Gold Standstill – Positive NFP & Stronger Dollar Weights

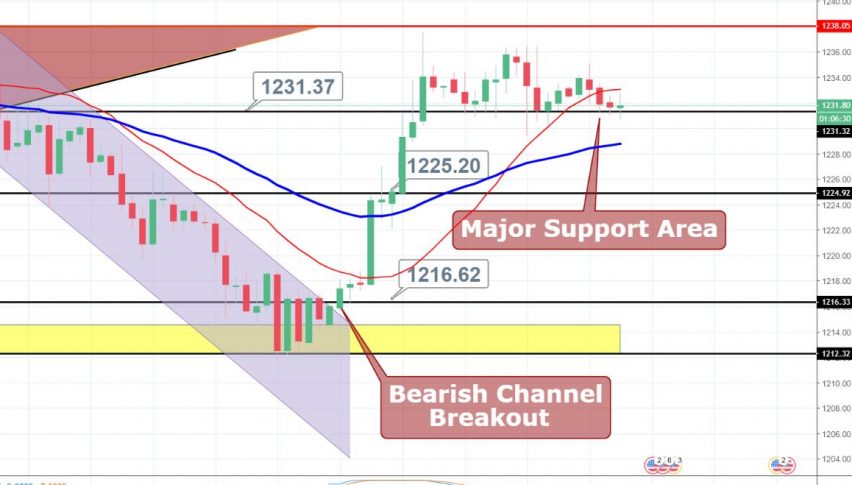

The yellow metal GOLD consolidates in a narrow range of $1,231 – $1,236 over a stronger dollar. The US job growth rebounded sharply in October, steering further labor market tightening that could prompt the Federal Reserve to hike interest rates again in December.

In addition to the employment report, the investors are now focused on the US congressional elections on November 6, which will conclude whether the Republican or Democratic party dominates Congress.

For now, we need to wait for a breakout in $1,231 – $1,236 range. The bearish breakout can lead gold prices towards $1,226 and $1,223 today.

Gold – XAU/USD – Trading Levels

Support Resistance

1229.67 1236.38

1226.39 1239.81

1219.68 1246.52

Key Trading Level: 1233.1

GOLD // XAUUSD – Trading Idea

The idea is to stay bearish below $1,233 with a stop loss below $1,236 and a take profit of $1,226. The bullish breakout can lead the market towards $1,239.

Good luck!