European Index CAC Closed In Profit – What’s Next?

At the beginning of the European session, the French stock markets were signaling a bearish trend while trading at $5213. The downward momentum was followed by a bearish close on Monday due to losses in the shares of different sectors including healthcare, industry, and utilities.

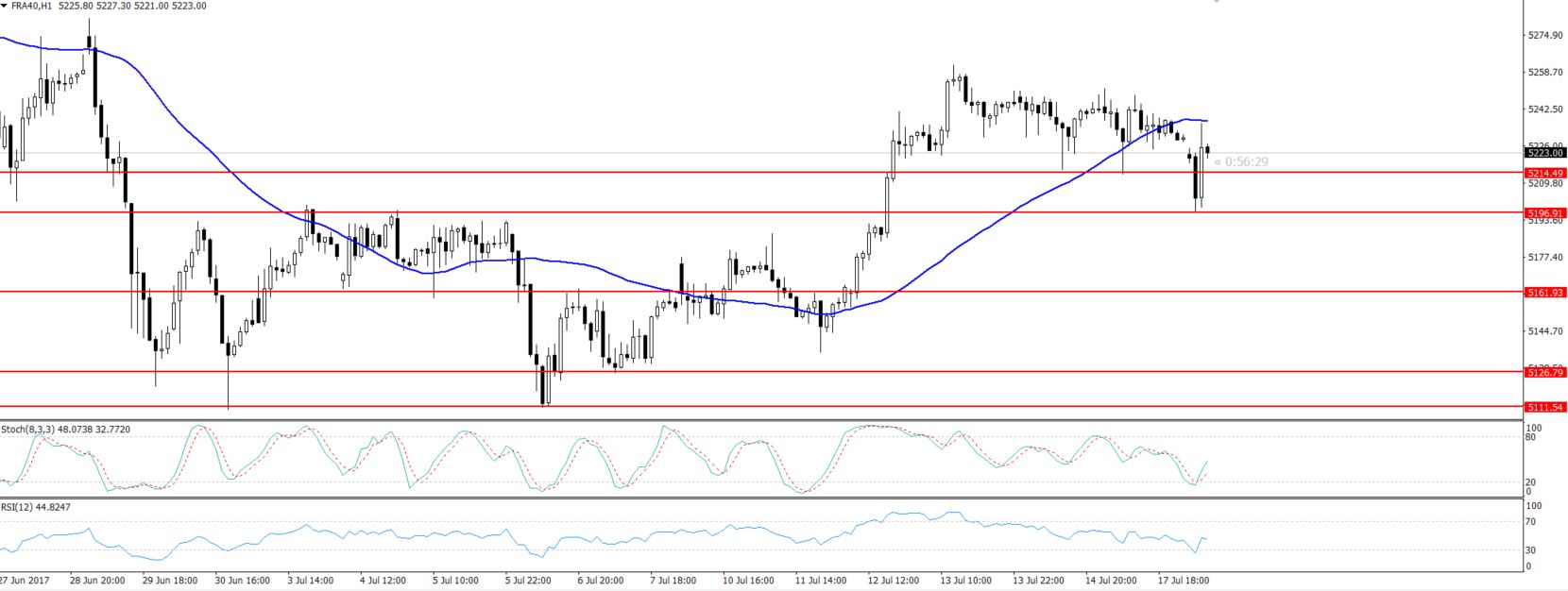

Thanks to the bearish breakout on the 4-hour chart, the CAC index slipped below the intraday support of $5215. Actually, investors traded the same bearish fundamentals earlier and took sell positions.

CAC 40 – Hourly Chart – Bearish Trend Resistance

CAC 40 – Hourly Chart – Bearish Trend Resistance

Our other technicals also suggested the bearish bias. For example, the RSI was bearish below 50 along with the Stochastic which was bearish under 30. The moving averages were extending a resistance at $5230. For more on how to trade moving averages, refer to our FX leaders moving average trading strategy article.

I wasn't expecting a huge dip, but it was enough for our early sessions profit. Therefore, I shared a sell call on the European Index to target $5199 and our forex signals closed at $5199. The index placed a low of $5197 and pulled back to $5223 after the release of Eurozone ZEW economic sentiment index, which showed a decline from 37.7 to 35.6 for the month of July.

CAC Trade Idea

As of now, the CAC is trading at $5223, below a solid trend line resistance of $5239. So, the idea is to stay in sell below $5236 with a stop loss above $5245 and a take profit of $5214 and $5197.