Reversing the USD/JPY Trade as Upside Momentum Looks Weak

We had a buy forex signal in USD/JPY which we opened yesterday as this forex pair was finding support at the 200 SMA (purple). That moving average held on despite many attempts to break below it yesterday, as you can see from the H1 chart above.

We closed that trade manually a while ago for more than 20 pips because the upside move today seems kinda exhausted. The upside momentum has been pretty weak and getting weaker in the last few hours, so the price action tells us that the upside move is complete in USD/JPY.

After all, the short term trend has turned bearish for this pair, so this upside move today is just a retrace of the downtrend which started on Thursday. The H1 chart is overbought now as stochastic shows, while the 100 SMA (green) is providing resistance.

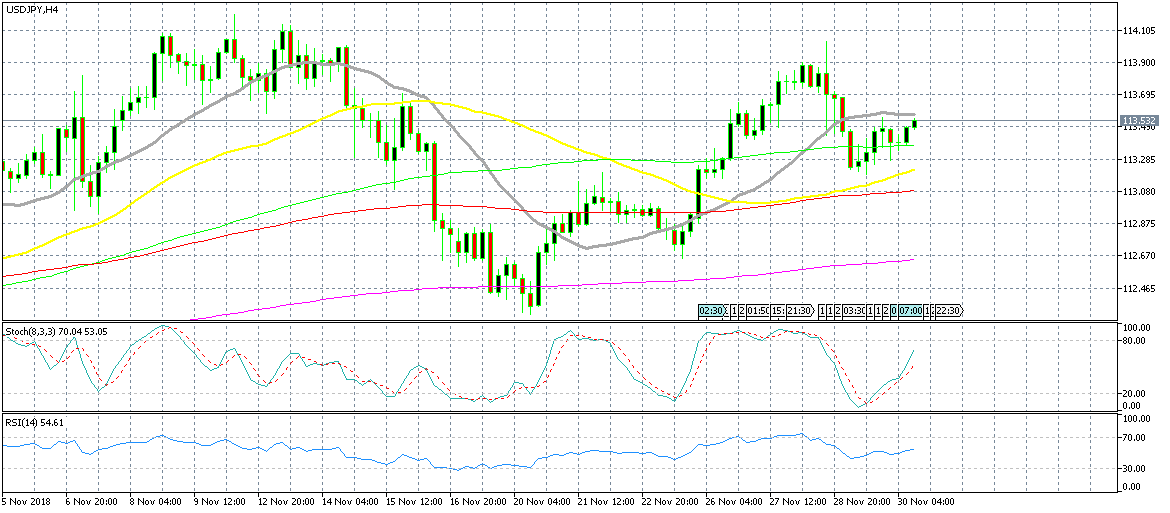

The H4 chart is almost overbought as well

Switching to the H4 chart, we can see that the price is almost overbought on this time-frame as well. Besides, the 20 SMA (grey) is standing a few pips above, which is likely to provide resistance if the buyers push higher.

Today is also Friday and the G20 summit has just started. So, the market is being cautious, because with Donald Trump there, you just don’t know how it will end up. For this reason, I think that we might see a run for safe haven assets just in case the trade war precipitates which would kill risk currencies next Monday.