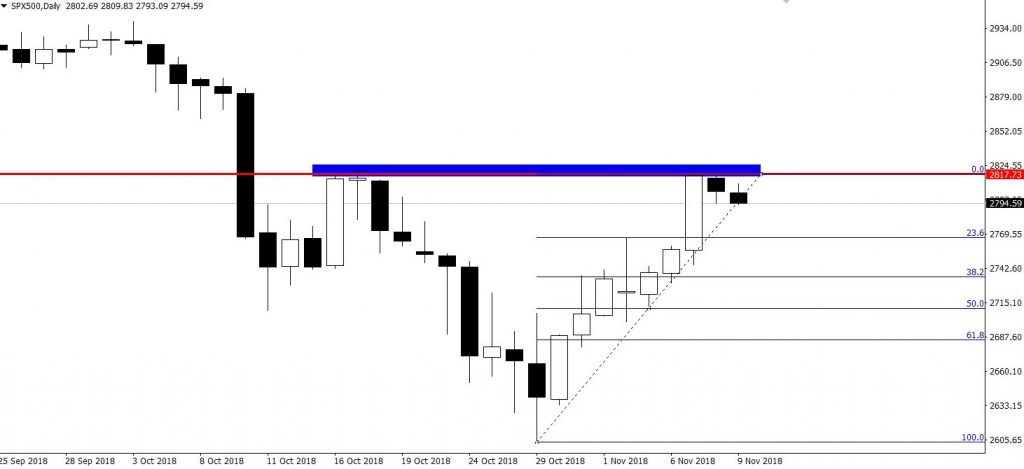

SPX Signal Making +140 Pips – Quick Update on Trade Setup

The S&P500 market index is falling dramatically towards our target level of $2,790. The violation of this level may add further selling..

The global stock markets jumped on Midterm elections, but the FOMC managed to drag it down to move it in our favor. Well, a sell-off didn’t come as a surprise. Recalling FX Leaders Morning Brief, Nov 8, How to trade S&P500 on FOMC, we opened a sell position in the SPX near $2,808 to target 180 pips at $2,790. The signal is doing pretty well as the S&P500 is making 140 pips for us.

What’s Next?

Looking at the 2-hour chart, the US stock market index is falling dramatically towards our target level of $2,790. The violation of this level may add further selling until next support near $2,772.

Support Resistance

2777.92 2835.27

2740.02 2854.72

2682.67 2912.07

Key Trading Level: 2797.37

The traders are advised to book partial profits in trade at $2,793 and wait for the target $2,790 while keeping their stop loss at breakeven.

Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account