10 Best Forex Brokers by Volume

10 Best Forex Brokers by Volume. Biggest and largest Forex Brokers revealed. With volume serving as a vital measure of a broker’s market power and dependability, we went on a journey to discover and compare the Top 10 Brokers by Volume.

In this in-depth guide, you’ll learn:

- What does Trading Volume mean in Forex Trading?

- Who are the Top Forex Brokers by Volume?

- The Advantages of Trading with High-Volume Forex Brokers.

- Conclusion on Forex Brokers by share numbers.

- FAQs on 10 Best Forex Brokers by share numbers.

And lots more…

So, if you’re ready to go “all in” with 10 Best Brokers by Volume…

Let’s dive right in…

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, IFSC, ASIC, CySEC, DFSA, FCA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | FCA, FSCA, FSC, CMA | USD 10 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | FSC, FSA, VFSC | USD 10 | Visit Broker |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

10 Best Forex Brokers by Volume (2024*)

- ☑️AvaTrade – trading volumes now surpass $70 billion per month.

- ☑️IC Markets – US $1.2 trillion in trading volume (March 2023).

- ☑️Forex.com – volume comparison updated every 60 seconds.

- ☑️Exness – biggest forex broker by trading volume with $2.275 trillion.

- ☑️HFM – boasting over 2.5 million clients worldwide.

- ☑️Saxo Bank – trading volume on the platform came in at $112.5 billion.

- ☑️XM – Trade With Up To $10500 Deposit Bonus.

- ☑️Oanda – 25 years of experience in volume trading.

- ☑️Interactive Brokers – real-time volumes for spots in their data feeds.

- ☑️ Pepperstone – more than $12.55 billion in daily trading volume.

What does Trading Volume mean in Forex Trading?

In Forex trading, volume serves as the foundation of market analysis. Furthermore, trading volume represents the total number of traded currency units during a certain period.

Unlike equities markets, where volume is easily quantified, Forex trading relies on volume estimates, frequently determined by the number of tick changes.

Overall, this indirect technique reveals a complex trader mood and liquidity environment.

Trading volume can be seen as the barometer for the strength of price changes; substantial volumes during a price shift indicate a greater consensus among traders on the price direction, making it an important signal for projecting market momentum.

Top 10 Forex Brokers by Volume?

| 👥Brokers | 👉 Open Account | ➡️ OCO Orders | 🖱️ One-Click Trading | 🗞️ News Trading |

| AvaTrade | 👉 Open Account | ❌No | ✔️ Yes | ✔️ Yes |

| IC Markets | 👉 Open Account | ❌No | ✔️ Yes | ✔️ Yes |

| Forex.com | 👉 Open Account | ✔️ Yes | ✔️ Yes | ✔️ Yes |

| Exness | 👉 Open Account | ❌No | ✔️ Yes | ✔️ Yes |

| HFM | 👉 Open Account | ❌No | ✔️ Yes | ✔️ Yes |

| Saxo Bank | 👉 Open Account | ✔️ Yes | ✔️ Yes | ✔️ Yes |

| XM | 👉 Open Account | ❌No | ✔️ Yes | ✔️ Yes |

| Oanda | 👉 Open Account | ✔️ Yes | ✔️ Yes | ✔️ Yes |

| Interactive Brokers | 👉 Open Account | ✔️ Yes | ✔️ Yes | ✔️ Yes |

| Pepperstone | 👉 Open Account | ✔️ Yes | ✔️ Yes | ✔️ Yes |

AvaTrade

AvaTrade is a currency powerhouse with a monthly trading volume of billions. This high volume of trading activity demonstrates the broker’s strong liquidity and the confidence it has earned from more than 400,000 traders.

AvaTrade’s performance is further supported by its numerous execution types and exceptional execution speed and reliability, which ensure traders have access to smooth operations and a myriad of market possibilities.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC |

| 📲 Social Media Platforms | Instagram You Tube |

| 🛍️ Retail Investor Accounts | 1 |

| 🗄️ PAMM Accounts | MAM |

| 🏦 Liquidity Providers | Currenex and other bank and non-bank entities |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Instant |

| ➡️ OCO Orders | ❌No |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | 0.9 pips EUR/USD |

| 💵 Minimum Commission per Trade | None; only the spread is charged |

| 💻 Trading Accounts | Retail Account, Professional Account |

| 📊 Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes (Dubai) |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade is multi-regulated globally | AvaTrade is not regulated in Nigeria |

| AvaTrade offers several robust trading platforms across device | There are no Nigerian CFDs that can be traded |

| Traders can access several educational materials and trading tools | Inactivity fees apply to dormant accounts |

| AvaTrade charges fixed spreads and zero commissions | AvaTrade does not offer 24/7 customer support |

| Nigerians can participate in social trading with AvaTrade | AvaTrade is a market maker and takes the opposite side of the trade against traders |

| AvaTrade is globally renowned for its superior trading conditions | The spreads are wider than that of competitors |

| Traders can expect a range of trading solutions from AvaTrade | |

| There is fast trade execution across markets | |

| Traders can expect deep liquidity from AvaTrade |

IC Markets

IC Markets dominates the currency market with over $29 billion in daily Forex transactions. In addition, IC Markets stands out for its tremendous liquidity and large trading capacity.

This high volume demonstrates the IC Markets’ scale and its popularity among traders who require fast and reliable execution and vast liquidity pools.

In addition, IC Markets caters to a global audience and provides a trading environment in which orders are filled quickly, reducing slippage and improving the trading experience.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, CySEC, FSA, SCB |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 🛍️ Retail Investor Accounts | 3 |

| 🗄️ PAMM Accounts | ✔️ Yes |

| 🏦 Liquidity Providers | 25 |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Market |

| ➡️ OCO Orders | ❌No |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | From 0.0 pips |

| 💵 Minimum Commission per Trade | From $3 to $3.5 |

| 💻 Trading Accounts | cTrader Account, Raw Spread Account, Standard Account. |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader IC Social Signal Start Zulu Trade |

| 💰 Minimum Deposit | HKD1,564.52 in $200 |

| 📉 Trading Assets | Forex Indices Stocks Commodities Cryptocurrencies Bonds Futures |

| Bonuses for traders? | ❌No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| True ECN broker with extremely narrow spreads | More sophisticated instructional resources for beginning traders would be useful |

| Traders have high leverage choices | Customer service could provide greater regional assistance to Australian traders |

| Strong liquidity leads to dependable transaction execution | Beginners may feel overwhelmed by the variety of advanced tools available |

| Support for a variety of trading platforms, including MT4, MT5, and cTrader | There are no supplementary services, such as wealth management or stockbroking |

| There are no constraints on trading techniques, which is perfect for scalping and hedging | The financial instruments offered are fewer than most other brokers |

| IC Markets is known for its raw spreads across markets | Spreads can widen significantly during volatile market conditions |

| Traders can use various trading strategies with IC Markets | |

| IC Markets is a true ECN broker with fast trade execution | |

| IC Markets offers deep liquidity |

FOREX.com

FOREX.com forms part of the StoneX Group and has a strong financial and institutional backbone, with assets totaling more than $7.2 billion.

This connection provides unrivaled market access, liquidity, and execution services to retail and institutional traders globally.

In addition, FOREX.com’s access to over 140 foreign currency markets and various liquidity venues distinguishes it as a top alternative for traders seeking stability, extensive market access, and a safe trading platform.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, CIRO, CIMA, SFC, FSA, MAS, FCA, NFA, CFTC |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 🛍️ Retail Investor Accounts | 3 |

| 🗄️ PAMM Accounts | ❌No |

| 🏦 Liquidity Providers | Anonymous |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Market |

| ➡️ OCO Orders | ✔️ Yes |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | $5 per $100,000 traded |

| 💵 Minimum Commission per Trade | Up to 5 digits after the comma |

| 💻 Trading Accounts | Standard Account, Meta Trader Account, RAW Spread Account |

| 📊 Trading Platforms | Mobile App, WebTrader, MetaTrader 5, TradingView |

| 💰 Minimum Deposit | $100 |

| 📉 Trading Assets | Forex, Indices, Stocks, Cryptocurrency, Commodities, Gold and Silver |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️Yes (except for US traders, as per US regulation) |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tight spreads across a variety of currency pairs | There are no strong incentives for high-volume trading |

| There are multiple trading platforms | The demo account expires after 90 days |

| Strong educational support for traders | Platform options can be challenging to browse |

| Competitive price and a straightforward fee structure | Aside from Forex, there are limited product options |

| An extensive toolkit for analyzing and trading | If you do not trade consistently, you will incur an inactivity fee |

| FOREX.com is heavily regulated by several entities | The spreads charged can be wider than other ECN brokers |

| There are excellent educational and research resources | Beginners may face a steep learning curve with FOREX.com and its advanced offering |

| There is a strong emphasis placed on execution speeds and transparency | |

| FOREX.com has an execution scorecard |

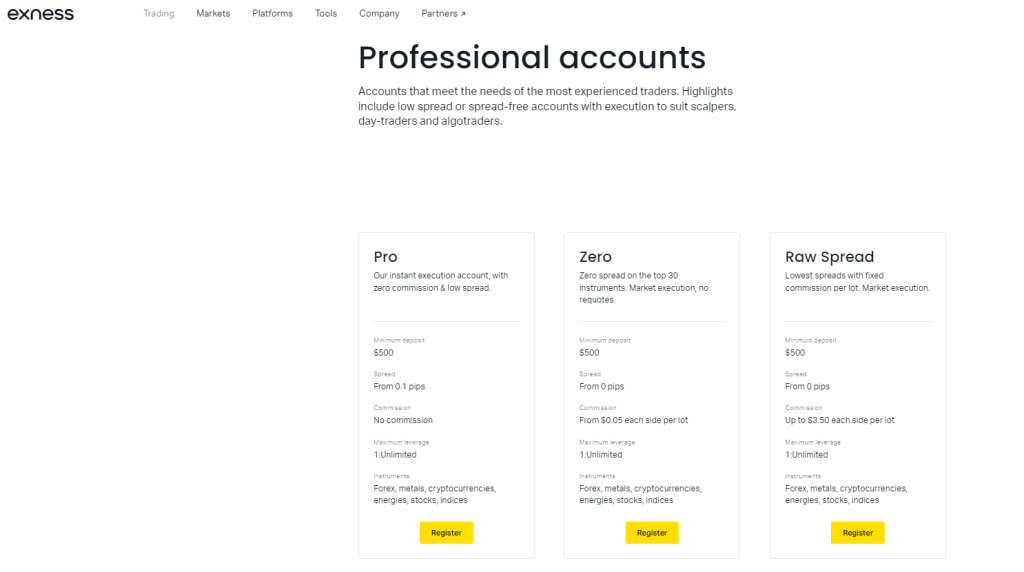

Exness

With over 700,000 clients and a monthly trading volume of more than $4 trillion, Exness is one of the largest forex and CFD brokers by volume.

In 2023 alone, Exness performed 1.9 billion transactions, demonstrating its ability to handle enormous trading volumes and provide smooth execution.

This superior activity level demonstrates the broker’s size and scope and its ability to provide liquid markets and efficient transaction execution across various currency pairs and tradable financial instruments.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 🛍️ Retail Investor Accounts | 5 |

| 🗄️ PAMM Accounts | ❌ No |

| 🏦 Liquidity Providers | ADS Securities, FXCM PRO, and others |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Market |

| ➡️ OCO Orders | ❌ No |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ❌ No |

| 📈 Starting spread | 0.0 pips EUR/USD |

| 💵 Minimum Commission per Trade | From $0.1 per side, per lot |

| 💻 Trading Accounts | IG Trading Account Limited Risk Account Islamic Account (Dubai traders only) Demo Account |

| 📊 Trading Platforms | MetaTrader 4 IG Platform ProRealTime (PRT) L2 Dealer FIX API |

| 💰 Minimum Deposit | $250 |

| 📉 Trading Assets | Forex Indices Shares Commodities Cryptocurrencies Futures Options |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ❌ No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes (Dubai customers only) |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness offers ZAR accounts, saving traders on currency conversion fees | Exness has limited educational material |

| There are flexible account types available | Unlimited leverage can result in the loss of invested funds |

| South Africans can deposit and withdraw in ZAR | The Cent Account is not denominated in ZAC |

| Exness is a reputable and well-regulated broker | Exness has a limited portfolio of instruments that can be traded |

| South Africans can trade ZAR against major currencies, with spreads from 121.5 pips USD/ZAR | |

| Exness has low minimum deposit requirements on most accounts | |

| The spreads charged are tight and competitive | |

| Exness receives liquidity from top institutions | |

| Traders can expect fast and reliable trade execution across markets |

HFM

With 2.5 million customer accounts and $2 billion in client deposits. HFM is an example of a broker who has effectively expanded its operations to fulfill the demands of a broad and large client base.

The sheer number of affiliates (41,000) and customer accounts (2.5 million+) demonstrate HFM’s broad popularity and the confidence it has earned in the forex world. The broker’s scale and liquidity depth guarantee that clients may obtain competitive spreads and execution times.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📲 Social Media Platforms | Facebook Telegram YouTube |

| 🛍️ Retail Investor Accounts | 5 |

| 🗄️ PAMM Accounts | ✔️ Yes |

| 🏦 Liquidity Providers | Barclays UK, BNP Paribas, and others |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Market |

| ➡️ OCO Orders | ❌ No |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | 0.0 pips |

| 💵 Minimum Commission per Trade | From $6 per round turn on Forex |

| 💻 Trading Accounts | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 📊 Trading Platforms | MetaTrader 4 and MetaTrader 5 |

| 💰 Minimum Deposit | No minimum deposit requirement |

| 📉 Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| 💰 US-based Account? | ✔️ Yes |

| 💰 US Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| A diverse range of account types cater to different traders | There is limited German-language help for local traders |

| Attractive bonus and promotion offer | Educational materials are not specifically suited for the German market |

| A diverse assortment of trading instruments | The withdrawal process might be enhanced for efficiency |

| Provides both MetaTrader 4 and MetaTrader 5 platforms | Spreads on certain accounts may not be as competitive |

| Multiple governments regulate the trading environment, assuring its security | The bonus system can be complicated and may not comply with local regulatory requirements |

| HFM ensures that order execution is consistent across markets and account types | HFM’s spreads can widen significantly according to the account type, market, and other factors |

| Traders can expect zero-pip spreads on several currency pairs | |

| There are commission-free options offered | |

| Traders can expect a safe and fair trading environment from HFM |

Saxo Bank

Their website shows Saxo Bank handles over 1 million clients and facilitates over 260,000 deals daily.

With over $100 billion in customer assets and a daily transaction volume of over $17 billion, Saxo Bank demonstrates its great capacity to provide liquidity and execute massive deal volumes.

This strength lets Saxo Bank provide its retail and institutional clients with competitive pricing and access to diverse marketplaces.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | Danish FSA, Danish FSA in UAE, Danish FSA in Brazil, Danish FSA in Czech, FCA, MAS, FINMA, CONSOB, Japan JFSA, Hong Kong FSC, ASIC, Dutch Central Bank and Authority for Financial Markets in the Netherlands, National Bank of Belgium and Financial Services and Market Authority, Banque de France and Autorite Marche Financial |

| 📲 Social Media Platforms | LinkedIn, Twitter, Facebook, YouTube |

| 🛍️ Retail Investor Accounts | 3 |

| 🗄️ PAMM Accounts | ✔️ Yes |

| 🏦 Liquidity Providers | Top banks and other institutions |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Instant, Market |

| ➡️ OCO Orders | ✔️ Yes |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | From 0.4 pips |

| 💵 Minimum Commission per Trade | From $0 on Mutual Funds |

| 🔎 Trading Accounts | Classic, Platinum and VIP |

| 💻 Trading Platforms | SaxoInvestor, SaxoTraderGo, SaxoTraderPro |

| 💸 Minimum Deposit | $2000 |

| 🔁 Trading Assets | Forex, commodities, CFDs, bonds, ETFs, Stocks, Mutual Funds, Crypto ETPs options |

| 💲USD-based Account? | ✔️ Yes |

| 💲USD Deposits Allowed? | ✔️ Yes |

| 💰 Bonuses for traders? | No |

| 📊 Minimum spread | From 0.9 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | No |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Saxo Bank excels in providing a diverse range of assets, including forex, stocks, bonds, and commodities. | The platform may be overwhelming for novice traders due to its advanced features and tools. |

| The platform offers sophisticated tools for in-depth market analysis, catering to experienced traders. | Compared to some competitors, Saxo Bank's fees may be relatively higher, impacting cost-effectiveness. |

| Saxo Bank provides extensive access to global financial markets, allowing diverse investment opportunities. | The sophisticated platform might have a steeper learning curve, requiring time to master for some users. |

| Experienced traders benefit from tailored support and research resources, enhancing decision-making capabilities. | |

| Saxo Bank incorporates cutting-edge technology for seamless and efficient trading experiences. | |

| Saxo Bank is ideal for high-volume traders | |

| Saxo Bank guarantees fast and reliable trade execution | |

| Traders can expect a well-regulated and transparent trading environment | |

| There are powerful third-party and proprietary platforms with excellent order execution |

XM

XM proves its currency market dominance with over $16 billion daily in trading volumes. This volume demonstrates XM’s strong liquidity and capacity to execute huge orders with minimum market effect, which benefits traders through improved pricing and execution.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 🛍️ Retail Investor Accounts | 4 |

| 🗄️ PAMM Accounts | ❌No |

| 🏦 Liquidity Providers | Unknown |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Market, Instant |

| ➡️ OCO Orders | ❌No |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ❌No |

| 📈 Starting spread | From 0.7 pips |

| 💵 Minimum Commission per Trade | From $1 per share |

| 💻 Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 📊 Trading Platforms | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 💰 Minimum Deposit | $5 |

| 📉 Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares, |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️ Yes |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✅Pros | ❌Cons |

| The XM accounts are accessible to all types of traders | Spreads can fluctuate drastically and quickly |

| Traders can use leverage up to 1:1000 | There are position size limits according to the trading account |

| XM caters to various trading strategies | ompared to alternative brokerages, XM offers a relatively limited assortment of cryptocurrencies, which may restrict the range of options available to traders interested in acquiring a diverse selection of crypto assets. |

| There is a diverse range of tradable instruments | Traders may incur inactivity penalties if their accounts remain inactive for prolonged durations. This situation may present a challenge for infrequent traders. |

| XM offers multi-currency accounts | XM functions through the implementation of variable spreads, the magnitude of which traders may perceive as being greater during periods of heightened market volatility. |

| XM applies for negative balance protection | XM, in comparison to certain industry rivals, does not consistently provide fixed deposit advantages, potentially impeding traders who are in search of supplementary incentives. |

| A cent account is provided by XM, enabling traders, particularly novices in the field, to commence their endeavours with more modest investments while efficiently mitigating their risk exposure. | A number of traders are perplexed by XM's fee structure, which varies by account category and has the potential to cause some users to become confused. |

| XM's platform provides traders with competitive margins that not only enhance cost-effectiveness but also possess the potential to optimise profits. | Depending on the regulatory climate, traders whose strategies favour higher leverage ratios may face repercussions if XM is able to enforce leverage restrictions. |

| XM offers a range of markets that can be traded | XM’s demo account is only available for 90 days if it is not used consistently |

| XM prides itself on fast and reliable trade execution | The spreads on instruments like NASDAQ can widen during volatile periods |

| Traders can expect transparent fee schedules with XM | The spreads are not as tight as those charged by other brokers |

| XM is well-regulated and ensures client fund security |

OANDA

OANDA is notable for its ability to provide competitive liquidity and execution across a wide range of currency pairings with a substantial daily trading volume of more than $10 billion.

This volume demonstrates OANDA’s strong market position and ability to meet its clients’ trading demands via efficient order execution.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 🛍️ Retail Investor Accounts | 5 |

| 🗄️ PAMM Accounts | ❌ No |

| 🏦 Liquidity Providers | JP Morgan, Deutsche Bank, Citibank, UBS, Morgan Stanley, Citadel Securities, Jump Trading, Credit Suisse |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Market |

| ➡️ OCO Orders | ✔️ Yes |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | From 0.1 pips |

| 💵 Minimum Commission per Trade | From $35 |

| 💻 Trading Accounts | Standard Account, Core Account, Swap-Free Account, Demo Account |

| 📊 Trading Platforms | Oanda Platform, MetaTrader 4, TradingView |

| 💰 Minimum Deposit | No specific minimum deposit required. |

| 📉 Trading Assets | Index CFD's, Forex, Metals, Commodity CFD's, Bonds CFD's, Precious Metals, Real-Time Rates |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️Yes (except for US traders, as per US regulation) |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✅Pros | ❌Cons |

| There is no minimum for lower deposits, which is convenient for traders who want to start modestly | Deposits of more than US$9,000 require additional documentation |

| Some accounts have minimal spreads, allowing for competitive trading conditions | Some accounts charge commissions per million transacted |

| OANDA offers a range of tradable markets | Some risk-averse traders may find a 50% stop-out too high |

| Advanced trading platforms include the MT4, MT5, and FxTrade platforms | Certain bonuses need a high minimum balance and trading volume |

| There are no restrictions on trading strategies | OANDA’s platform can be confusing for beginners |

| Offers an advanced range of trading tools for high-volume trading | |

| Charges tight and competitive spreads | |

| The OANDA platform is advanced and ensures fast and reliable trade execution | |

| OANDA is regulated globally by top entities |

Interactive Brokers

As a NASDAQ-listed entity with $14.1 billion in equity capital and $10.2 billion in surplus regulatory capital, IBKR clearly shows its financial stability and ability to handle high-volume trading.

Furthermore, with 2.56 million client accounts, IBKR is known for its extensive market access, permitting 1.931 million daily average revenue trades, demonstrating its active and diverse customer base.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| 📲 Social Media Platforms | LinkedIn YouTube |

| 🛍️ Retail Investor Accounts | 2 |

| 🗄️ PAMM Accounts | ✔️ Yes |

| 🏦 Liquidity Providers | Various banks and institutions |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Instant, Market |

| ➡️ OCO Orders | ✔️ Yes |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | Form 0.6 pips |

| 💵 Minimum Commission per Trade | From 0.0005 USD |

| 💻 Trading Platforms | IBKR Lite, IBKR Pro |

| 💻 Trading Accounts | Individual, Joint, Trust, IRA, Non-Professional Advisor, Family Office, Advisor, Advisor Client (including Non-Professional Advisor and Family Office), Broker Client, EmployeeTrack. |

| 📊 Trading Platforms | IBKR Trader WorkStation IBKR Desktop IBKR Mobile IBKR GlobalTrader IBKR Client Portal IBKR APIs IBKR Impact |

| 💰 Minimum Deposit | No specific minimum deposit required. |

| 📉 Trading Assets | Global Stocks, options, futures, currencies, cryptocurrencies |

| 💲 USD-based Account? | ✔️ Yes |

| 💲 USD Deposits Allowed? | ✔️ Yes |

| ➕ Bonuses for traders? | ✔️Yes (except for US traders, as per US regulation) |

| 📈 Minimum spread | From 0.0 pips |

| ☪️ Islamic Account | ❌ No |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Extensive range of financial instruments including stocks, options, futures, Forex, bonds, and more. | Complex fee structure that may be confusing for some traders. |

| Direct market access (DMA) providing transparent and efficient trading execution. | Higher minimum deposit requirements compared to some other brokers. |

| Competitive pricing with low commissions and margin rates. | Steeper learning curve for beginners due to the advanced trading tools and features. |

| Powerful trading platforms such as Trader Workstation (TWS) and IBKR Mobile, offering advanced tools and analytics. | Limited customer support options, primarily through email and chat. |

| Global presence with access to over 135 markets in 33 countries. | Inactivity fees on dormant accounts. |

| Interactive Brokers is known for its high-volume trading solutions | IBKR can be extremely complex for beginners |

| The IBKR platforms are award-winning | |

| IBKR is an ideal broker for experienced and professional traders | |

| The spreads charged are tight and competitive |

Pepperstone

Pepperstone is a notable name in the forex world, with monthly trading volumes surpassing $7 billion. This substantial trading volume shows Pepperstone’s confidence and efficiency among its clients.

Furthermore, traders can expect access to some of the deepest liquidity in the market, ensuring that traders can execute large trades with minimum slippage. They are known for their fast and reliable trade execution across financial markets.

Pepperstone is dedicated to technical innovation, ensuring traders can access cutting-edge trading platforms to give them an edge in volatile financial markets.

Unique Features

| 🔎 Feature | 👁️🗨️ Information |

| 🏛️ Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📲 Social Media Platforms | LinkedIn You Tube |

| 🛍️ Retail Investor Accounts | 2 |

| 🗄️ PAMM Accounts | Only MAM for Fund Managers |

| 🏦 Liquidity Providers | Barclays, HSBC |

| Execution Venues | Sucden Financial Limited, IS Prime Limited, LMAX Limited, GAIN Capital, Jefferies Financial Services, Inc. (Morgan Stanley, Morgan Chase) |

| 🧑🤝🧑 Affiliate Program | ✔️ Yes |

| 🧑⚖️ Order Execution | Market |

| ➡️ OCO Orders | ✔️ Yes |

| 🖱️ One-Click Trading | ✔️ Yes |

| ✏️ Scalping | ✔️ Yes |

| 📌 Hedging | ✔️ Yes |

| 🤓 Expert advisors | ✔️ Yes |

| 🗞️ News Trading | ✔️ Yes |

| 📊 Trading Api | ✔️ Yes |

| 📈 Starting spread | Variable, from 0.0 pips EUR/USD |

| 💵 Minimum Commission per Trade | From AU$7 |

| 💻 Trading Accounts | Forex Indices Shares Commodities Cryptocurrencies ETFs Currency Indices |

| 📊 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader TradingView Capitalise.ai |

| 💰 Minimum Deposit | AU$200 |

| 📉 Trading Assets | Forex Indices Shares Commodities Cryptocurrencies ETFs Currency Indices |

| ➕ Bonuses for traders? | ❌No |

| 📈 Minimum spread | From 0.0 pips |

| 💻 Demo Account | ✔️ Yes |

| ☪️ Islamic Account | ✔️ Yes |

| BaFin Regulation | ✔️ Yes |

| 👉 Open Account | 👉 Open Account |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| MetaTrader 4, MetaTrader 5, and cTrader are available with Pepperstone | There are limited educational materials |

| Pepperstone offers straight-through processing without dealing with desk intervention | In-house analysis and trading signals could improve |

| Pepperstone's customer support is quick to respond | While Pepperstone offers a diverse range of trading instruments, some traders may find that certain niche assets or markets are not available for trading through this broker. |

| Active traders can expect narrow spreads and competitive commissions | There is a smaller range of markets that can be traded compared to rivals |

| Pepperstone is a large and prominent broker | |

| There are reliable execution speeds, and Pepperstone publishes its execution venues | |

| Traders can expect 0.0 pip spreads on major forex pairs | |

| Pepperstone is trusted and has a transparent fee schedule |

The Advantages of Trading With High-Volume Forex Brokers

High-volume forex brokers offer various advantages suitable for both novice and seasoned traders, including the following.

Liquidity

One major benefit is the greater liquidity these brokers provide. They have access to an extensive network of players, such as banks, financial institutions, and fellow traders. This guarantees prompt execution at fair market rates, even in turbulent times.

Competitive Pricing

High-volume brokers offer a significant benefit in terms of competitive pricing. These brokers can negotiate favorable conditions with liquidity providers due to their extensive trading activities, resulting in narrower spreads and reduced expenses for traders.

Brokers who handle a large volume of trades usually offer an advanced trading setup complete with intricate platforms, cutting-edge tools, and technology.

This arrangement facilitates fast-paced transactions while delivering real-time market data, analytics, and automated trade options. These attributes are invaluable to traders because they can make informed decisions and execute sophisticated trading strategies across markets.

Range of Markets and Trading Partners

Furthermore, choosing a broker with high trading volume means you can access various markets and trading options.

These brokers have many resources and strong networks, so they can offer many different currencies, including major, minor, and exotic pairs. They also offer other assets like commodities, indices, or cryptocurrencies.

This flexibility allows traders to explore different investment opportunities across different parts of the market. It is an ideal way to spread out your investments and reduce the risks of focusing too much on one type of investment.

Conclusion

In our experience, brokers with high trading volume offer unparalleled liquidity and market-depth access. This ensures that traders expect fast and reliable trade execution and competitive pricing. High-volume brokers like those we discussed offer the best technological infrastructure, catering to most trading strategies and trader objectives. However, we noted that the complexity and sheer number of services offered can be daunting, especially for beginners.

Faq

Research brokers that are heavily regulated by top-tier authorities. Furthermore, look for reviews, examine spreads/fees, and ensure they provide the currency pairings you want to trade.

Concentrate on narrow spreads, rapid execution times, extensive liquidity, dependable customer service, and any unique tools required for your trading style.

Trading volume is important because it affects liquidity (how easily you buy and sell without changing the price). High-volume brokers often provide the best order fills, lower slippage, and competitive pricing.

Not always. While high-volume brokers provide certain advantages, beginners may prefer the superb instructional tools and user-friendly platforms other broker types provide.

Many high-volume brokers have several flexible account types to meet various trading demands. These might be Standard, ECN, Micro, or VIP accounts.

A high volume in forex indicates that many currency pairs are purchased and exchanged in a certain period. This signals high market activity, which can lead to improved liquidity and narrower spreads for retail and institutional traders.