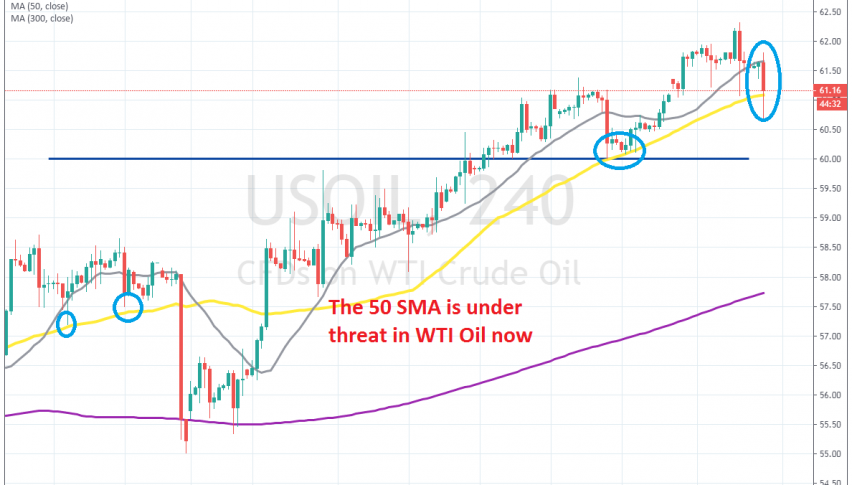

Crude Oil Makes A Bearish Reversal, Breaking Below the 50 SMA

Crude Oil has been bullish since late September and the 50 SMA has been keeping itn up. But, a battle is going on now around the 50 SMA

In September we saw a $15 surge in crude Oil prices, after the attack on the Saudi Oil producing facilities. But, they recuperated the facilities and Oil reversed back down. The support area above the $50 level held and since then the price action has been quite bullish.

Buyers have been in total control, despite the occasional pullback lower. OPEC was planning about cutting production again in December, which encouraged buyers further. Not all members like further quotas, since their main revenue comes from Oil exports.

But, they decided to go ahead and cut production by an additional 50k barrels/day. As a result, WT crude broke above the $60 level and that area turned into support immediately in the first retrace down last week. The price bounced off that moving average and it reached $62.30s, but it has pulled back lower again in the last few sessions. Earlier today, sellers pushed below the 50 SMA on the H4 chart, but it has moved back above it now. It seems like a fight is happening between buyers and sellers around the 50 SMA now.

It remains to be seen who will win this battle, but this might be a good opportunity to go long oif the 50 SMA holds as support. We will follow the price action in the next few hours and probably open a trade here, so follow our live signals page guys for forex signals.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account