Daily Brief, Aug 30: Economic Events Outlook – Get Set to Trade USD/CAD

Happy Friday, traders.

On Friday, the Greenback continues to trade bullish despite neutral GDP figures. Well, most of the bearish bias is originating from the previous GDP data. The US economic growth decreased as expected, but worse than that was a revision of the second-quarter US GDP from 3.1% to 2%. The data confirms that the US economy remains solid even in the face of trade uncertainty. The Federal Reserve is expected to cut rates by 25 basis points in September to support the economy in the face of trade risk.

On the economic calendar, we have a series of economic events but most of them are low impact and may not help us determine the trend in the market. Therefore, all of the focus shifts to the GDP data from the Canadian economy.

In this update, we are going to see how what GDP figure is, what to expect from Canadian GDP data and how it’s likely to impact the trading in the USD/CAD currency pair.

CAD – GDP m/m – 12:30 GMT

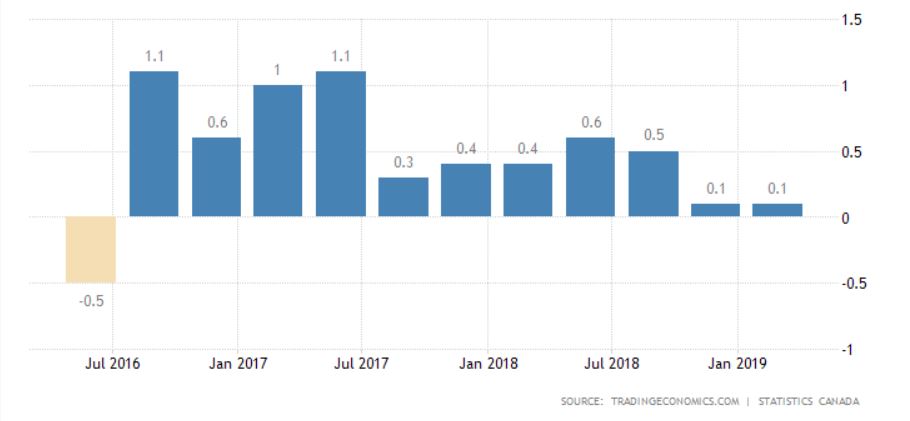

As per the report shared by Statistics Canada, the Canadian economy grew at 0.1% in the first quarter of 2019, the identical extension rate as the fourth quarter of 2018. By the way, it was the lowest since Q2 2016.

GDP growth rate in Canada averaged 0.78% from 1961 until 2019, touching an all-time high of 3.10% in the fourth quarter of 1963 and a record low of -2.30% in the first quarter of 2009.

The Canadian economy has beaten some of its rivals lately. Can this continue? After undergoing a 0.2% growth in June, a more moderate growth rate may be seen in July, however, economists’ forecast is negative at 0.1%.

USD/CAD Trades Symmetric Triangle Pattern, Wait for Breakout

A day prior, the Canadian dollar edged lower against its US counterpart, prolonging its pullback from a near two-week high the previous day. Traders pondered the likelihood of a surprise interest rate cut next week from the Bank of Canada.

As you see, the US economic calendar remains quiet with significant economic events coming out only from the Canadian economy. Which is why today all of the focus shifts to the Canadian currency pairs.

Following a skyrocketing move of 1.3225 resistance breakout on August 27, the USD/CAD pair had already violated the psychological mark of 1.3300. The pair is now trading right above 1.3303 while the RSI and EMA are suggesting a bullish bias,

At the moment, the commodity currency Loonie may find hurdle around 1.3333. Closing of candles below this may drive bearish bias back and that’s highly likely if the Canadian economy manages to produce positive GDP data.

Positive GDP figure of more than 0.1% may help us take a sell position below 1.3333 until 1.3280 and 1.3240. Although the market is lacking volatility, the significant variation and divergence of GDP data from 0.1% forecast may bring sharp sell-off in the USD/CAD.

On the flip side, USD/CAD may have a dramatic bullish movement if the Canadian economy fails to exhibit improvement by even 0.1%. In that case, the violation of 1.3333 may lead USD/CAD towards 1.3385.

USD/CAD- Technical Levels

Support Resistance

1.3239 1.3315

1.3194 1.3346

1.3118 1.3422

Key Trading Level: 1.327

USD/CAD – Trade Plan

The idea is to stay bearish below 1.3333 and bullish above 1.3270 until the GDP data is out. On positive news, we can short the pair below 1.3333 to target 1.3280.

In another case, I will be looking to buy above 1.33 to target 1.3364.

Good luck!