Daily Brief, Aug 15: Economic Events Outlook – Retail Sales Share the Stage

On Thursday, the global financial markets continue to trade the Risk-off sentiment. Global stocks exchange indices slid as investors feared a historic decline in long-term US bond yields could prove as a signal of recession globally.

Thus, traders rushed to the safety of sovereign debt and drove yields on 30-year Treasuries to all-time lows at 1.97%. Bond yields have now dropped a huge 60 basis points. Consequently, GOLD is staying bullish as investors trade risk-off sentiment.

Watchlist – Top Economic Events Today

The European Banks will be closed in observance of Assumption Day, therefore, we may experience thin volatility in the European session. Yet, the Retail Sales from the United Kingdom will keep the market’s momentum.

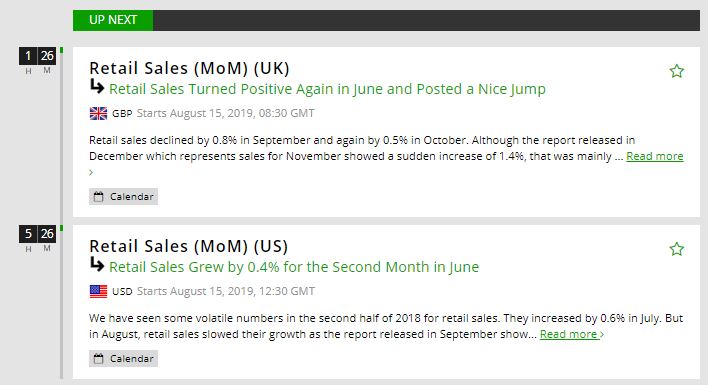

GBP – Retail Sales m/m – 8:30 GMT

The Office for National Statistics is due to release the retail sales data at 8:30 GMT. It’s the primary gauge of consumer spending, which accounts for the majority of overall economic activity. In June, the retail sales jumped by 1% vs. the forecast of -0.3% forecast, extending solid support to Pound.

This month, economists are expecting a drop of -0.3% in retail sales. A negative number of sales indicate slower inflation and slacks in the economy. Therefore, the Sterling bulls can face challenges on Thursday.

USD – Retail Sales m/m – 12:30 GMT

The Census Bureau is due to release the retail sales data at 12:30 GMT. It’s the primary gauge of consumer spending which accounts for the majority of overall economic activity. Economists look very optimistic about retail sales as the figures are expected to jump by 0.3% which is slightly slower than 0.4% beforehand. Considering this, investors are likely to continue trading the dollar with a slightly bearish sentiment.

USD – Core Retail Sales m/m – 12:30 GMT

This also shows a change in the total value of sales at the retail level, but excluding automobiles. The data is due at 12:30 GMT and the retail sales are expected to grow by 0.4% vs. 0.4% beforehand.

Philly Fed Manufacturing Index – 12:30 GMT

Philly FED manufacturing index is a leading indicator of economic health – businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment. Philly Fed usually comes with volatility and trading opportunities. The index is expected to drop to 10.1 from 21.8. There will be a nice buy opportunity in the Greenback if the index surprisingly gains more than 15/20.

USD – Unemployment Claims – 12:30 GMT

The US Department of Labor will be releasing a report on the number of individuals who filed for unemployment insurance for the first time during the past week. This is the nation’s earliest economic data. The market impact fluctuates from week to week – there tends to be more focus on the release when traders need to diagnose recent developments, or when the reading is at extremes.

Economists are expecting a slight rise in the number of claims from 209K to 212K. However, this data will be overshadowed by the retail sales figures.

Check out the FX Leaders economic calendar for the live coverage of these major events.

Good luck!