US Earnings Provide A Good Opportunity to Buy EUR/USD

The Euro has been one of the strongest currencies recently. It has made the most of the USD weakness last year and the improving Eurozone economy has helped things as well. EUR/USD broke above the 1.25 level today for the second time after breaking it last week.

But, the US employment report reversed the situation. The US Dollar got some strong bids after the average weekly earnings beat expectations. Last month’s number was revised higher as well. Apart from that, the new jobs came at 200k against 180k expected.

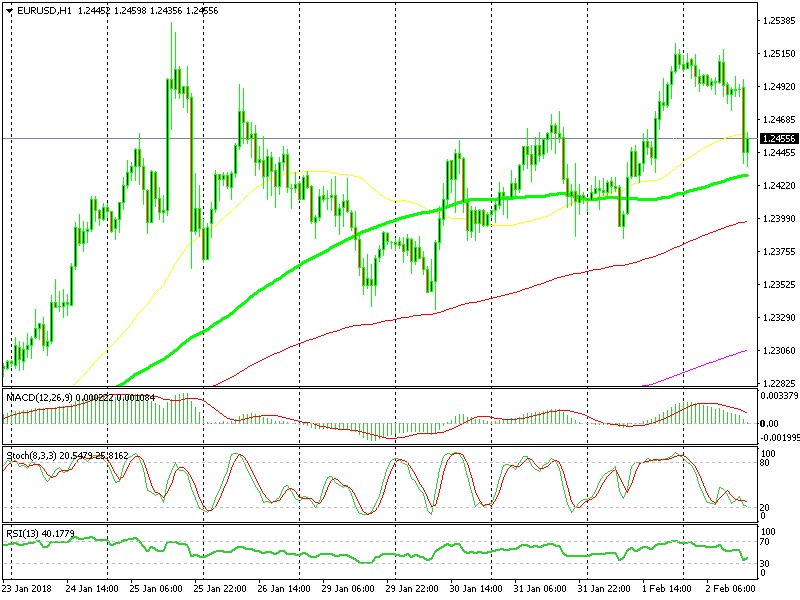

The 100 SMA is surely providing support

That round of data sent the USD higher and EUR/USD lower. Now, the Euro is at the 100 SMA (green) on the hourly chart. This moving average is providing support since the price bounced off of it initially.

I don’t think this is the big reverse everyone is waiting for. Such reverses take time to happen. So, I’m looking to buy EUR/USD down here, hopping for another attempt to the upside.

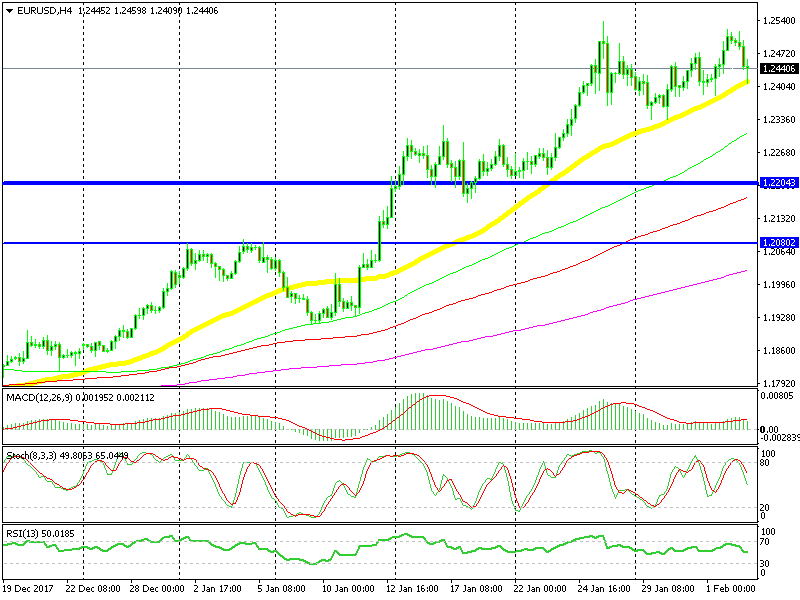

The 50 SMA is a better place for buyers

Although, there’s a better place to look for longs. Switching to the H4 chart, you can see that the 50 SMA (yellow) has been a solid support indicator. It has stopped the declines earlier this week and last week, so it might do the same again today. It comes at 1.2405 which is a big level, so I think I might wait for that level.