Terrible Economic Numbers From Canada Send USD/CAD to A Month High

USD/CAD jumped nearly 100 pips higher on really bad Canadian retail sales and inflation figures. Both reports were horrible today.

Today, it has been pretty quiet regarding the economic data during the European session. But, important economic data releases came from Canada in the US session and they were a major disappointment. Let’s list the retail sales and inflation numbers below.

| Actual | Expected | Previous | |

| Retail Sales | -0.1% | 0.3% | 0.2% |

| Core Retail Sales | -0.4% | 0.1% | 0.9% |

| Monthly CPI | -0.4% | 0.1% | 0.1% |

| Yearly CPI | 2.2% | 2.7% | 2.8% |

| Core Common CPI | 1.9% | 2.0% | 2.0% |

| Core Median CPI | 2.0% | 2.1% | 2.1% |

| Core Trim CPI | 2.1% | 2.2% | 2.1% |

As you can see, all numbers are negative. They are lower than expectations and lower than last month as well. Retail sales turned negative while core retail sales, which are more important, declined by 0.4%.

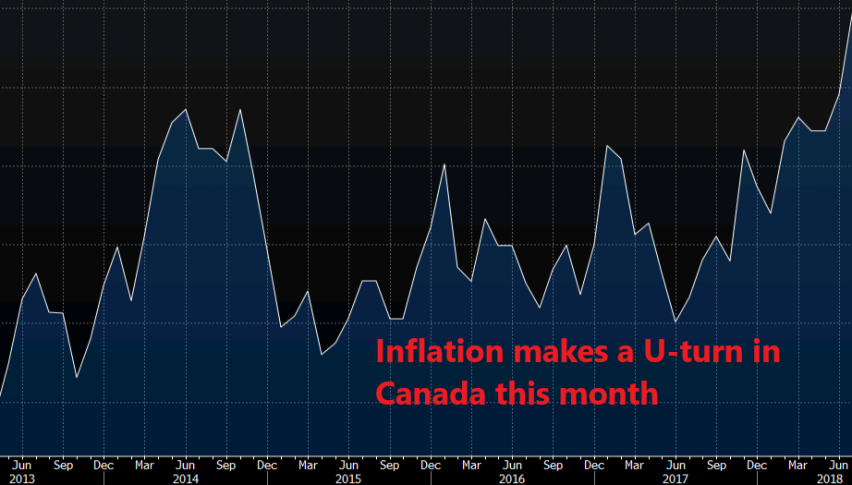

Inflation declined by 0.4% as well on a monthly basis. The annualized inflation number slipped to 2.2%, against 2.7% expected and down from 2.8% last month. Core common, core median and core trim CPI all ticked lower as well.

So, it a terrible round of economic data from Canada all over. The Canadian Dollar has lost around 90 pips and USD/CAD jumped from 1.3030 to 1.3120 s a result, reaching a 5-week high on the charts. I expect the CAD to remain bearish in the US session and perhaps into next week as well.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account