EUR/USD Bears Must Break This Major Level First

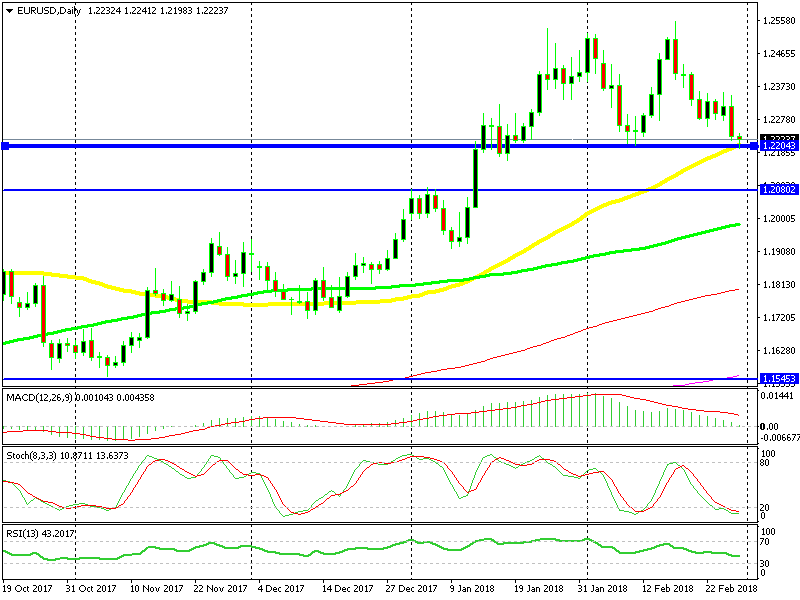

EUR/USD broke above 1.25 for the second time about two weeks ago, but it failed once more to stay above there. Since then, this pair has turned bearish in the smaller timeframes such as the H1 and H4 charts and has lost quite some ground. Yesterday’s hawkish statement from Powell gave the Buck another push higher and EUR/USD another push lower.

So, this forex pair is really starting to turn bearish on the larger timeframe charts as well. But, it faces a major level now on the daily chart and it seems like the sellers won’t have it easy.

The 1.22 level is a big round level in itself, so it holds some stigma on its own. This level was the low earlier this month which reversed the pullback lower, so it is a major support level as well.

This is the big level, before 1.20, of course

The 50 SMA (yellow) has caught up with the price as well now and at the moment it is standing exactly at 1.22. This moving average has provided support and resistance last year. It is providing support today too, so it won’t be that easy for sellers to push past it.

The stochastic indicator is also oversold now. This means that the retrace lower is complete and the uptrend must resume soon. But, the market is starting to reverse. Hopefully, Powell will give the US Dollar another lift and this level will finally break. Let’ see. I have a bearish bias myself for this pair.