 – $4,200 Price drivers: Economic Recovery, Positive risk sentiment, Post coronavirus, Tighter monetary policies |

In our previous Palladium forecast for Q4 of 2020, we predicted further bullish momentum, as the global economy was rebounding after the recession in Q2 of last year and that’s what happened. Although, now XXPD/USD is a period of retreat after making record highs in May 2021 above $3,000. Palladium suffered some huge losses in the spring 2020 crash, falling from just under $ 2,900 to $ 2,600, which means it lost 1/3rd of its value in just a few weeks. But, it reversed higher soon after, and unlike gold, which has turned bearish since then, palladium has been bullish, making lower highs, as the increasing demand keeps attracting buyers at every dip, like the bullish reversal we witnessed at the beginning of February, after the pullback in January 2021.

With vehicle sales growing and tighter car emission standards across the globe, the demand for palladium is increasing. Since palladium is preferred for gasoline engines, the increasing regulations are helping palladium. The market share is also growing since the Volkswagen diesel emissions scandal in 2015, which was a shock for the industry. On the other hand, the supply side is not too flexible for palladium. Predictions are that until 2024 there won’t be any major increase in supply, despite the rising prices and increasing car sales. Standard Chartered analyst Suki Cooper commented that “Elevated investor interest makes the market susceptible to profit-taking, but dips are likely to be viewed as buying opportunities,” which confirms our bias and has proven to be true so far. So, we are following the current dip in Palladium and once the pullback is complete, we will try to go long.

Recent Changes in the Palladium Price

| Period | Change ($) | Change % |

| 6 Months | +288 | +13.6% |

| 1 Year | +327 | -14.8% |

| 3 Years | +1,576 | +118.5% |

| 5 Years | +1,868 | +352.3% |

| Since 2010 | +1,984 | +662.2% |

Palladium is produced as a co-product or by-product of platinum mining and as a byproduct of nickel smelting. The supply comes from just a handful of countries, which makes the palladium price prediction vulnerable to supply disruptions or shortages. The production is dominated by Russia and South Africa, which account for a little less than 40% each, followed by Canada at 10%, the US at 5-6% and Zimbabwe at 4% of the total global palladium production.

Palladium is one of the four metals in the precious metals group. It is considered as both a commodity – which makes it a risk asset, hence the bullish momentum during the global economic rebound in summer last year – and a safe haven. It is a rare commodity; 30 times rarer than gold and more precious than all the other precious metals, which makes it a safe haven in times of uncertainty, and it has indeed been acting as such in recent times. It has benefited from both of these statuses during the past year, in very uncertain markets that have been behaving unusually, so it is expected to continue to be bullish in 2021.

Palladium Live Chart

Palladium Price Prediction for the Next 5 Years

The price of palladium is prone to a number of factors. The demand, for the production of gasoline cars in the US and China, and to a lesser extent, Europe, is the main factor, since it is the primary source of use. The global economy affects automobile production, thus the demand, while the palladium supply is quite inelastic, since it is dependent on production in Russian and South African mines, which can only have negative effects that cause major disruptions in the supply. Although some new palladium production facilities might emerge in the future, in Australia and probably Canada. Due to the extreme price sensitivity, recycling of catalytic converters also has an impact on the prices.

Palladium Acts as Both a Precious Metal and a Commodity Metal

As mentioned above, palladium is both a precious metal like gold, silver and platinum, which act as safe havens in uncertain times, and a commodity metal, which is used in industry. We know that industrial production increases when the global economy is in an expansionary period and the demand for commodities increases. This means that palladium benefits both ways – when the economy is in expansion and the demand for automobiles increases, which boosts the demand for commodities like palladium, and when the sentiment is negative and the safe havens are in demand. But, I wouldn’t call palladium a safe haven per se, since only about 1% is used in jewelry, mainly in the lower Chinese class, who buy it as a substitute for gold or silver, but it acts as such most of the time.

During the outbreak of the coronavirus in China in January and February 2020 the sentiment turned negative and palladium surged by around $ 950, to record highs of $ 2,880. This was the main reason for the surge, because the demand for palladium declined as a result of lower car manufacturing activities in China during those months, when large parts of the country were in lockdown. The big crash that followed in March was a result of the USD turning massively bearish, which sent all assets diving lower. But the continuous uptrend from May, until the end of 2020, as the Chinese and US economies rebounded strongly and the price remained bullish until January 2021, shows that the palladium demand recovers in times of economic recovery. So, palladium is expected to increase as the world economy keeps rebounding nicely and the manufacturing sector remains in fast expansion. This should keep the demand for this precious metal up.

Palladium Supply and Demand Forecasts

Demand – Both palladium and platinum are mainly used in autocatalytic converters, to reduce harmful exhaust emissions. Palladium is used in engines that run on gasoline, while platinum has a wider range of use in diesel-powered vehicles, which are much more common. The other disadvantage that palladium has, compared to platinum, is that when it comes to physical demand for the jewelry market, there is more demand for platinum than there is for palladium. Both metals, as well as most other markets, saw disruptions in production and demand in 2020, but 2021 looks much more promising, as manufacturing continues to expand pretty fast all over the globe.

The GDP in the Eurozone is expected to be negative in Q1 of 2021, which would mean a recession after another negative quarter in Q3, but that is mostly priced in, since it was anticipated, while according to the IMF, the world GDP is expected to increase by 5.4%, as Christine Lagarde pointed out. The forecasts for automobile demand are for a record high in 2021, driven by two main factors – the growth in demand from the two financial giants, China and the US.

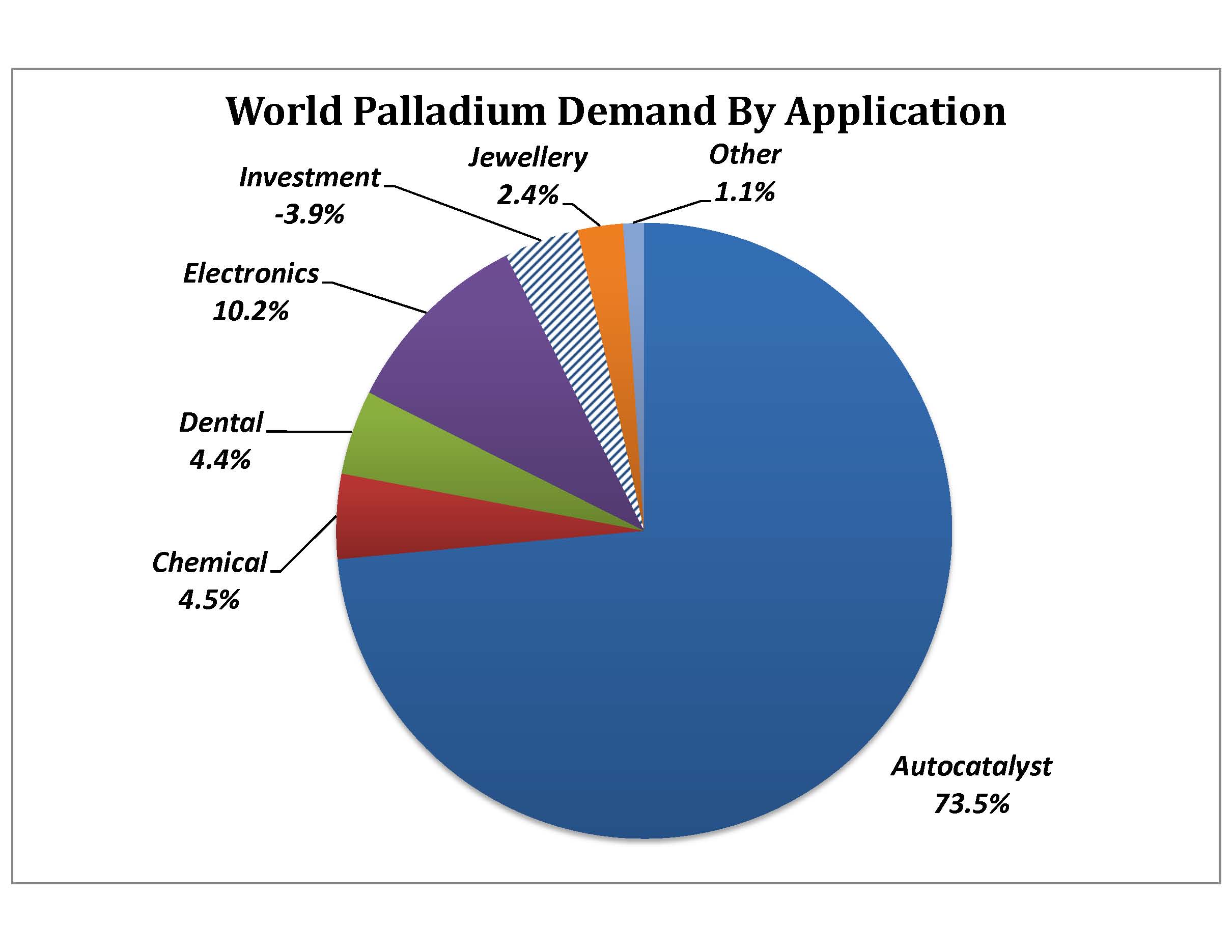

Source: Advantage Futures – Palladium demand by industry/application

We witnessed a decent economic rebound in China during 2020, and 2021 is expected to be another strong year. China accounts for a third of the total global car production, and it is expected to roll out tighter emission control legislation, which it is anticipated will help support the domestic demand. Another reason is the strong rebound in the US economy, particularly in manufacturing, which includes cars. Since Joe Biden took up office as the President of the USA, one of the main policies for the Democratic Party has been green energy, which means tightening the legislation for car emissions, so after putting forward an aggressive green agenda during Joe Biden’s election campaign, they are expected to act more decisively.

The excessive amount of cash injected into the global economy through the monetary and fiscal stimulus programs, should support economic growth and manufacturing on one hand, which will also increase the demand for physical palladium. On the other hand, this cash will also filter through the financial markets and increase the demand for palladium futures in the forex market, which will also have a positive impact on the price.

Supply – The supply is much less flexible than the demand; major increases are very difficult but it can be reduced by disruptions. In April and May 2020, the tight lockdown regulations forced many South African mining companies to suspend operations for a period of time, which boosted the palladium prices, hence the bullish reversal in July last year.

Recycling accounts for a large portion of physical palladium in the annual supply. However, according to Metals Focus, “The recovery in mine supplies this year and expectations of increased recycling will not offset the growth in demand, which will result in the tenth successive physical deficit in 2021. This will further deplete above-ground stocks, placing additional upward pressure on the palladium price.”

According to UK platinum group metal (PGM) refiner Johnson Matthey, in 2019, palladium was the most diversified metal geographically, with around 38% of the supply coming from South Africa, around 41% from Russia and the remaining 21% from elsewhere. ABN AMRO Group FX and precious metals senior strategist Georgette Boele expects higher palladium prices in 2021, though the increase is likely “to be modest,” she said. “There is still a supply shortage because of the higher palladium demand for car converters, to meet the more stringent emission standards in China and Europe in the future,” Boele said in a research note.

Share of Palladium supply by country

Chartered Bank global research precious metals analyst Suki Cooper said: “The palladium market is set to remain undersupplied, while platinum is likely to tighten in H2-2021, as the substitution risk gains momentum towards the end of the year.” Palladium has been in tight supply, with the production woes in Russia and South Africa, and a certain top PGMs producer could add to the narrowness in supply in the future.

At the Norilsk Nickel facility in Russia, there is the issue with permafrost, which might result in some reduced output in the future. If something happens with their infrastructure, and they have to rebuild or shore up in some way, it could slow production. With output in Russia potentially being impacted down the road, and the disruption seen in South Africa in 2020, Ralph Aldis of US Global Investors suggests that deposits discovered recently might ease the situation. He mentioned that Chalice Gold Mines’ Julimar project in Australia was something to take notice of.

Palladium Predictions

Large organizations, companies involved in car manufacturing in particular, and hedge funds that invest in auto companies, do their own analysis and forecasts for raw materials used in car manufacturing. Palladium is one of these materials, and it attracts the attention of large corporations. We have listed some of their forecasts for Q1 and the whole of 2021.

| Organization | Q1 2021 | Q4 2021 | AVG 2021 |

| ABN Amro | 2,000 | 2,161 | 2,000 |

| ANZ Bank | 2,332 | 2,205 | 2,110 |

| BOCIL | 2,300 | 2,250 | 2,325 |

| BofAML | 2,750 | 2,500 | 2,500 |

| CPM Group | 2,232 | 2,210 | 2,171 |

| CRU Group | 2,100 | 2,157 | 2,240 |

| Capital Econ | 2,175 | 2,252 | 2,100 |

| Citigroup | – | 2,400 | 2,650 |

| Commerzbank | 2,200 | 2,200 | 2,200 |

| E D & F Man | 2,150 | 2,300 | 2,350 |

| EIU | 2,292 | 1,802 | 1,193 |

| ETFS Capital | – | – | 2,500 |

| Fastmarkets | – | 2,380 | 2,400 |

| GoldCore | 1,950 | 2,115 | 2,221 |

| Intesa Sanpaolo | 2,200 | 2,200 | 2,150 |

| Investec | – | – | 2,314 |

| JP Morgan | 2,450 | 2,450 | 2,163 |

| Jefferies | – | 2,200 | 2,250 |

| Macquarie Group | 2,500 | 2,400 | 2,500 |

Source: Investing

Gold-Palladium Ratio and XPD/USD Correlation

The Gold-Palladium (XAU/XPD) ratio takes into account the value of each metal in relation to the other one. This ratio has been above parity (1) for the vast majority of the time. This means that gold has been more expensive than palladium, which is confirmed by the price in the chart history for both metals. There have been only two occasions on which palladium has been more expensive than gold, once from 1998 until 2002 and the other time being right now. The ratio has been on a bearish trend since 2009, and in 2019 it fell below parity. After a bounce during the beginning of the coronavirus pandemic, which sent gold to record highs and pushed the XAU/XPD ratio close to 1, the bearish trend resumed again as palladium resumed its bullish trend, while gold has turned bearish since then. There’s more room to the downside compared to the 2001 low, and a few more years before it returns back up above 1, which indicates further upside momentum in palladium if gold doesn’t fall too fast.

From 2014 until 2016, the USD index surged, as shown in the DXY chart below. During the same period, the XPD/USD retreated lower, which means that the increase in the USD had a negative impact on the price of palladium. From 2016 until 2018, the DXY turned bearish, falling from 103 points to 88 points, and the XPD/USD increased from $ 480 to $ 1,140. During the shock of the first half of March 2020, the DXY surged from 94 points to 103 points, while palladium crashed lower, only for things to reverse in the coming months. So, when trading palladium during the coming months, we must keep an eye on the DXY.

The 20 weekly SMA is pushing the DXY down

Palladium Technical Analysis – Moving Averages Are Still Pushing Higher

As mentioned above, palladium has been bullish since 2008, with the bullish trend picking up pace since 2016. After the crash in early 2020, the bullish trend has resumed again. It was trading around $ 200 to $ 300 until the end of the 1990s, when it made a strong bullish move, partly driven by its increased use in the computer dotcom industry, which surged during that period. It breached above the big round level at $ 1,000 for the first time, but returned back down to its normal range in the early 2000s. During the 2008 crisis, palladium didn’t surge as much as gold did, and it traded in a slow but steady uptrend until 2008, which meant that it was increasing in value as a commodity, as the global economy was rebounding from the 2008-09 economic crisis. But the US-China trade tariffs sent it surging higher from 2008, as it became clear that a trade war was underway. This meant that palladium acted as a safe haven, turning extremely bullish during uncertain times. This was verified when the XPD/USD surged during January and February 2020, as the coronavirus epidemic hit China. It trembled during March and April but resumed its uptrend in July, which confirms its safe haven status. The 20 SMA (gray) has been doing a great job as support on the monthly chart, pushing the price higher and offering good buying opportunities during pullbacks down there.

Palladium continues to find support at the 20 SMA

Switching to the weekly chart, it also points up for palladium. The price surged above all moving averages on this time-frame, and after the quick dip last year, it returned above that and made new highs after bouncing off the 100 SMA (green) in March 2020. The 50 SMA (yellow) has turned into the ultimate support indicator for the XPD/USD since then, holding since May 2020 as support. This suggests strong buying pressure down at the 50 SMA, so buyers remain in charge in palladium.

The retrace continues on the weekly chart

On the daily chart, the 200 SMA (purple) has been acting as the ultimate support, holding during deeper pullbacks lower. It pushed XPD/USD to new highs above $3,000, leaving Gold behind as a precious metal. Right now the price is retreating and it’s getting to the 200 daily SMA again, which is a good place to go long. We might do so if we catch Palladium down there, at around $2,500.

Getting ready to buy XPD/USD at the 200 SMA