Daily Brief, Nov 15: Economic Events Outlook – Retail Sales & CPI Figures Set to Play

Happy Friday, traders.

The dollar and risky currencies gained some support on Friday as renewed bets for a breakthrough in Sino-US trade talks were tempered with caution. A day before, the White House financial adviser Larry Kudlow announced that both nations were getting close to a settlement, and the “mood music is pretty good.” He gave no fresh details, but the sentiment was sufficient to reverse the safe-haven Japanese yen’s overnight profits and to redirect the Australian and New Zealand dollars upward.

The economic calendar is loaded with fundamentals from the Eurozone and the United States. Who’s ready to make some good pips to end the week? Well, let’s take a look at these events.

EUR – Italian Trade Balance – 9:00 GMT

Italy’s trade surplus increased to EUR 2.585 billion in August 2019 from EUR 2.491 billion in the corresponding month a year ago, dropping below a market forecast of EUR 4.732 billion. Exports declined 3.4% to EUR 29.790 billion, while imports sank at a more accelerated 4.1% to EUR 27.204 billion.

Both exports and imports decreased to their weakest since August 2017. Balance of trade in Italy equalized 994.54 EUR million from 1991 until 2019, touching an all-time high of 7902.67 EUR million in July 2015 and a record low of -6389.30 EUR million in January 2011.

Today, Istat is expecting a slight surge in the Italian trade surplus as the figure is expected to rise from 2.59B to 3.54B.

EUR – Final CPI y/y – 10:00 GMT

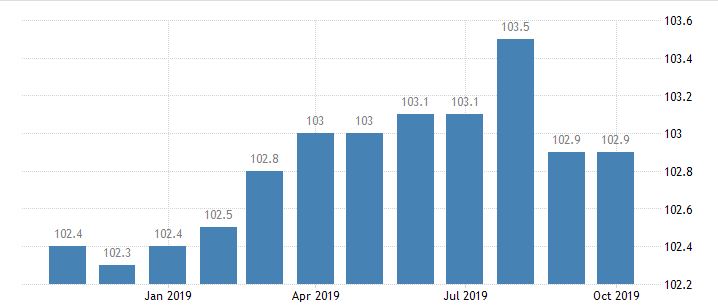

Consumer Price Index CPI in Italy remained mostly stable at 102.90 index points in October from 102.90 index points in September 2019. CPI in Italy equalized 47.30 index points from 1957 unto 2019, marking an all-time peak of 103.50 index points in August 2019 and a historic low of 3.60 index points in February 1957.

Economists are neutral CPI data as its forecast to remain 0.7% vs. 0.7% beforehand.

USD – Retail & Core Retail Sales m/m – 13:30 GMT

For all the new members, retail sales are a primary gauge of consumer spending, which accounts for the majority of overall economic activity. In October, retail sales fell by -0.1% vs. the forecast of 0.2%%.

This month, economists are expecting a 0.1% rise in retail sales and a 0.3% rise in core retail sales. A higher number of sales indicate higher inflation and a growing economy. Therefore, the actual data will be good for the greenback.

That’s all for now, but stay tuned to our economic calendar for the live market updates and forex trading signals.

Good luck!