The Post-FED Technical Outlook For The Yen

The USD is struggling to find solid footing against the majors as the Thursday U.S. session heats up. Yesterday’s FED announcements brought a hawkish tone to the Greenback, but short-term traders made an about-face at the commentary. The stated plan of a 24 month period of “gradual tightening” did not phase skeptics — the USD fell significantly against the Euro, Japanese yen, and Canadian dollar.

The action in the USD/JPY came as a surprise to this analyst. My position trade recommendation proved a breakaway loser, with price failing at topside resistance.

Holding open positions into the FED announcements is inherently risky. We will see if the aftermath is a bit kinder to the trading account.

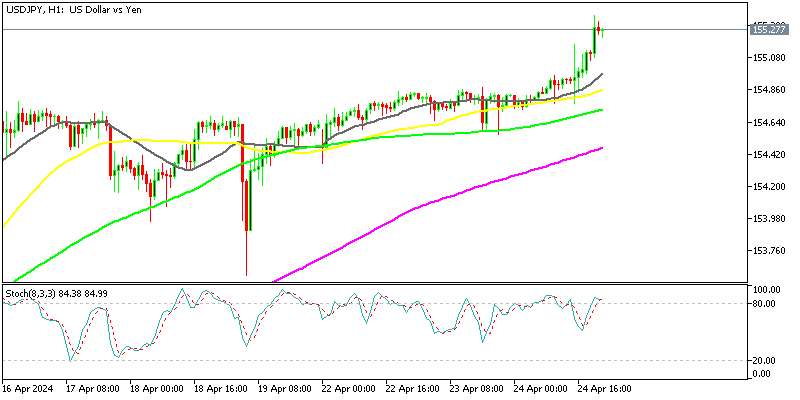

USD/JPY Technicals

Topside resistance on the daily chart proved valid for Wednesday’s session. The 106.50 handle stood tall in the USD/JPY, driving bearish participation.

++12_19_2017+-+3_22_2018.jpg)

Here are the key levels for today:

- Resistance(1): 20 Day EMA, 106.48

- Resistance(2): Daily SMA, 106.50

- Resistance(3): Bollinger MP, 106.67

- Support(1): Swing Low, 105.24

Overview: A bit earlier, this market tested support at the Swing Low of 105.24. If the intrasession low at 105.26 holds up, we will have a Double Bottom formation on the daily timeframe. It appears that this market is poised to rotate between the 106.50 and 105.25 area for the remainder of the week.

There is a live trade for the USD/JPY that is performing well over on the signals page. Check it out for a way of capitalizing on the current market dynamic facing the USD/JPY.