What A Reversal After Such Inflation Numbers! GBP is Doomed…

The inflation report from the UK is the biggest economic event on the calendar today. There are many ways to trade such a forex event, although it´s never easy, particularly today. The price jumped about 30-40 pips after the release, only to reverse and end up about 100 pips lower an hour later.

Apart from HPI (house price index) which slightly missed expectations, all the other components of the report beat expectations. But, the house prices in the UK have been running wild for years, particularly in the South East.

The main CPI (consumer price index) number jumped from 2.3% to 2.7% (annualized), core CPI rose from 1.8% to 2.4%, while RPI surged by 3.5%.

These are really great numbers; the core inflation, which is the main mandate for the BOE (Bank of England), moved comfortably above the 2% target.

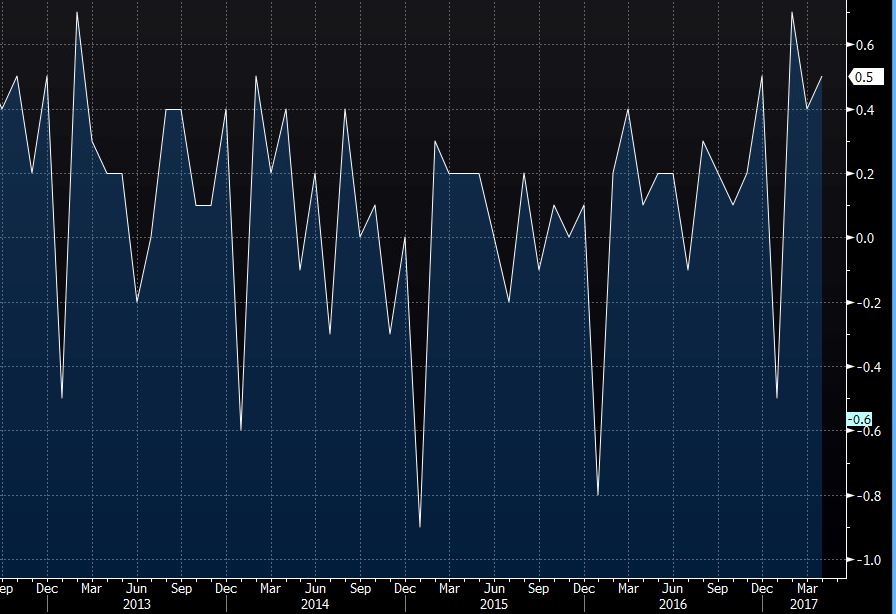

We´re above the range now

It´s surprising to see GBP/USD make such a reverse. GBP pairs, especially GBP/USD, have been in a continuous uptrend over the last 10-12 weeks, without any particular reason or any particular economic data. Watching it falter on such an inflation report is surprising.

It actually means that 1.30 in GBP/USD is unbreakable. The closer we get there, the more the selling pressure builds up. You would have thought that 1.30 would go after this report, but on the other hand, the BOE can´t hike the rate with Brexit looming.

GBP/USD is not making a run to the downside either, but this is quite a strong signal that 1.30 is a “no go” zone. So, if this forex pair crawls back up near 1.2950, I would definitely open a long-term sell forex signal, obviously placing the stop above 1.30, and targeting 200-300 pips at least.