Thus far, it has been an average day on the currency markets, featuring typical trading ranges across the majors. Among the most active pairs are the commodity dollars, the USD/CAD and AUD/USD. The action has produced tight conditions for September USD Index futures, with rates holding their ground slightly beneath the 97.000 handle.

To cap off this week’s hyperactive schedule of FED events, Chicago FED President Charles Evans issued public comments a bit earlier today. His tone was consistent with Powell and the FOMC, citing concerns over lagging inflation, slowing foreign trade growth, and reduced capital investitures. In short, the FED acknowledges that the U.S. labor market and economy is strong, but plans to cut rates to get out in front of perceived trouble on the horizon.

September USD Index Futures In Heavy Rotation Beneath 97.000

The economic calendar of the past five days has been hectic. Next week will be much less intense, with U.S. Retail Sales (June) being the only U.S.-based market mover. Perhaps the relative quiet will be a calming influence on the USD Index.

++7_12_2019.jpg)

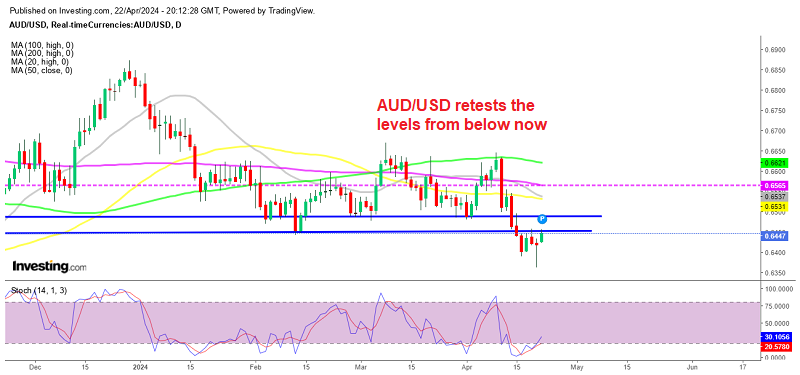

Here are two levels worth watching as we roll into next week’s trade:

- Resistance(1): Psyche Level, 97.000 (not pictured)

- Support(1): Bollinger MP, 96.500

Overview: At this point, the uptrend of late-June and early-July remains valid for the September USD Index. Rates remain in daily bullish territory, although the market is in a deep two-day consolidation phase.

For now, it appears as if the dust is settling from the FED’s pivot in policy. The initial knee-jerk reaction regarding a ½ point rate cut has stabilized, and it appears that the ¼ point July cut is already priced in. If so, a bullish bias is warranted until we see the USD Index enter correction under 96.000.