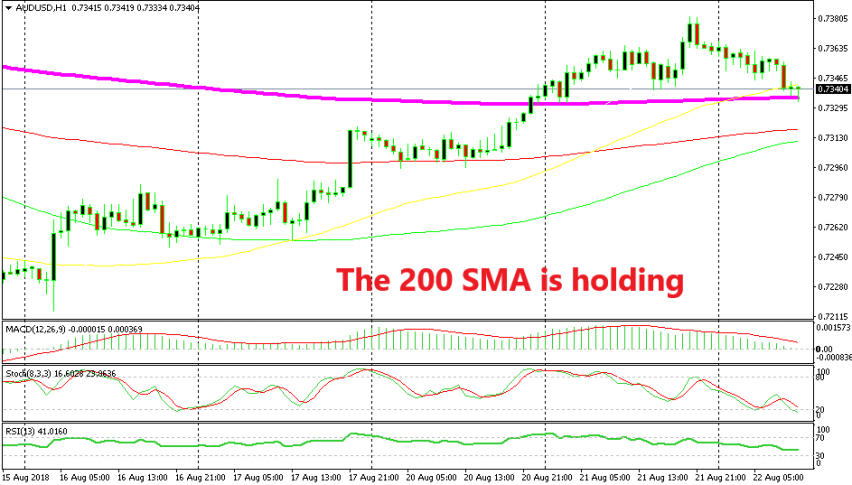

Long AUD/USD at the 200 SMA

AUD/USD has been following a straightforward uptrend in the last week or so. It reversed form 0.72 and has climbed nearly 200 pips since...

The short term trend has changed in AUD/USD. Risk currencies such as commodity dollars have been receiving some decent bids this week as the market sentiment improves. On the other hand, the USD has entered a bearish phase as the USD index USDX heads down. Donald Trump gave a hand in pushing the USD lower.

So, AUD/USD has been following a straightforward uptrend in the last week or so. It reversed from 0.72 and has climbed nearly 200 pips since then. But the price reversed last evening right at the 50 SMA on the daily chart.

It has been retracing lower during the Asian session but it seems as the retrace might be over now. As you can see on the hourly chart, the 200 SMA has been providing support in the last two hours. The stochastic indicator is also oversold which means that AUD/USD is oversold on the H1 chart.

The last two hourly candlesticks look bullish as well. They have formed a doji and a pin, both of which are reversing signals. So, the chart setup points to a bullish reversal at the moment, so that is the reason why we went on AUD/USD.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account