Daily Morning Brief, Oct 30 – Top Forex Trade Setups and Economic Events

Good morning, traders.

It’s been a pretty strong start to the week with nine trading signals out of which six closed in profit. Today, the market focus may shift a bit from the technical side to fundamentals, as the US economy is due to release the consumer confidence figures during the New York session.

Overall, the Greenback is trading bullish against its rivals, supported by a safe haven appeal as rising trade tensions and worries of a retardation in global economic growth weigh on investors’ appetite for risk assets. Bearing this in mind, we aren’t expecting hundreds of pips movement as traders will be saving their shots for the US Non-farm later this week.

Major Forex Setups & Economic Events Today

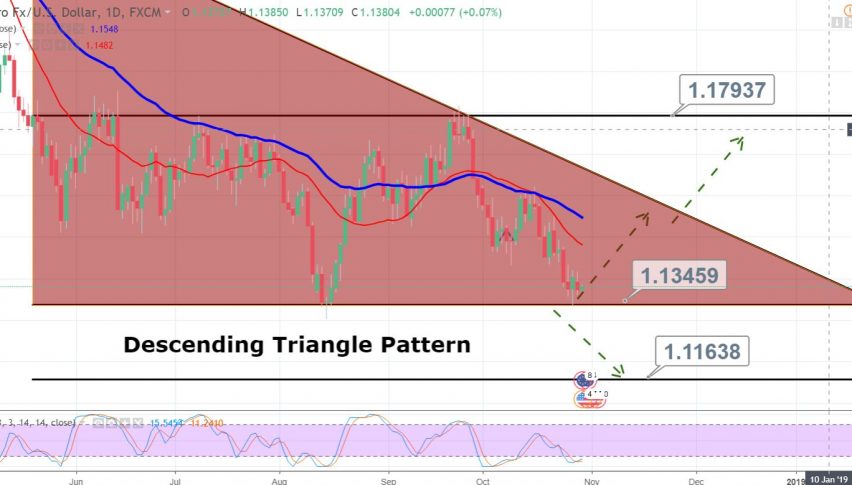

EUR/USD – Descending Triangle Pattern

The technical side of the Euro hasn’t changed much and the EUR/USD keeps on consolidating in a descending triangle pattern on the daily timeframe. The pattern is extending a strong support to the direct currency pair above $1.1335. While on the upper side, the resistance prevails at $1.1450 and $1.1600.

Potential Economic Events to Impact

German Prelim CPI m/m – The Destatis will be releasing the German Prelim Inflation data during the London session. As per economists’ forecast, the CPI figures are expected to plunge from 0.4% to 0.1%. So, it seems to place a bearish pressure on the Euro today.

Hence, the bearish breakout of this pattern can lead the direct currency pair towards $1.1165. While we may see pair soaring towards $1.1500 in case the EUR/USD manages to hold above $1.1335.

Daily Technical Levels

Support Resistance

1.135 1.1406

1.1327 1.1439

1.1271 1.1495

Key Trading Level: 1.1383

EUR/USD – Market Sentiment

Weekly – Strong Sell

Daily – Strong Sell

Hourly – Sell

EUR/USD – Trade Plan

The idea is to stay bearish below $1.1380 with a stop loss above $1.1410 and take profit at $1.1365 and $1.1350. While buying is preferred above $1.1415 for quick take profit of around 30 pips.

USD/JPY – Double Top & Overbought, Is it good time to sell?

The Japanese Yen is seen as a haven through times of intensified investor fears. But the pair continued to trade in a narrow range ahead of the Bank of Japan’s monetary policy decision due to come out on Wednesday.

Investors avoided riskier assets and migrated to buy the Greenback after Bloomberg announced that Washington is preparing to announce tariffs on all remaining Chinese imports by early December. Now it all depends upon the talks between the US President Donald Trump and Chinese President Xi Jinping next month.

The technical outlook of the USD/JPY remains bullish, but lately, the pair has come under a double top resistance area of 112.700. We may see some selling, or more properly saying, some profit-taking by investors ahead of the US consumer confidence report today.

Potential Economic Events to Impact

CB Consumer Confidence – For all the newbies, the financial confidence is a leading indicator of consumer spending, which accounts for a majority of overall economic activity. For instance, you will spend more only if you are confident about your job or business.

Back in September, the consumer confidence surged to 138.4 points, but the figure is likely to dip to 136.3 this month. The data is due at 14:00 (GMT).

Daily Technical Levels

Support Resistance

111.95 112.67

111.54 112.97

110.83 113.69

Key Trading Level: 112.26

USD/JPY – Market Sentiment

Weekly – Stong Buy

Daily – Strong Buy

Hourly – Buy

USD/JPY – Trade Plan

The idea is to capture a retracement by selling below 112.750 to target 112.450, while buying is preferred above 112.250 today.

Good luck!

Thanks for the setups.

I’m seeing a breakout on USDJPY.

Always welcome. Keep following for more updates.