Daily Brief, Sep 30: Economic Events Outlook – UK Final GDP in the Highlights

At the starting of last week, US Dollar showed signs of weakness over increased signs of uncertainty between US-China talks, prevailing geopolitical tensions, and global economic slowdown. However, at the end of last week, uncertainty over US-China trade talks vanished due to Trump’s comment on disclosure of deal settlement between US-China in upcoming October.

Looking ahead on the fundamentals side, the Eurozone’s current account will be in focus. Asian trading volumes are anticipated to be light this week as Chinese markets will be closed starting Tuesday for National Day.

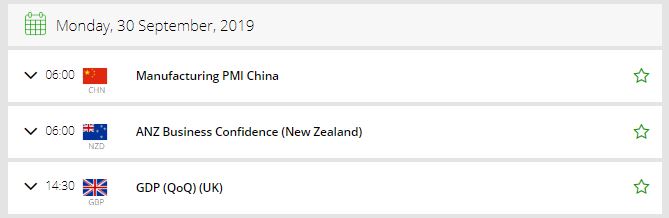

Watchlist – Economic Events Outlook

CNY – Caixin Manufacturing & Non-Manufacturing PMI – Released

The Monday session has begun with the manufacturing and non-manufacturing PMI figures which were due earlier today.

China on Monday delivered a firmly followed indicator on its manufacturing activity. The official Purchasing Managers’ Index (PMI) came out at 49.8 in September — beating the 49.5 analysts surveyed by Reuters had anticipated.

The official PMI figures appeared in at 49.5 in August. For your info, the PMI data above 50 indicate extension, while those under that level flag recession. A private survey of China’s manufacturing activity, the Caixin/Markit factory Purchasing Managers’ Index (PMI), is also scheduled for release on Monday. Analysts polled by Reuters expect the data to come in at 50.2 for September, down slightly from 50.4 in August.

EUR – German Prelim CPI m/m – All Day

The Destatis is due to release of CPI data for Germany, which shows a change in the price of goods and services purchased by consumers.

Consumer prices account for a majority of overall inflation. Inflation is significant for currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate. The German CPI figures fell by -0.2% during the last month, so let’s see if the economy has improved this month or not.

GBP – Current Account – 8:30 GMT

The Office for National Statistics is due to release the Current Account figures for the United Kingdom which exhibits a difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter.

Economists are expecting a squeeze in the trade deficit from -30.0B to -19.2B. Since it’s a quarterly figure, the impact is supposed to be a bit higher, but in this case, the goods portion does not affect because it’s a duplicate of the monthly Trade Balance data.

GBP – Final GDP q/q – 8:30 GMT

The Office for National Statistics is due to release Final GDP for Britain. The economic event shows a change in the inflation-adjusted value of all goods and services produced by the economy.

Lately, the UK economy has grown at a faster pace of 0.5%, but the global economic slowdown, the US-China trade war, and Brexit uncertainties seem to hurt the market. Negative GDP rate of -0.2% is on the cards today.

That’s all for now, but stay tuned to our economic calendar for the live market updates and forex trading signals.

Good luck!