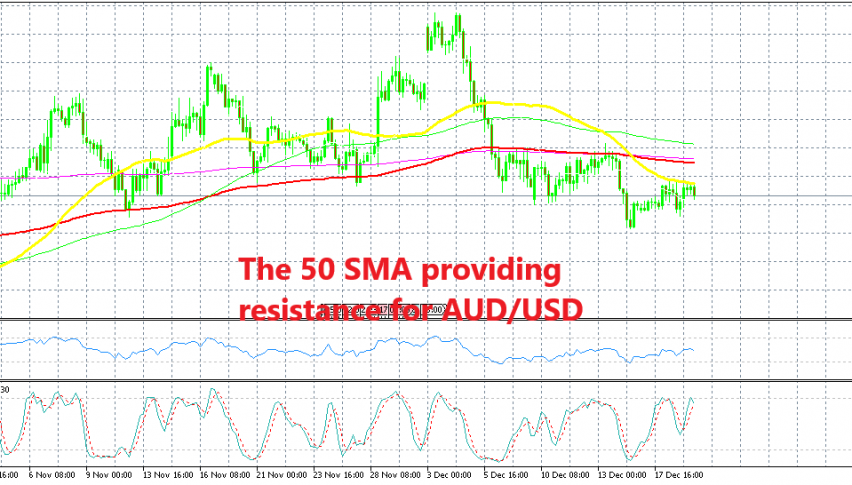

AUD/USD Bulls Failing at the 50 SMA Again

We have an open sell forex signal in AUD/USD which we opened on Monday. We had another sell signal in this pair but it closed in profit as AUD/USD lost around 80 pips on Friday last week and we decided to go short again on this pair as it was retracing higher on Monday.

But that retrace turned out to be bigger than we expected as the US Dollar retraced lower this week due to the FED meeting which will take place this evening. The market is expecting the FED to sound dovish today and probably announce a slowdown in the pace of rate hakes.

As a result, AUD/USD continued to retrace higher but it ran into the 50 SMA (yellow). This moving average has turned into resistance now. It stopped the climb yesterday and we saw a 40 pip decline at the beginning of the US session. But, another wave of USD weakness came and this pair climbed back up.

Although, the 50 SMA didn’t let go. The buyers have been trying to push above it all morning today but without much success. This moving average stood tall as AUD/USD formed two dojis in the previous two H4 candlesticks. Those dojis are reversing signals and we see that the current H4 candlestick looks bearish already as AUD/USD declines.

So, our signal is safe for now but the downtrend should resume for the price to reach the take profit target. To me, this pair is on a bearish trend and the bias is still to the downside because the 100 SMA (red) used to be support and it turned into resistance in the last two weeks after being broken to the downside. But now, the 50 SMA is providing support and is not letting the price climb higher to the 100 SMA, which means that the sellers are still in control.