GBP/USD Breaking Support Despite Positive UK Data – What Do You Make of It?

The UK economic data has been pretty good today. Apart from the miss in the trade balance, all the other data was positive. After all, the UK won´t turn into a net exporter overnight just because of the soft Pound.

UK manufacturing and industrial production put up an impressive jump with oil and pharmaceuticals leading the way. The Buzzard oil field in the North Sea was opened in November, so that must account for a big part of this jump.

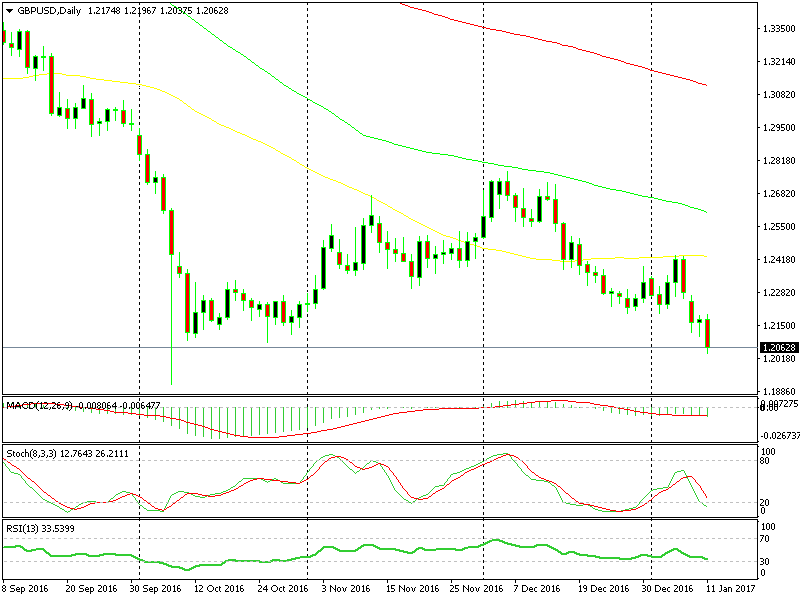

Yet, the GBP kept declining all day today, breaking the 1.21 support level. That´s been the real low, thus support, despite the short-lived GBP crash which reached 1.19.

The 1.21 support level has finally been broken

The 1.21 support level has finally been broken

This must be worrying for GBP buyers, especially coming after weeks of great economic data. This is a very bearish signal. It opens the door for further declines and the 1.20 level is within sight now.

There´s a wave of USD selloff happening right now as Donald Trump is taking questions in a press conference in Trump Tower in new York, but the GBP seems doomed. Once the USD selling is over (if Trump doesn´t send the Buck to the cemetery), 1.20 in GBP/USD will be smoke on the water.