SMAs Turn From Support to Resistance in USD/CAD As Buyers Remain in Control

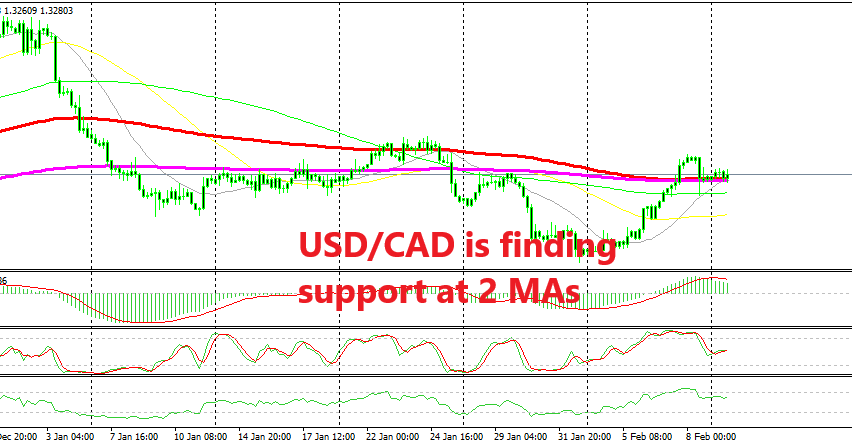

USD/CAD reversed higher last week and it is now finding support at a couple of moving averages

[[USD/CAD]] made a bearish reversal at the end of December as crude Oil prices turned higher at that time. This pair lost nearly 6 cents during that first bearish leg and last week we saw this pair complete another bearish leg down, sending this pair 300 pips lower after a pullback higher in the previous weeks.

Although, USD/CAD made a bullish reversal last week, recuperating the losses of the second bearish leg. This pair climbed nearly 300 pips last week, breaking all the moving averages on the H4 chart. There was a pullback lower before markets closed for the week, but we can see that the buyers are still in control.

The 100 SMA (red) and the 200 SMA (purple) held their ground despite being pierced briefly which tells us that the sellers couldn’t regain control of this pair. Now the buyers are in control as long as the price stays above these two moving averages. This might be a good place to go long from, since crude Oil, both US WTI and UK Brent are slipping lower.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account