The past 48 hours have been good to backers of the Canadian dollar. WTI crude oil is showing signs of life after rolling to the August futures contract and Canada’s CPI has come in strong. Going into today’s FED meeting, it looks like currency traders are happy holding USD/CAD shorts.

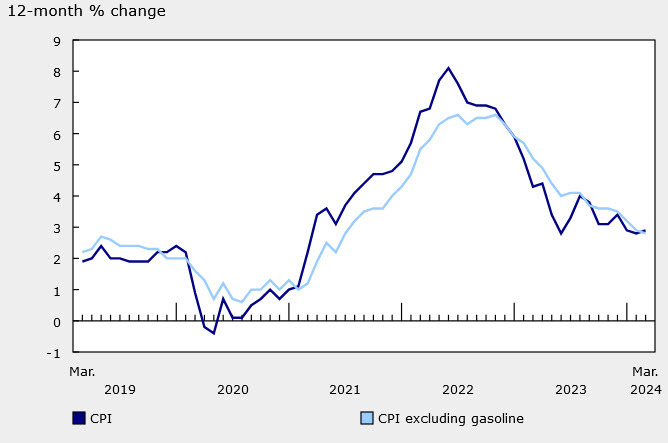

During the U.S. pre-Wall Street open, several Canadian inflation metrics hit the newswires. Here is a quick recap of the data:

Event Actual Projected Previous

BoC CPI Core (MoM, May) 0.4% -0.1% 0.0%

BoC CPI Core (YoY, May) 2.1% 1.2% 1.5%

CPI (MoM, May) 0.4% 0.2% 0.4%

CPI (YoY, May) 2.4% 2.1% 2.0%

In short, this is a fairly strong group of numbers for the Canadian dollar. Both inflation and core inflation have picked up significantly from last winter, suggesting that Canada’s economy is in a recovery phase. This fact hasn’t been lost on currency traders as the Loonie has gained more than 50 pips vs the Greenback in 48 hours.

USD/CAD: Technical Outlook

The daily technical outlook for the USD/CAD suggests that the bears are in control of the action. Rates are challenging downside support at the Daily SMA and are threatening to push lower.

+2019_06_19.png)

Here are the levels to watch in this market as we roll into today’s FED Announcements:

- Resistance(1): Bollinger MP, 1.3409

- Support(1): Daily SMA, 1.3363

- Support(2): 62% Current Wave Retracement, 1.3317

Bottom Line: Although trading during a FED release is inherently risky, a buy from downside support at the 62% Current Wave Retracement (1.3317) is an affordable way to play the action. Until elected, I will have buys in queue from 1.3318. With an initial stop at 1.3293, this trade produces 25 pips on a standard 1:1 risk vs reward management plan.