S&P 500 Fibonacci Trade Cashes In-What Next?

Without a doubt, the S&P 500 has been one of the most popular targets among traders and investors for 2017. The election of Donald Trump to the White House has brought people to the U.S. equities market in droves, creating ideal conditions for active trading. It goes without saying, but the bulls have cleaned up and bears have struggled mightily.

From a short-term trader’s perspective, opportunities to buy dips in the S&P 500 have been few and far between. However, when the chance has presented itself, getting long has been golden.

Yesterday’s trade recommendation was one of those setups that is tough to refuse. Kudos to all who took some money out of the market on the trade.

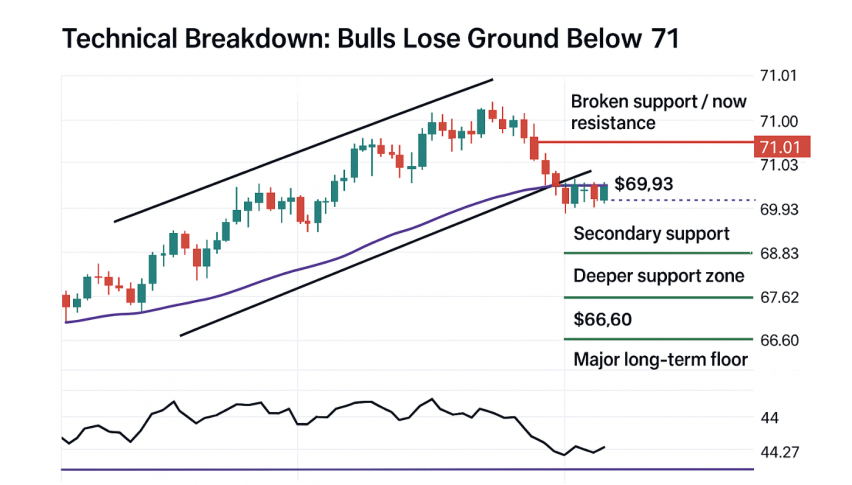

S&P 500 Technical Outlook

Today’s U.S. cash open has shown more bullish sentiment, with the DJIA up over 100 points and the S&P 500 up five. The 38% Fibonacci retracement for the March E-mini S&P 500 futures contract has proved valid.

++12_15_2017.jpg)

It is difficult to find any resistance levels worth shorting for the S&P 500. But, we are seeing compressed price action, which may set up prolonged rotation. Market behaviour for the coming week will depend greatly upon the U.S. Congress passing tax reform before the Christmas break.

Here are today’s levels:

- Resistance(1): Thursday’s high, 2673.50

- Resistance(2): Swing high, 2675.50

- Support(1): 38% retracement of bull run, 2655.25

- Support(2): Bollinger MP, 2627.25

Overview

Finding solid trade location to the long in the S&P’s is a challenging task. Even though I maintain a strong topside bias, most of the good locations are gone. Until we begin to see signs that the Trump tax plan will stall out in Congress, it is not a good idea to hold shorts.

For now, this is a wait and see market. Grumblings are coming out of the U.S. Senate regarding passage of the tax plan. In the event that it is not signed next week before the Christmas break, a swift correction is very likely. Stay tuned.