US Session Forex Brief, June 14 – Retail Sales Give the USD a Lifeline

The US Dollar has been on a declining trend in the last two weeks as the weak economic data has piled up, showing that the US economy is joining the rest of the globe in this economic slump that has been going on for more than a year. The US economy was holding up well until recently, hence the major uptrend in the USD since early last year. But, after a number of quite weak economic data from the US and rumours that the FED might cut interest rates now instead of hiking them, traders started thinking that this was probably it for the uptrend in the USD, hence the bearish reversal in the last two weeks and that’s the reason that today’s retail sales report for May was more important than in the other months.

European Session

- French Final CPI – The consumer price index inflation turned negative in January in France as inflation was weakening globally back then. But we saw a jump of 0.8% in March and another increase by 0.3% in April. Today’s CPI report was expected to show a 0.2% increase, but it missed expectations, increasing only by 0.1%.

- China’s Industrial Production – The pace of growth of the industrial production in China slowed towards the end of last year due to the trade war between China and the US and a weakening global economy. But in March we saw a jump to 8.5%, although that might have been skewed due to seasonal factors, because the pace of growth fell to 5.4% in April and it was expected to remain like that in May. But today’s report missed expectations and industrial production fell to 5.0% on an annualized basis.

- IEA Pessimistic About Oil Prices – IEA comments in its latest monthly report on the oil market say that global oil supplies will increase far more than demand next year. World oil demand to accelerate to 1.4 mil bpd in 2020, but will be offset by production surge to 2.3 mil bpd at the same time. Notes ongoing US shale boom as main reason. Says that despite OPEC efforts, they are still pumping much more oil than required.

US Session

- US Retail Sales – The retail sales report takes extra importance this time after a number of weak economic reports we have seen from the US in recent weeks. The headline sales came positive at 0.5% for May, although they missed expectations of 0.7%. Core retail sales also grew by 0.5% in May as they were expected to. Last month’s report showed a 0.2% decline for April, but that was revised higher today to +0.3%. The control group was revised higher from 0.0% to 0.4%, while core sales which exclude autos were also revised higher from 0.1% to 0.5%. So, retail sales turned positive this month growing by 0.5%, but the revisions for April are the big story here as they paint a much better picture of that month, so the FED should take this into consideration next week.

- US Industrial Production – Industrial production is on a declining trend in the US, similar to Europe, having declined in the last four months from January to April. Today it was expected to turn positive and post a 0.2% increase in production. Although, it beat expectations, increasing by 0.4% in May.

- US Prelim UoM Consumer Sentiment – The University of Michigan consumer sentiment has been on an improving trend this year. It started the year at 90.7 points after the sentiment deteriorated towards the end of last year as the global economy weakened. It increased up to 102.4 points in May as we saw in last month’s report, but last month’s number was revised lower to 100.0 points. This month, the sentiment is expected to decline to 98.1 points, which might bring an end to the improving trend. The US economy has taken a downturn in the last couple of months, so don’t be surprised to see another negative number for June.

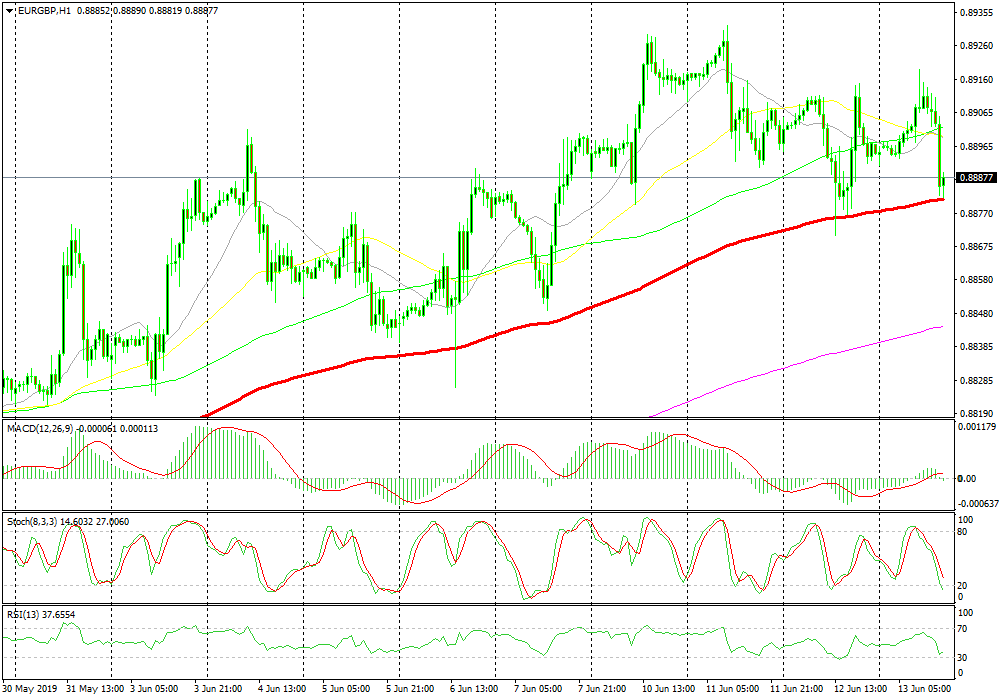

Bullish EUR/GBP

- The trend has been bullish for several weeks

- The pullback lower is complete on the H1 chart

- The 100 SMA is providing support

The price is finding support at the 100 SMA

EUR/GBP has been on a bullish trend since the beginning of May when it reversed higher. Since then, the pressure has been completely on the upside for this pair, and the 20 SMA and the 50 SMA have been providing support on the H4 time-frame and pushing the price higher. So, all the retraces lower have been really good opportunities to go long on this pair. Today we are seeing yet another pullback lower but the pullback is now complete as the stochastic indicator suggests, while the 100 SMA (red) is providing support on the H1 chart. The H4 chart is not oversold yet, but the picture in the H1 chart is pointing to a bullish reversal.

In Conclusion

The sentiment has finally turned positive in financial markets in the last couple of hours after the retail sales came positive and the numbers from April were revised higher as well. USD/JPY has climbed nearly 50 pips while EUR/USD is heading towards 1.12 again. But, the odds of the FED cutting interest rates in July are not declining.