First Quadrant – Algo Company

Forex Algorithmic Trading – First Quadrant Case Study

In the last several months, we have published a number of articles about algorithmic trading. We have also looked at some successful hedge funds that use automatic forex signals for trading. This article will be about an algorithmic hedge fund, which only invests in currencies. This hedge fund is First Quadrant LP (FQ). First Quadrant is a hedge/investment fund that was established in 1988 and bases their trading entirely on forex signals that they receive from their algorithmic trading software. Their primary field of trading is forex, so it’s pretty relevant to give this a look.

2015 has been a successful year for First Quadrant LP, despite a January 15th drawdown

First Quadrant LP uses a home-built algorithmic trading software as well as trading software built by third parties. The most distinctive thing about FQ is their trading strategy. Their algo trading is somewhat different from the algo trading industry. Most of the algorithmic trading firms use market inefficiencies or very fast trading execution as their trading strategy. They build or buy expensive and complex algorithmic trading programmes that process large amounts of data in a very short time and look for small market inefficiencies. Then the algo trading programmes issue buy/sell forex signals targeting a fraction of a pip.

This happens thousands… even millions of times a day and it is called high-frequency trading. We have a section in our algo trading article that shortly explains high-frequency trading. There are also firms that use algorithmic software and execute trades extremely fast. This trading software look for clues and certain words during statement releases and press conferences from central banks, and then they buy or sell the involved currency so fast that it is almost impossible for humans to react. That´s why sometimes you see huge moves or gaps that happen in less than a second. Can you remember the 50 cent move in the Swiss Franc pairs – that was instantaneous!

First Quadrant’s Trading Strategy

First Quadrant, uses a more traditional strategy. The forex strategy that their trading programs are built on is the ‘fair value model’. This is a theory which has the roots in the Salamanca school during the European Renaissance period about 40 years ago. Basically, this strategy means that different countries and economies are weighted to see their fair value, taking into account the outlook for the future. Then, the currencies are analyzed and weighed against each other as well to see whether they are valued fairly in relation to their economies. As we said, this theory was developed first at the School of Salamanca to assess the real value of gold and silver, which was used for trade between Spain and its colonies.

Many analysts argue that the fair value forex strategy works best under normal conditions when the nerves are calm and the forex traders are rationally choosing sides. This makes sense in my opinion as well, because from my experience I trade better when I have time to think the trades over and conduct a thorough analysis. But the analysts at First Quadrant believe that the fair value forex strategy works best under times of stress. They argue that the forex market and other financial markets balance faster in troubled times when the volatility is high and risk aversion is switched on.

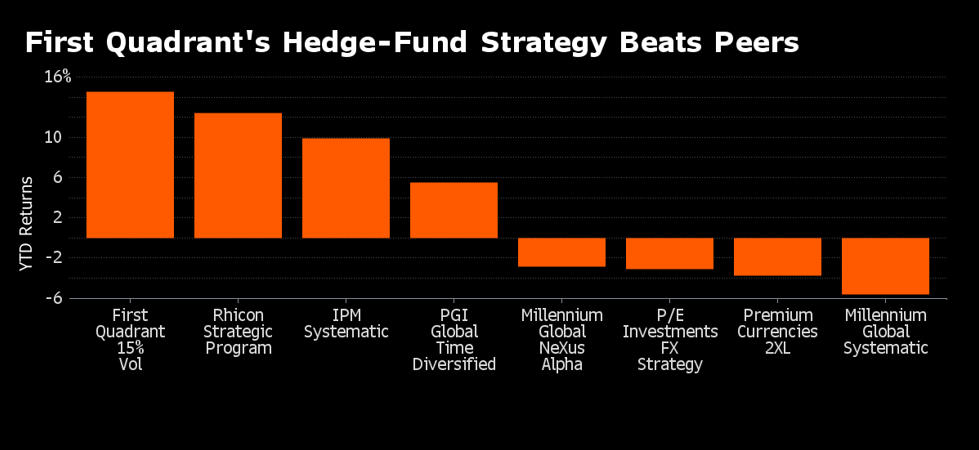

FQ Beats Pears Chart

Anyway, no one can properly judge that theory, especially when the forex strategy that it’s based on has worked pretty well in the past. They had a nearly 10% drawdown in January 2015 when the Swiss National Bank removed the EUR/CHF peg, but everyone who was active in the forex market that day suffered severe losses. But, apart from that day which was an exception for everyone, FQ has had a steady and profitable year. Bloomberg analyzes a basket of hedge funds that use systematic trading strategies based on algorithm forex signals, and the chart above shows that the FQ fund has outperformed its forex peers. The FQ hedge fund closed the year with a 15% profit while some of the other hedge funds even closed the year with a loss, and that´s a respectable return for a medium hedge fund.