We opened a sell forex signal in AUD/USD last Friday since the commodity currencies were showing signs of weakness. This was after a few of weeks where the pair climbed, with the Aussie being the weaker link amongst the two.

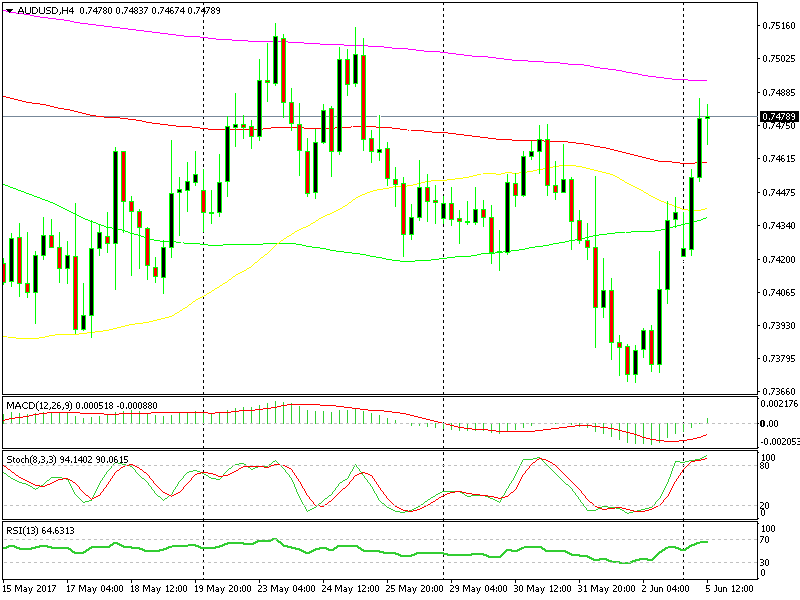

All the moving averages were clustering around 0.7430-40, so a strong resistance area formed around there, on paper at least.

On Friday evening, those moving averages were breached, but the candlestick formation on the H1 and H4 chart signaled a possible reverse, which never came.

We´re approaching the 200 SMA, so get ready to sell

We´re approaching the 200 SMA, so get ready to sell

Last night, AUD/USD opened with a gap lower which was encouraging to bears, but the gap was quickly filled. It didn´t stop there though, the economic data from the Pacific started coming in and the Aussie started getting excited. However, I doubt it was just the Australian economic numbers that sent the AUD surging.

The Australian “company operating profits” beat expectations last night. Though the main reason for the AUD surge, in my opinion, was the Chinese Caixin services PMI, which was sort of impressive.

So, unlike the CAD and NZD which are more or less unchanged from last night, the Aussie has climbed about 60 pips and it´s these numbers that sent it running higher.

We`re still keeping a bearish view on AUD/USD for the immediate future because the bigger picture hasn´t changed and the H4 chart is well overbought. Besides, the moving averages are still above the price on this timeframe chart, so they´re likely to provide resistance if the buyers feel too confident.

The best place to sell, in my opinion, is around 0.75, which is a strong resistance area and where we can find a number of moving averages. So, get ready for another forex signal in this forex pair.