A Short Month That Wouldn’t End – February 2016 Monthly Review

Alright, we finally closed this month. We closed January with some great results and entered February with positive attitude, but the market wasn’t in the same mindset as us. The stock markets sell off resumed again in the first day and soon the global markets panicked. The Euro, the Swiss Franc and the Yen made some massive gains while the risk currencies suffered heavy losses. The dust finally settled after two weeks but fear is still present. The EU/UK negotiations didn´t produce enough to satisfy the market expectations and the British Pound reached new lows. The Euro is not immune towards a possible Brexit, so that weighed on the Euro as well.

Did we escape another global financial crisis or is it still to come?

Forex Signals

Last month, we made more than 800 pips, but still complained in last month´s review about how fear affects the market and makes trading difficult. Little did we know what was about to come. As you now know, the fear of the recent months turned into panic in the first two weeks of February. The market ranged from several hundred pips to more than a thousand pips in less than ten trading days. This was really difficult to trade, and not even close to the ease of last month´s price action. As a result, we ended February with -357 pips. But at least we managed to minimize the losses, because at some point, on Thursday afternoon of the second week we were more than 900 pips down. But the market calmed in the last two weeks and we crawled back up. We just didn´t want to give back all the profit we made in January… and we didn´t since we are now more than 500 pips in profit for the year to date.

We opened 82 signals this month, one of which is still open, the USD/JPY long-term signal. Since the market was moving really fast in the first two weeks, our signals closed pretty quickly and that´s when we issued most of our signals. Perhaps we should have held back, but you never know when you are into a flash crisis until it´s over. The market realised by the end of the second week that this was a panic drive crisis and that´s when it ended. We opened 45 forex signals in the first two weeks for a total loss of 870 pips. Only then did we decide to step back a little, look at the bigger picture and become cautious. This worked well for us since we only had three losing signals on the third week out of sixteen and made 224 pips. We did the same thing on the fourth week and it went even better; we had just one losing forex signal out of 16 and we made 322 pips in the last week which keeps us well up for the year so far. The EUR/USD long term forex signal is about 100 pips in profit but that´ll be a bonus for March.

The market this month

Personally, it felt like the longest month ever. We had plenty of action this month and lots of events connected to the forex market. In the first two weeks, the financial markets and the forex market were totally out of their minds. During the last several months, the global economy and, in particular, the commodity-based economies experienced a slowdown. Because of that, the investors have accumulated of fear which finally exploded in the first two weeks of February. The global stock markets slumped, with Nikkei leading the decline – losing about 15% of its value during that period. That spilled into the forex market, and the money flowed into the funding and safe haven currencies. The Swiss Franc and the Euro gained about 500-600 pips while the Japanese Yen made a massive 1,000 rally in just eight trading days. The BOJ was itching to intervene and many predicted that another global crisis was near… but everything calmed down in the following two weeks. There´s still a sense of fear and the market is on its toes; anything can spark another wave of panic and we´re not out of the woods yet, but at least the huge volatility has diminished for the time being. On the last day of this month, we had some good US economic data and that has made our perspective a little brighter.

With recent developments in the global markets, like the falling inflation in the Eurozone, the slowdown of the European economy and the Brexit (which would inevitably affect the Euro for the worse), the ECB increased the dovish rhetoric for their March QE additional stimulus. It still remains to be seen what actions they will take because they promised a lot for their December meeting despite missing market expectations. The Euro declined in the second two weeks anyway and gave back most of the gains. Speaking of Brexit, the referendum date has set for the 23rd of June. The poor Pound Sterling was the worst performer this month, losing about 700 pips against the Buck and nearly 20 cents against the Yen. The OPEC and other petrol producing countries have been very vocal this month about halting the price decline but after every comment another would contradict saying that they won´t cut production or exports. Still, they managed to get the price above the 30$/barrel and the Canadian Dollar has benefited from this, gaining more than 10 cents in about 5-6 weeks.

Economic Data

The Chinese economic data has shown the same trend this month regarding services and manufacturing; the service sector is expanding slowly while the manufacturing sector is contracting. Although it missed expectations, the consumer inflation grew by 0.2% from the previous month, but producer inflation declined 5.3% this month. The Japanese industrial production declined as well and the GDP reflected this as it contracted 0.4% in the fourth quarter of 2015. The economic data this month from the Eurozone showed quite a bleak picture. The manufacturing and industrial sectors missed expectations and the inflation came out 0.1% below the consensus. Unemployment went south by 0.1% as well. We had some positive signs from the UK, with retail sales jumping 2.3% and manufacturing beating the expectations. The construction sector missed expectations but it is still expanding at a healthy pace. The manufacturing sector in the US is still below 50 PMI level which means it remains in contraction. The service and the non-manufacturing PMI are expanding but didn’t hit the mark, so there are worries that these sectors might fall into contraction as well. The unemployment remains in a solid shape at least, with unemployment declining to 4.9% and the Q4 GDP revised up from 0.4% to 1.0%.

Pairs analysis

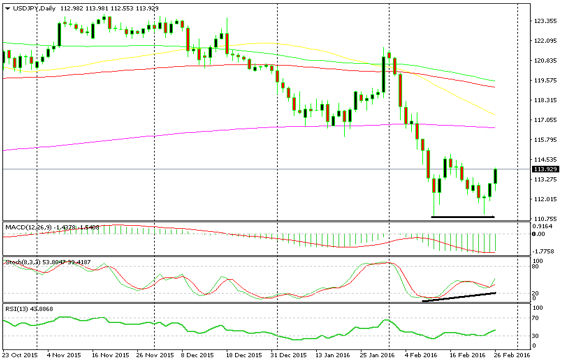

We made an analysis of this pair last month but many things have changed since then, so I think we should have another look at it. As we can see from the daily chart, it started to decline from day one. The Bank of Japan eased further on the last day of January and this pair popped about 300 hundred pips up. But panic grew and the decline began. There are two big bearish candles on the weekly chart. The price reached 111 and then slowly crawled back up, but when it reached the weekly 100 MA it failed to break above and returned back down to 111. It didn´t break below 111 either and in the last three days it reversed back to close the month just shy of 114. There´s a double bottom pattern in the daily chart which is a bullish sign and the indicators are heading up but we have to break above 115 so the pattern can become valid. If that happens, then 119 is the target.

There´s a bullish divergence pattern forming

A bullish double pattern is forming here as well

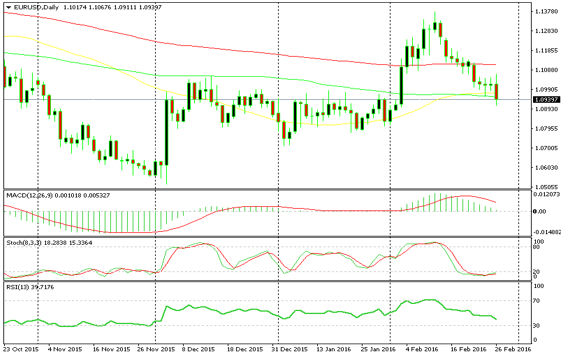

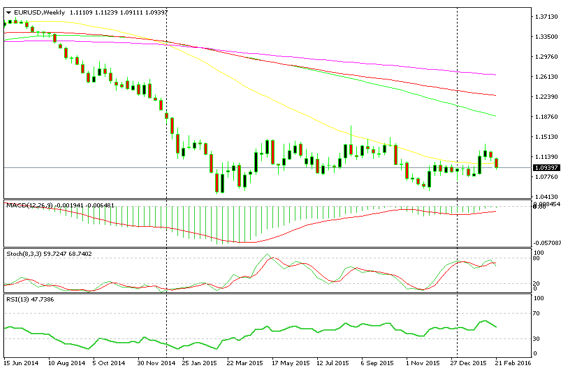

The Euro was another beneficiary of the panic that swept the market in the first two weeks of February, and EUR/USD went up to 1.1375 from around 1.08 as you can see on the daily chart. But the market settled and the ECB increased their dovish rhetoric so the move up faded. The Brexit fears weighed further and this pair closed the month only a 100 pips higher from where it started in the beginning of February. On the weekly chart, the price finally closed a week above the 50 MA since early 2014, but it turned south again and now we are now back below that MA. So, was that a fake out? We have to see how the situation develops and what the ECB will do on their March meeting.

The Euro gave back most of the gains by the end of the month

The price finally closed above the 50 MA but sank below again

Week in conclusion

The hectic month of February is finally over. It´s been a total rollercoaster; the forex market was moved by the panic in the first two weeks and a flash mini-crisis. The Yen gained about 10 cents in a few trading days and the BOJ threatened to intervene when they did a ring around with the second level banks. We were caught in the middle of this mayhem, faced some tough times and suffered some losses in the first two weeks – but made 2/3rds back by the end! The ECB will hold their meeting on the 10th of March so we´ll see what they decide. The performance in the last two weeks has been great so we hope to continue on this successful path in March as well.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account