U.S. Session Gold Brief-October 4, 2017

December gold futures have shown sustained weakness over the past month. Since the September 8 high of 1362.4 gold has fallen precipitously to the 1271.0 level. Amid the recently charged news cycle, this is a bit of a surprise. There have been several reasons for investors to rush into safe haven assets in force. As of yet, we haven’t seen it.

The last few sessions have brought several profitable trading signals facing gold here at FX Leaders. Let’s take a look at the technical roadmap and see if we can identify some keys moving forward.

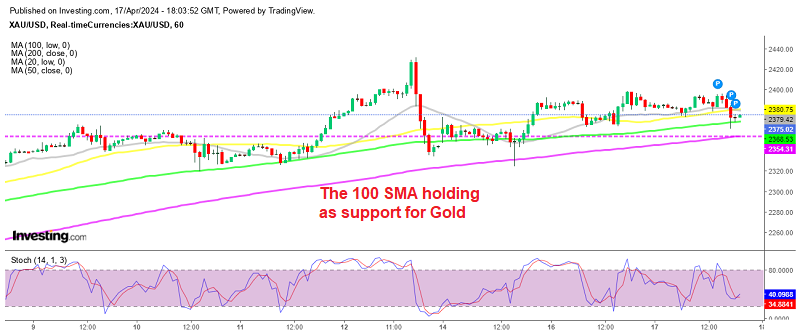

Gold’s Technicals

Intraday timeframes are often very useful in refining market entry and exit points. However, I am partial to a simple look at the daily chart to gain insight facing important support and resistance levels.

December Gold Futures, Daily Chart

December Gold Futures, Daily Chart

Gold is in the midst of a pronounced downtrend. However, Tuesday’s near Doji formation prompted buyers to enter the market during the overnight. So far during the U.S. session, it has been more bearish sentiment.

A few observations as we move deeper into today’s U.S. session:

Key resistance level at the 38% retracement from last week’s high to Tuesday’s low, 1288.6.

Convergence of the 20 Day EMA, 38% retracement, 50% retracement, and Bollinger MP between 1300.3 and 1288.6 form a robust resistance area.

Tuesday’s low of 1271.0 will act as downside support.

Trade has been established above Tuesday’s high of 1277.4.

Bottom Line: The strength in U.S. equities has offset the negative news cycle facing the United States. It is important to remember that the “trend is our friend.” Shorts from the 38% retracement level at 1288.0-1288.6 give us a way to capitalize on the prevailing trend. Tight 1:1 R/R scalps from this level are the ticket for the rest of the U.S. session.

Upon confirmation of failure within the established resistance zone, a position trade will become available later in the week. As always, trade smart and watch the risk management!

++10_4_2017.jpg) December Gold Futures, Daily Chart

December Gold Futures, Daily Chart