Looks like the SNB (Swiss National Bank) has been active again in the forex market by trying to help the CHF. When these guys try to help their currency, they usually get on the short side of it, meaning they sell the Swiss Franc against the Euro.

That´s the biggest problem the central banks of such safe haven currencies face; when there is uncertainty, they get heavy bids, thus making the job for these banks extremely hard.

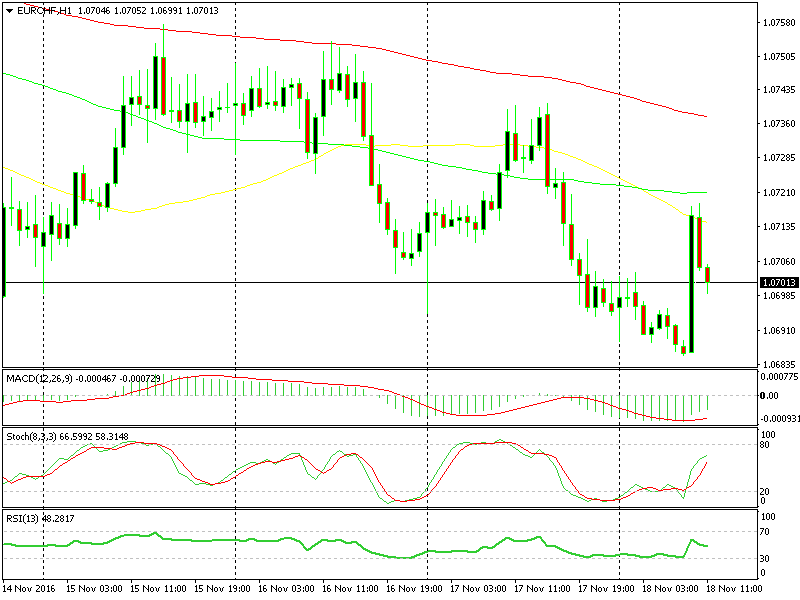

We opened a short term buy forex signal in EUR/CHF a couple of weeks ago with a stop loss at 1.0684 and the price got too close to it a few hours ago. But the SNB decided to cover our backs again and step in at 1.0686. I can´t see any comments around about this intervention, but it is obvious. A 30 pip jump in this forex pair in a matter of minutes, when it takes hours and days for it to cover this distance, is nothing but intervention.

The market is stubbornly pushing down despite the intervention.

The market is stubbornly pushing down despite the intervention.

Only yesterday, a SNB member strongly pointed out that one of the main tools the SNB has is intervention and that they are active in the forex market at any time. That´s music to our ears when it comes to our EUR/CHF signals, but the market is being stubborn. It is pushing down again as EUR/USD breaks the 1.06 support level.

This opens the door for a move further down in this pair, but we´ll cover it shortly. As for our EUR/CHF signal, just keep the stop tight in case the SNB gets tired and throws in the towel. The January 2015 event when the SNB crashed the forex market is too taunting, so better safe than sorry.