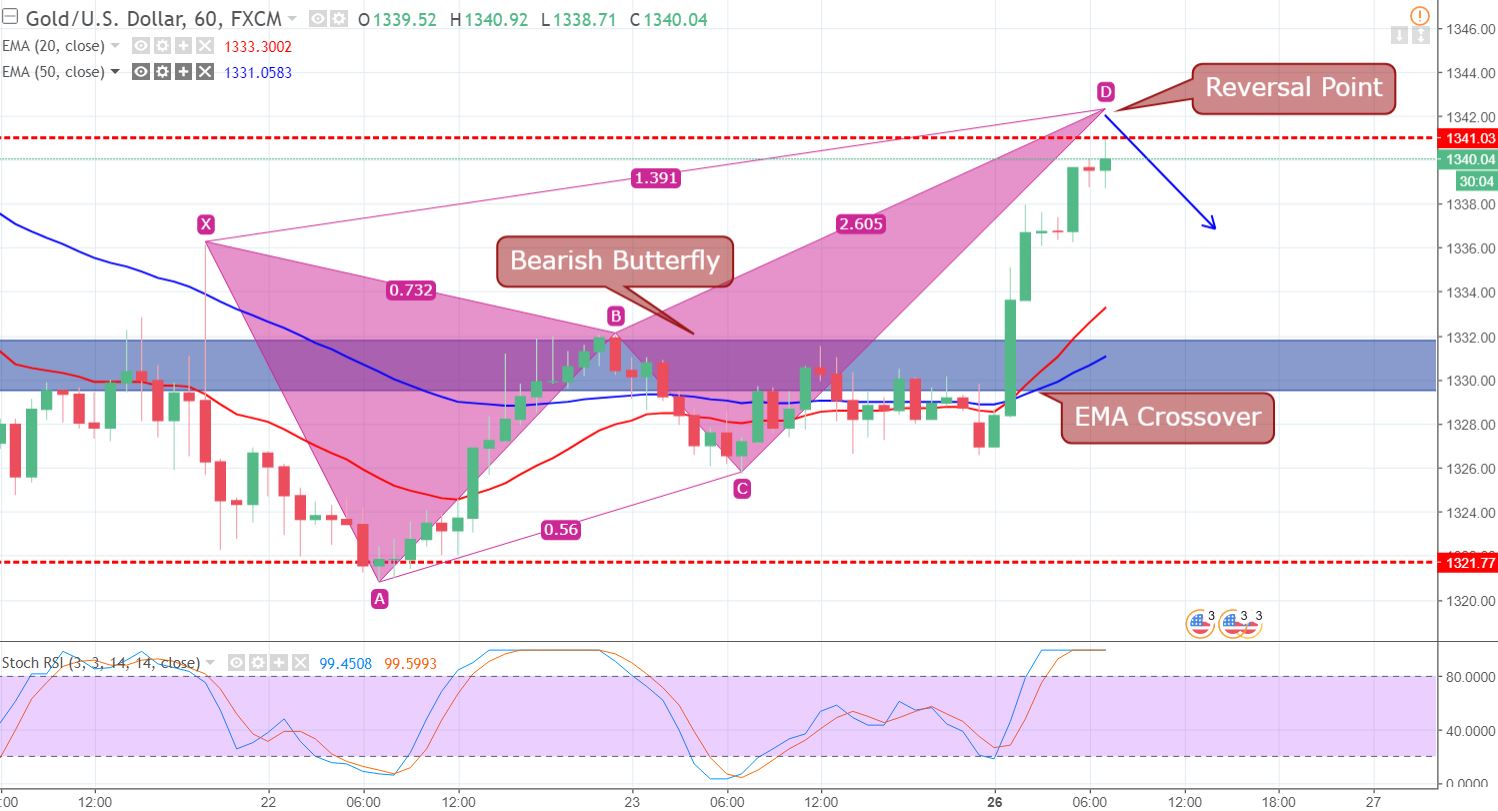

Gold Bullish EMA Crossover – Bearish Butterfly In Action

The yellow metal made a bullish move during the late Asian session due to the weakened dollar. It appears the bulls are switching their investments from Greenback to Gold before the Fed Chair Powell testimony later this week.

Fed Chair Powell Testifies

Powell is due to testify on the semi-annual Monetary Policy Report before the House Financial Services Committee in Washington DC on Friday, which will be his first testimony as a new Fed Chair. Soon we’ll see if he keeps dovish or switches to a hawkish stance.

Due to the uncertainty, investors are moving to a safe haven investment while selling the Greenback. Gold gained bullish momentum when the 20 periods EMA (red) crossed the 50 periods EMA (blue).

Gold – Hourly Chart

For now, Gold is forming a bearish butterfly pattern, which is likely to complete at $1,345. You can see the precious metal has entered the overbought zone, meaning the bullish sentiment is likely to weaken soon.

Gold/XAU/USD – Trading Plan

Since our earlier trading signal on Gold closed, we need to wait for $1,344/45 to take a sell position below it.

Good luck!