Daily Brief, July 30: Economic Events Outlook – BOJ Policy Decision is Out

What’s up, fellas.

During the Asian session, the Bank of Japan kept its monetary policy unchanged, taking a wait-and-see stance ahead of an expected interest rate cut from the Federal Reserve tomorrow.

The BOJ maintained the frames on its yield curve control program and asset purchases, it said in a statement on Tuesday, a result expected by most economists in a Bloomberg survey. It also left its interest rate pledge unchanged. Roughly a third of economists had expected the BOJ to strengthen its commitment to keeping interest rates extremely low.

Watchlist – Top Economic Events

EUR – French Consumer Spending m/m

At 6:45 (GMT), the INSEE (Institut National de la Statistique et des études économiques) released the French consumer spending figures. It’s the primary gauge of consumer spending, which accounts for the majority of overall economic activity.

Logically, the more people spend leads to a higher demand for goods & services. Higher demand causes an increase in prices, and the increase in prices is called Inflation. That’s what ECB (European Central Bank) is trying to achieve. Anyhow, the actual figures failed to surprise the market as consumer spending plunged by -0.1% vs, 0.2, extending another reason to ECB for a dovish policy.

EUR – German Prelim CPI m/m

Destatis is due to release of the figure during the European session. Germany is one of the major business hubs in the Eurozone and its economic events play a good role in Euro valuation.

Economists are expecting no change in consumer price index as it’s expected to stay at 0.3% vs. 0.3% beforehand.

USD – Core PCE Price Index m/m – 12:30

The Bureau of Economic Analysis will release the PCE price index at 12:30 GMT. It is expected to remain unchanged at 0.2%. The figure is significant as it shows the change in the price of goods and services purchased by consumers, excluding food and energy. So, higher demand leads to higher inflation, making the dollar stronger.

You must be wondering how it’s different from Core CPI. Well, the Core PCE only measures goods and services targeted towards and consumed by individuals. Prices are weighted according to total expenditure per item which gives important insights into consumer spending behavior. This is rumored to be the Federal Reserve’s favorite inflation measure, but CPI is released about 10 days earlier and tends to garner most of the attention.

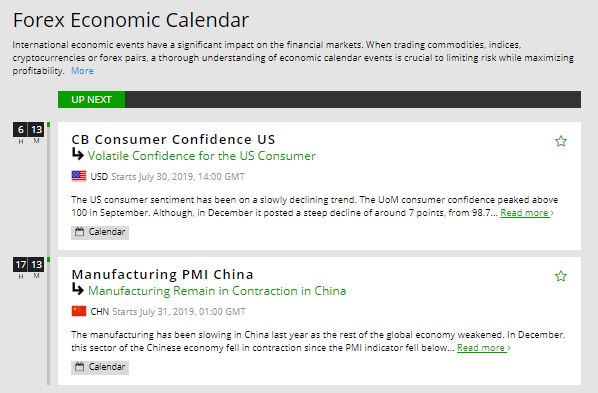

USD – CB Consumer Confidence 14:00 GMT

CB Consumer Confidence will be monitored by the investors as this data will be of high importance on Tuesday because it usually causes sharp tradeable volatility in the market. It’s expected to be 125.2 vs. 121.5, giving us a reason to support bullish Dollar.

Refer to FX Leaders Economic Calendar for live coverage of US consumer confidence later in the day.

Good luck, see you again with a technical trade setup.

Stay tuned to FX Leaders!