Forex Signals Brief For 10th – 16th July – Top Economic Events Worth Watching This Week!

Good morning, forex friends. The rainy weather here is just awesome! Last week, the market remained highly volatile and our trading signals captured a good number of pips.

One of the major market movers was the June NFP report which was released on Friday. The U.S. dollar rolled and turned bullish to climb higher against peer currencies. Actually, the NFP was positive but the unemployment rate was negative at 4.4%. What's up with the bullish dollar? Let's find out!

Firstly, the non-farm payrolls increased by 222K for the month of June, convincingly beating the expectation of a 175K gain. Better yet, the NFP figure for the month of May was upgraded from 138K to 152K. Yes, the NFP has been positive for 2 months in a row now.

Weekly Highlights

CAD – The Bank of Canada is scheduled to release their monetary policy report on Wednesday at 14:00 (GMT). To me, it's quite surprising that they're expected to increase their interest rate from 0.50% to 0.75%. Considering the falling oil price and the falling inflation in Canada, I really don't think it's a good plan.

USD – FED Chair Yellen is due to testify on Wednesday at 14:00 (GMT). Since Janet Yellen is the chairwoman of the FED, her testimonies always need to be monitored closely in order to find out potential hints on the upcoming monetary policy.

USD – The June CPI (consumer price index) figure is due to be released at 12:30 (GMT) on Friday, with a positive forecast of 0.1% which is higher than -0.1% (previous). What I have observed is that the inflation figures have been generally weaker than anticipated over the 3 months preceding June. Consequently, investors are in doubt whether the Federal Reserve (FED) will be able to take further steps to normalize monetary policy in the near future. We should monitor the CPI and Core CPI figures on Friday because they have the potential to move the U.S. dollar.

GBP – The Office for National Statistics will declare the UK labor data on Wednesday, July 12th, at 8:30 (GMT). The data is expected to be unfavorable as the jobless claims are likely to be 10.4k, higher than 7.3k (previous). Investors are advised to monitor it ahead of trading any GBP currency pairs.

Overview Of The Forex Majors

EUR/USD – Another Week With Triple Top Pattern

The EUR/USD traded in a narrow range with a high to low movement of 127 pips, while the open to the close movement was only 19 pips. During the previous week, the EURUSD fell dramatically following a sharp rally, ultimately printing a doji candle on the weekly timeframe.

In our previous weekly forecast, we suggested that the EUR/USD would hold below the major resistance of $1.1450. Looking at the weekly timeframe, the pair has formed a triple-top which extends from this important resistance zone.

This week, forex junkies will be monitoring the high-level economic events from the United States, as the Eurozone doesn't have much to release this week. In particular, the Fed Chair Yellen’s testimony and the U.S. CPI data are in the spotlight. Traders, take a look at this amazing article to enhance your understanding about Euro trading.

EURUSD – Key Trading Levels

Support Resistance

1.1241 1.145

1.1176 1.1515

1.1072 1.162

Forex Trading Signal Idea

I'm sticking with the same Idea, which is to have a sell position below $1.1445 with a stop loss at $1.1475 and a take profit $1.1315. On the flip side, buy positions seem suitable above $1.1285 in this week.

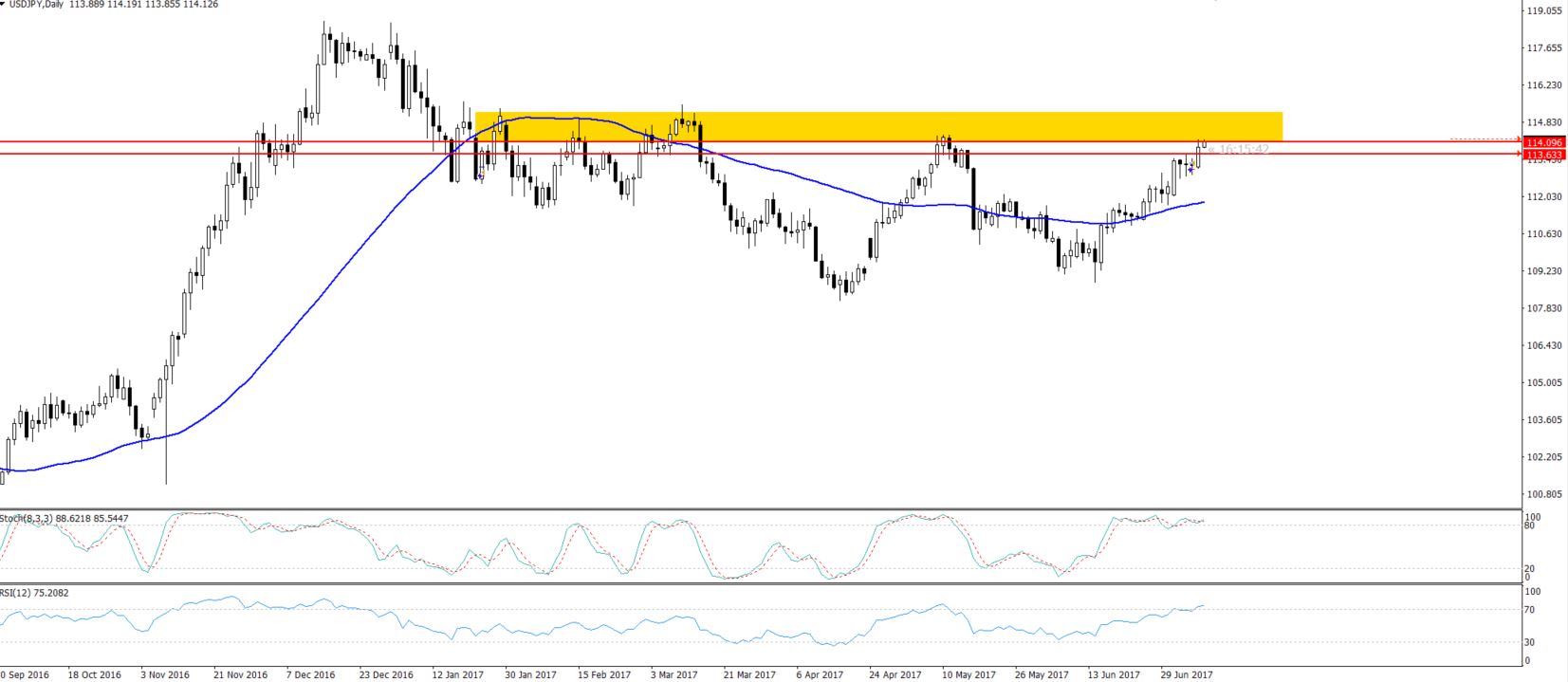

USD/JPY – Diminishing Haven Demand

The USD/JPY has come out of its sideways trading range of $111.750- $112.850. The U.S. dollar strengthened during the previous week because of the better than expected Nonfarm payrolls report.

On the flip side, the Bank of Japan weakened the safe haven currency on Friday as it offered to buy unlimited amounts of 10-year JGBs (Japanese government bonds) at a return of 0.11%, recording its first fixed-rate bond purchase since February 2017. In response, the Nikkei declined by 0.52% to 19,891. The Japanese yen weakened against the Buck, as the bond buying program will increase the money supply in the Japanese market.

Technically, the pair has entered the overbought region. Let's take a look at the RSI and Stochastic indicators on a 4-hour chart of the USD/JPY. Both of these are holding at +70 & +80 respectively, signifying that the bulls are dominating but are likely to cut their positions on the pair in order to take some profits. If you want to gain further understanding regarding everything about the USD/JPY, take a look at Trading the USD/JPY – A Beginner's Guide.

USDJPY – Key Trading Levels

Support Resistance

113.31 114.14

113.06 14.39

112.65 114.81

Forex Trading Signal Idea

Our previous forecast of the USD/JPY was really accurate as the market remained bullish above $112.20. This week, $113.60 is a crucial trading level. We need to stay bullish above this level in order to target $114.850. On the other hand, sell positions are recommended only below $113.300.

Conclusion

During the second week of July, forex freaks are likely to encounter echoes of the better than expected NFP figures from the previous week, while focusing on the new economic events such as UK labor market data, U.S. inflation figures, and the Canadian monetary policy events. Anyway, today (Monday), the market is likely to trade in a less volatile environment in the absence of major news events.

New Instruments in Our Forex Signals Service

I'm really excited to share that we are consistently increasing the number of instruments in order to accommodate our followers at its full. Aside from gold & crude oil, we are about to add more instruments such as cryptocurrencies. Stay tuned for astounding analysis & forex signals!