Forex Signals Brief for May 11: Dollar Dips as CPI Disappoints

Traders have been waiting, since last week, for a U.S. dollar retracement but the lack of fundamentals prevented it from happening. However, it finally looks like the long-awaited retracement has begun after the headline CPI reading came in at 0.2% versus the estimated 0.3% increase. Whereas, the core CPI report posted a 0.1% gain instead of the estimated 0.2% increase.

The U.S. dollar index, which measures the greenback’s performance against 6 peer currencies, has closed a bearish engulfing candle. This is signaling the potential continuation for a bearish retracement in the dollar. This looks like an opportunity for all those who were stuck in the anti-trend trades.

On Thursday, the FX Leaders Team closed with three winners in Gold, EUR/JPY, and EUR/GBP. We managed to benefit from the weaker dollar sentiment as it drove bulls in the bullion market. Similarly, weakness in the dollar strengthened the single currency euro and our long signal EUR/JPY closed at take profit. Thanks to Bank of England for being dovish, we got quick pips in the EUR/GBP short position.

At the moment we are involved in GBP/USD and USD/JPY trades. Our long-term position in the Cable is bringing in more than 100 pips while we target $1.3237.

Speaking about fundamentals, the economic calendar is loaded with the Canadian labor market report, ECB President Draghi’s speech and the Prelim UoM Consumer Sentiment from the United States.

Forex Signal Watchlist

USD/CAD – Over the past few days, the Loonie has strengthened in the wake of solid gains in crude oil prices. The Canadain labor market report is the key event on the radar. We are waiting for the pullback that should give us a good chance to buy here.

GBP/JPY – After the recent weakness in the Sterling led by the dovish BOE, the GBP/JPY has oversold. This may offer us a chance to catch the bullish retracement.

Live Forex Signals

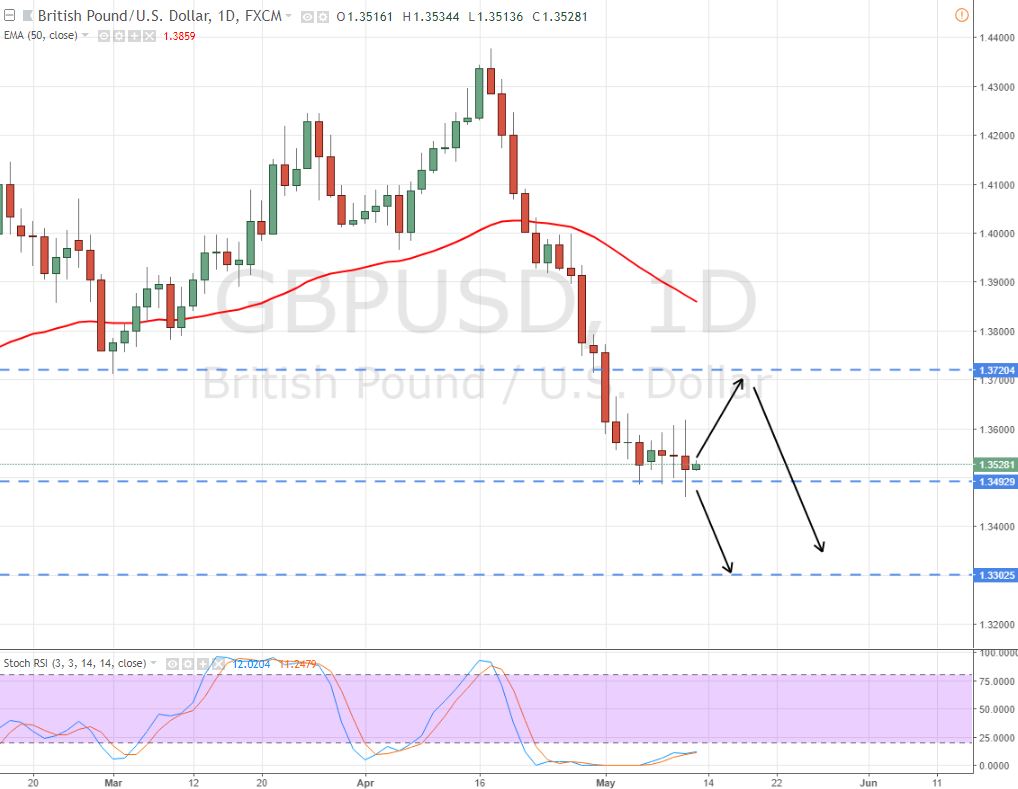

GBP/USD – BOE Plays In Our Favor

The GBP/USD is stuck at the bottom, unable to take advantage of the selloff in the dollar. However, the BOE’s monetary policy report remained in our favor. MPC officials decided to keep the interest rate on hold at 0.50% while lowering the growth forecast for 2018 and 2019, strengthening bearish sentiment for the Sterling. The GBP/USD is facing support near $1.3495. The violation of this level will help us achieve our target.

GBP/USD – Daily Chart

USD/CAD – 61.8% Retracement

As we discussed before, the USD/CAD is heading south on the back of the weaker dollar and stronger Loonie. The geopolitical tensions in the Middle East are fueling demand for the commodity currency. The USD/CAD is heading towards 61.8% Fibonacci retracement at $1.2700. Chances of a pullback remain high.