Forex Signals Brief for Jan 19: It’s Three from Three in Choppy Waters

Hey Fellas,

Forex markets have been up and down this week, as the USD tries to decide which direction to take. The waters have certainly been a little rough, but the FX Leaders Team still managed to score three out of three winning signals.

Given the abrupt change in trend in the USD, our focus wasn’t on the majors yesterday. The boys found winners in the EUR/JPY, the DAX and another nice spot in Gold.

We are currently long the EUR/CHF, while our other positions in the AUD/USD and GBP/USD remain intact.

Our long-term Bitcoin (BTC/USD) trade is hovering around the 11,000 marks as buyers have swept in and bid up the price.

Traders will again be looking for direction from the USD as we potentially have more US Government turmoil. So keep watching the forex signals page for the very latest opportunities.

Forex Signal Watchlist

CAC – The CAC looks like it’s putting in a double top so we are getting ready to sell.

Nikkei – After a massive run-up the Japanese Stock Index is looking a little toppy, so we are thinking a short might be in order.

Live Forex Signals

AUD/USD – 80 is In-Play

The Aussie continues to wrestle with the 80 cent level. Some positive economic data helped lift the AUD but it’s going to be tough to try and break out. There is a fair bit of overhead resistance in the 80-81 cent range which should hold things down. The downside target is at 0.7650.

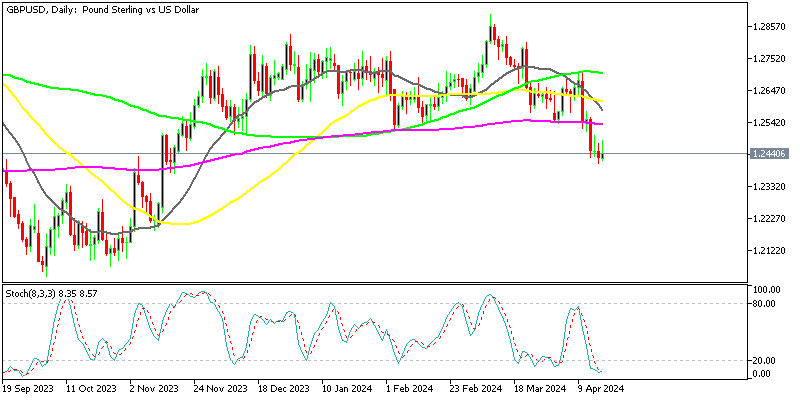

GBP/USD – Weak USD

The GBP/USD has kept on pushing higher, thanks in part to a weak USD. Hopefully the high that was put in earlier in the week will provide some resistance for us. Our downside target remains at 1.3237.