Crude Oil Recovering Losses Made on Saudi Arabia Price Cut Sentiments

A day before, WTI Crude Oil took a sharp dip amid news that the top oil exporter Saudi Arabia may cut crude oil prices for a second straight month in September after benchmark price in the Middle East weakened.

However, crude oil prices increased by more than 2% today, recovering from their highest decline in years as the United States President Donald Trump imposed additional tariffs on Chinese imported goods, escalating the trade tensions between the worlds two largest economies and WTI crude oil consumers.

Donald Trump’s tweet created shockwaves in international stock markets, whereas WTI crude oil prices fell about 7% due to the story. It was their biggest plunge in more than 4-years. WTI crude oil prices were already down more than 3% before the Donald Trump statement.

Besides, Federal Reserve Chairman Jerome Powell’s stated that the rate cut delivered on Thursday was the way of adjustment policy, and traders were disappointed because they were expecting a more aggressive rate cut.

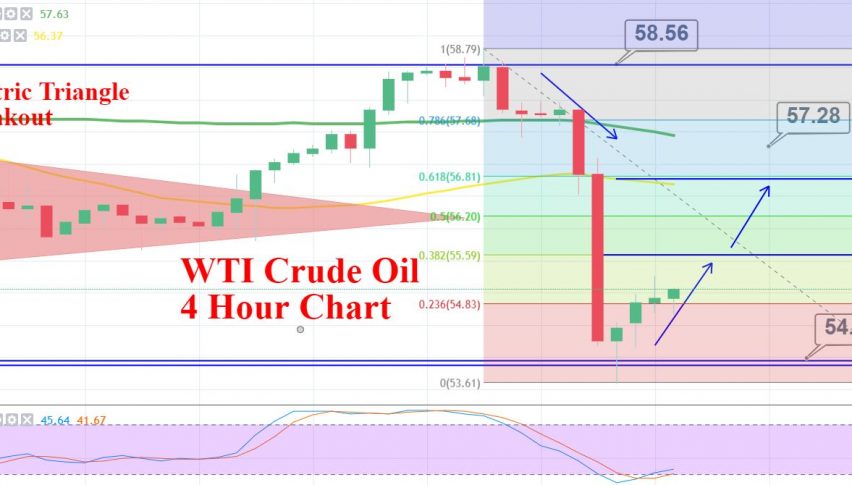

On the technical side, crude oil is slightly bullish at $55.07 and it may head towards the $55.60 resistance area which marks the 38.2% Fibonacci retracement level. Below this, we may see oil falling towards $54.85 support. While, the bullish breakout of this level could extend buying until $56.77, the 61.8% Fibo level.

Support Resistance

57.29 58.77

56.4 59.37

54.91 60.85

Key Trading Level: 57.88

The market may move on NFP data, as the weaker or stronger dollar will decide the fate of crude oil price later during the US session.

Good luck!