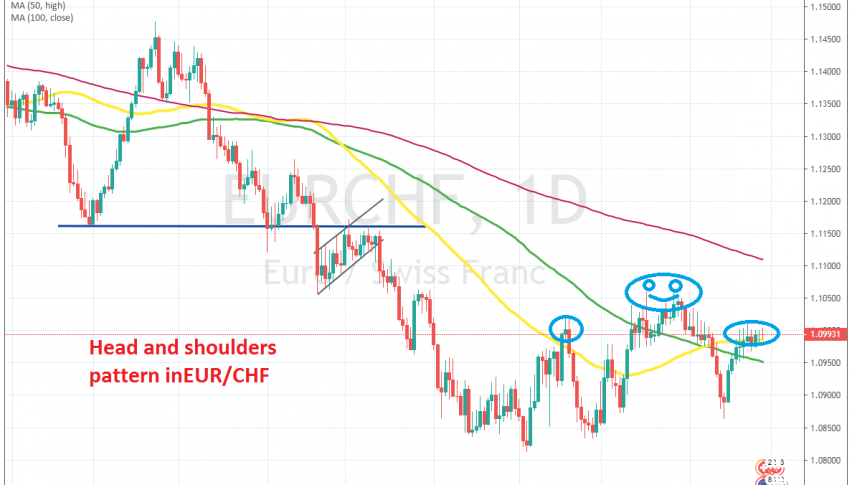

Selling the Head And Shoulders in EUR/CHF

EUR/CHF has formed a head and shoulders patter on the daily chart, so we decided to use this pattern to go short

EUR/CHF has been trading on a bearish trend for quite some time, since it reversed back in April last year. Sellers have remained in control since then and in summer this year, the price broke below the big round level at 1.10,which used to be a threshold for the Swiss national Bank.

but, despite threats from them, the SNB hasn’t acted much to reverse the decline in this pair and stop the CHF from strengthening further. In September, EUR/CHF fell to 1.08, where it formed a bottom above that level and it reversed higher from there.

The price broke above the 50 SMA (yellow) in September and last month EUR/CHF m,oved above the 100 SMA (green) as well, as the sentiment improved in the last two months. But, this month, the Euro resumed the bearish trend and EUR/CHF fell below these moving averages again.

In the last two weeks though, the buyers have pushed up again, but they’re running against the 50 SMA now. The price is overbought now on the daily chart and it seems like a head and shoulders pattern is forming here. So, we decided to go short on this pair and opened a sell signal at the 50 SMA.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account