Bullish EMA Crossover in EUR/JPY – Is It Time To Go Long?

It was a nice call on EUR/JPY, as our forex trading signal closed at 127.7 and that’s exactly the level where Japanese cross took a U-turn. Thanks to European CPI flash estimate. Well, I’m not done yet. We may have another position in EUR/JPY during the U.S. session today. So, better be ready…

EUR/JPY – Fundamental Review

The European CPI flash estimate figure rose to 1.9% upbeating the analyst forecast of 1.6% and the previous inflation figure of 1.2%. I think it’s strong enough to encourage investors to hold their long-term positions in the single currency Euro. In fact, economic events like this are needed to get us nice retracement on the EUR/USD weekly chart, especially above $1.1500.

EUR/JPY – EMA Bullish Crossover

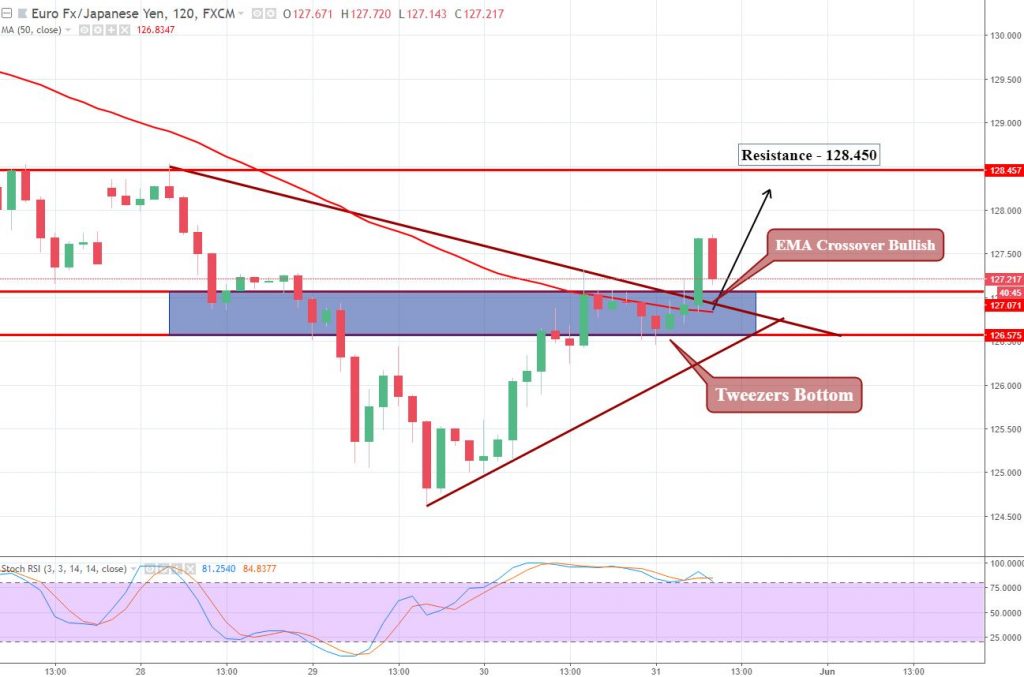

On the 2 hour chart, the EUR/JPY has a bullish crossover on 50-period EMA and the same level (127) is now extending a significant support to the Japanese cross.

EUR/JPY – 2 Hour Chat

The RSI and Stochastics are in the overbought zone on the 2-hour timeframe, but we still have enough room for buying them in bigger timeframes like daily and weekly. Here’s a quick summary of support and resistance levels.

Support Resistance

125.52 127.34

124.96 127.9

124.05 128.81

Key Trading Level: 126.43

EUR/JPY – Potential Forex Trading Signal

I will be looking for another buying trade above 127 with a stop loss below 126.600 and take profit above 127.700. All the best!