Crude Oil Continues Rising- What’s Behind It?

Today in the early Asian market, WTI crude oil prices surged due to a drop in crude oil inventories continuously. The US Crude Oil WTI was higher 2% at $58.96.

Well, one of the reasons behind the surge is the fall in WTI crude inventories reported by the American Petroleum Institute (API).

According to the American Petroleum Institute, WTI crude inventories dropped by 7.5 million barrels in the week ended June 21 to 474.5 million. The drop in stocks came an unexpected drop of 2.5 million barrels. Crude inventories at US delivery hub Cushing, Oklahoma, dropped by 1.3 million barrels.

Secondly, the reason behind oil prices is intensifying tensions in the Middle East. The conflict between Iran and the US continues, while investors eye G20 meeting and OPEC meeting on June 28 and July 2, respectively.

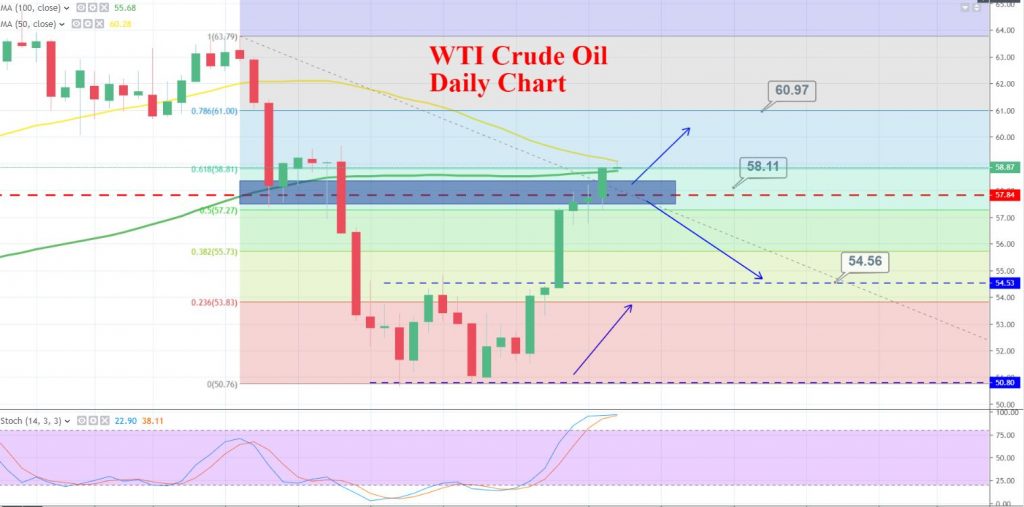

WTI is staying right above the resistance level which is now working as a support at 57.85. The bullish breakout of this level may extend the buying trend until 59.40 and 61. Stochastics and RSI are heading north, suggesting bullish bias among traders.

Support Resistance

56.84 58.16

56.09 58.73

54.77 60.06

Key Trading Level: 57.41

The idea is to stay bullish above 58 with an initial target of 59.40. Elsewhere, selling is suggested below 60 today.

Good luck!