US Session Forex Brief, November 26 – Sentiment Improves as Italians Agree to Lower Deficit, but Donald Trump Never Disappoints to Surprise

We heard rumours this morning that the Italian Government has agreed to reduce the deficit for next year’s budget to 2.0%-2.1%. Later on, Italian politicians confirmed those rumours with the two Deputy Prime Ministers on the wires. Luigi Di Maio said that it is not a problem to lower the deficit as long as the budget measures remain the same, while Salvini added that he is not fixated with deficit being on one or two points higher or lower. Mind you, they were very fixated until the weekend, so this change of heart is a bit surprising.

This improved the sentiment in the financial markets in the morning and, as a result, risk assets such as commodity currencies and the Euro as well as the stock markets have been on demand during most of the European session. We had some ECB members as well this morning confirming the recent slowdown in the Eurozone economy. The ECB President Draghi is speaking later today, so these comments are a sign of what’s to come during Draghi’s speech.

To wrap it up, the US President Donald Trump threatened to close off the US-Mexico border permanently if necessary, in response to the human caravan that wants to enter the US.

The European Session

- Italy’s Di Maio Suddenly Accepts A Lower Deficit – Italian Deputy PM Luigi Di Maio said early this morning that deficit reduction is not a problem if the budget measures remain the same. Well, if the budget measures remain the same, then the deficit will still increase next year, despite agreeing to lower it now.

- Salvini Back Up Di Maio – The other Deputy PM Matteo Salvini added that he doesn’t mind if the deficit is 0.1% higher or lower and the EU cannot take Italy hostage. He did mind until the weekend, so I guess they are going with a lower deficit. He added that the government had positive feedback from the European Commission but he didn’t talk about numbers.

- German Ifo Business Climate – The Ifo business climate in Germany was expected to cool off to 102.3 points from 102.8 points previously. But, it cooled off more than expected as the actual number came at 102.0 points. Although, this indicator shows that the business climate is still strong in Germany.

- ECB’s Praet Accepts the Economic Weakness – The ECB chief economist Peter Praet said that it is clear that the downside risks have increased considerably but there is very limited spillover from the Italian bond market. I suppose Mario Draghi will also sound sort of dovish later today.

- ECB’s Lautenschlager Follows Up – ECB member Sabine Lautenschlager added that the economic growth is in line with ECB forecasts and the QE program will end by the end of this year.

- Trump to Close Mexico Border? – Donald Trump woke up early today tweeting about closing the US-Mexico border permanently if necessary. The Tijuana-San Diego border has been shut in both directions and Trump also mentioned the wall, so perhaps the wall will be built, let’s see.

The US Session

- ECB President Draghi Speaks – The President of the European Central Bank Mario Drgahi is to hold a speech in about an hour. He will testify on the economy and the monetary policy before the European Parliament Economic and Monetary Affairs Committee. Other ECB members have acknowledged the weakness in the Eurozone economy which hints at what Draghi will say later today.

- BOE Governor Carney Speaks – Mark Carney will also hold a speech this afternoon but he is speaking about a book called “Capitalism in America; A History”, so I don’t know whether he will touch the monetary policy in his speech, but anyway, Brexit is taking all the attention now.

- UK PM May to Make A Statement – UK Prime Minister Theresa May will speak at the Commons Room later today about leaving the EU. There haven’t been any new developments on Brexit during the Weekend summit in Brussels, so she will likely repeat the same comments we have heard recently.

Trades in Sight

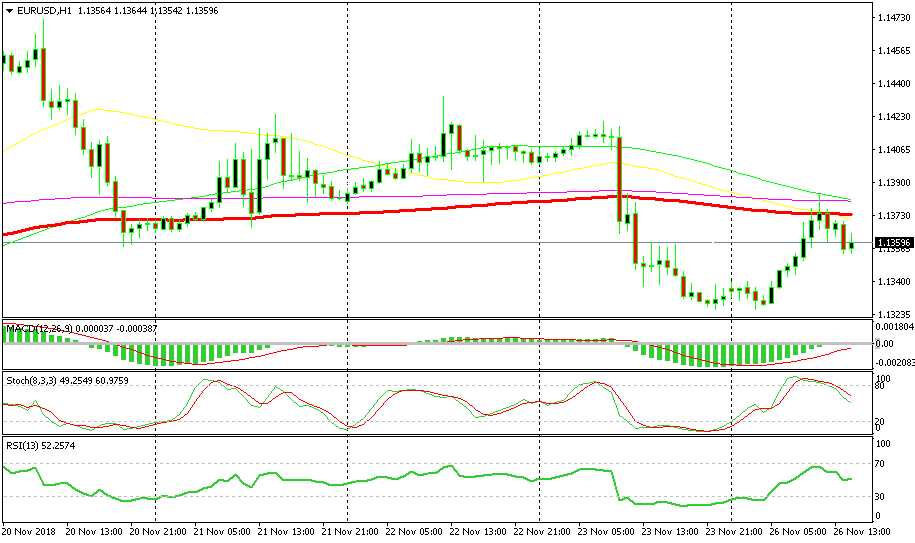

Bearish EUR/USD

- The main trend is still bearish

- The retrace higher is complete

- Moving averages provided resistance

The stochastic indicator is turning lower already

We sold EUR/USD a while ago as it was climbing higher on better market sentiment due to the Italian government accepting a lower deficit for the 2019 budget. Although, this looked more like a retrace higher during the larger bearish trend and the retrace was complete on the H1 chart as the stochastic indicator showed. Besides, the bunch of moving averages were providing resistance, so that’s why we decided to go short on this forex pair.

In Conclusion

The stock markets were rallying higher during the European session as the sentiment improved in financial markets. But, it seems like the climb has stopped and some European indices such as the French CAC40 are already reversing lower, but this latest move looks pretty weak, so neither side looks safe to trade right now.