EUR/USD Forming Bullish Reversal Pattern

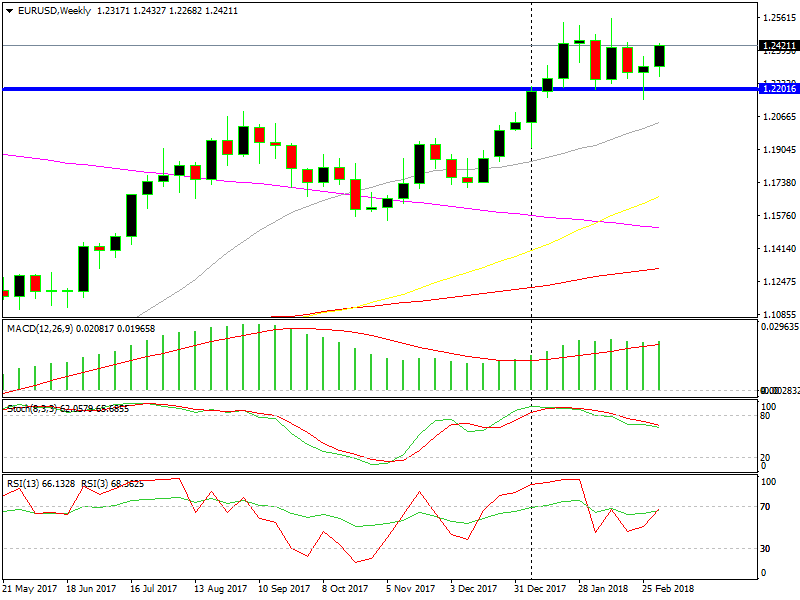

The EUR/USD has been on an uptrend for more than a year, but in the last several weeks, found it difficult to break past the 1.25 level. Buyers managed to push it up twice, but both times the price returned back down and the EUR/USD lost nearly 400 PIPs in two weeks.

I would say that this sort of price action points to strong buying pressure, but the situation is different. The market wants to turn around and perhaps complete a retrace lower to 1.15 or even to 1.10. With the way things have been going recently, 1.20 is too far to be considered a decent pullback.

A strong resistance has formed around 1.21

President Donald Trump and now North Korea is disturbing the market. It felt relief yesterday when North Korea offered a truce, improving the sentiment considerably. Whenever the market changes moods, the USD suffers the consequences.

The last two days last week, the EUR/USD got a lift from Trump’s comments about tariffs and trade wars. This week, the North Koreans gave it another boost, sending this forex pair towards the highs again, nevertheless, the market does not want to buy the USD, sending this forex pair lower. The politics are hurting the Dollar and they keep pushing the EUR/USD higher. This pair is now forming a bullish chart setup.

Last week’s candlestick closed as a pin or doji, whichever you prefer. Both are a reversing signal after a move down, such as the one we saw at the end of February. This week’s candlestick already looks bullish, thus we are heading up again.

This might be the perfect opportunity to sell this pair at close to 1.25. We missed the chance the last time when the EUR/USD was trading at that level, so if the price action tells us that the resistance at 1.2500-50 will hold, we might go short. Get ready for a long-term forex sell signal.